Gold Technical Analysis: Struggles to gain any positive traction despite risk-off mood

• US-China trade tensions-led global wave of risk aversion trade fail to revive the precious metal's safe-haven demand, with traders even shrugging off a modest USD retracement.

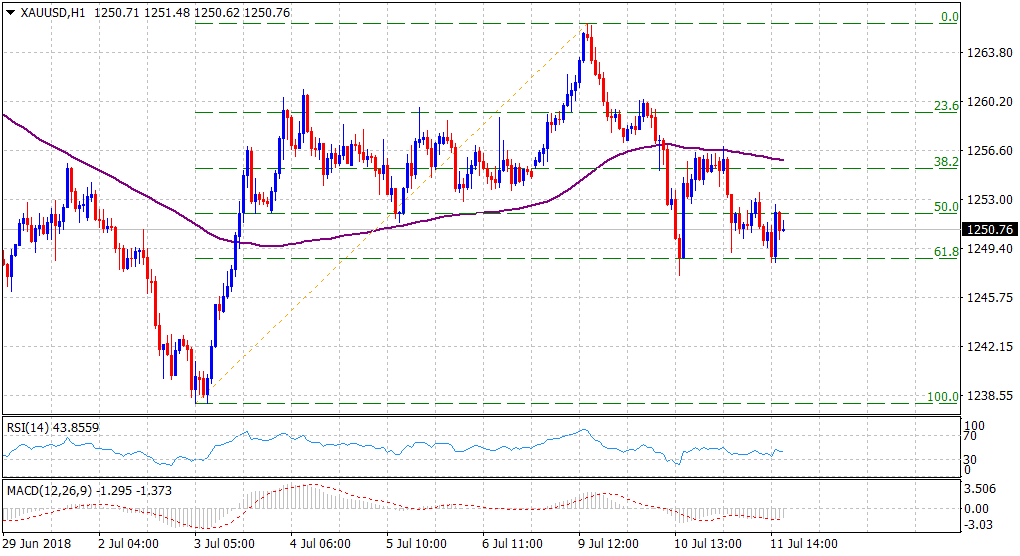

• The fact that overnight recovery attempt was rejected near 100-hour SMA support-turned-resistance points to prevailing selling interest at higher levels, albeit $1248-47 area has been acting as a floor over the past 24-hours.

• With short-term technical indicators holding in negative territory, a follow-through weakness below 61.8% Fibonacci retracement level of the recent recovery move would add credence to the near-term bearish outlook.

Spot Rate: $1250.76Daily High: $1256.93Daily Low: $1248.36Trend: Bearish

ResistanceR1: $1254.50 (horizontal zone)R2: $1260 (overnight swing high)R3: $1266 (near two-week tops set on Monday)

SupportS1: $1247 (overnight swing low)S2: $1242 (recent daily closing low)S3: $1238 (YTD low set earlier this month)

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these securities. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Forex involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.