Gold Terra Resource Looking for Multi-Million Ounce Deposit at Yellowknife City Gold Project, Raising C$2.88M

The Critical Investor discusses the turnaround Gold Terra Resource has made in the last few years and its current exploration program.

Gold Terra Resource Looking for Multi-Million Ounce Deposit at Yellowknife City Gold Project, Raising C$2.88M

1. Introduction

When the mining industry is facing a gold bull market as it is now, many new opportunities are created in all kinds of forms and shapes in order to profit from it handsomely. This can, for example, be done through putting private assets into listed entities, buying new assets, creating a new vision for existing assets, but also turning around existing companies that have solid assets but not the management to make it a success. The last two options are what has happened to Gold Terra Resource Corp. (TSXV:YGT)(OTCQX:YGTFF)(FRA:TXO) recently, as it has seen a gradual turnaround in the last few years. Work is currently focusing on expanding its current mineral resource estimate with a drill program on the Campbell Shear, one of the highest priority targets at Gold Terra's district scale Yellowknife City Gold Project.

It has gone through a name change from TerraX Minerals to Gold Terra Resource, some changes in management with the most important changes being the entry of David Suda as CEO who initiated the turnaround, him bringing in mining legend Gerald Panneton as executive chairman, and a new exploration vision on its flagship Yellowknife City Gold project. Panneton is a big name in mining land, being the founder of Detour Gold, re-discovering the deposit after it closed in 1998 due to low gold price environment, and finally brought it into production in less than six years from acquisition (January 2007 to February 2013). It resulted into one of the largest gold mines in Canada today, producing nearly 600,000 ounces a year with 16 Moz in reserves. Detour Gold was sold eventually in 2020 for C$4.89 billion to Kirkland Lake Gold. Panneton received the PDAC 2011 Bill Dennis Award for the discovery of Detour Lake.

Management believes there could be an opportunity for a multi-million ounce deposit, and in this analysis, I will discuss the most important subjects of the investment thesis for Gold Terra Resource, which in my view is quite interesting.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

2. The company

Gold Terra Resource Corp. is a gold focused exploration and development company with assets in northern Canada. Gold Terra's 100%-owned flagship Yellowknife City Gold Project in the southern part of Northwest Territories is a district-scale land package of 800km2 in the historical district of Yellowknife, which has seen lots of historical gold production.

The Yellowknife City Gold project is located near the city of Yellowknife, and as such is close to vital infrastructure including all-season roads, air transportation, service providers, hydroelectric power and skilled personnel. The district-size property lies on the prolific Yellowknife greenstone belt, covering nearly 70 km of strike length on the southern and northern extensions of the shear system that hosts the now closed Con and Giant gold mines, which have produced over 14 million ounces of high grade gold (Giant mine: 8.1 Moz @ 16.0 g/t Au and Con mine: 6.1 Moz @ 16.1 g/t Au).

In the most recent Fraser Institute Survey of Mining Companies (2019-2020), Northwest Territories is ranked a modest 50 out of 76 jurisdictions regarding the Policy Perception Index, although there was no further elaboration on this in the survey. While the territory is tough on permitting, Gold Terra management has always had successful applications for its land use permits and received them on time.

Gold Terra Resource is led by three men, including two heavyweights in mining: CEO David Suda, COO Joe Campbell and Executive Chairman Gerald Panneton. As Panneton is by far the biggest name here, I will start with him. He is a geologist with over 35 years of experience in domestic and international exploration and development in the gold mining industry. Most importantly, Panneton was the founder, president and CEO of Detour Gold Corporation (2006-13), where under his leadership, the Detour Lake project grew over tenfold from 1.5 million ounces in resources to over 16 million ounces in reserves, and besides this the project was brought into production in just over six years. Today, the Detour Lake mine ranks as one of the largest gold mines in Canada with an annual production of 600koz Au. He raised no less than approximately C$2.6 billion in capital while at the helm of Detour Gold, and he was the recipient of the PDAC 2011 Bill Dennis Award for Canadian mineral discoveries and prospecting success of the year.

Earlier in his career, his most important position leading up to his Detour success was at Barrick Gold Corporation (1994-2006), where for the last six years of his tenure, he was director of advanced projects and evaluations for the exploration and corporate development group. He was instrumental in advancing two gold projects towards production, Tulawaka and Buzwagi in Tanzania. Why would such a distinguished mining executive coming from a multibillion dollar company join a small junior, you might ask? The answer can be found in a news release from November 2020, where he was quoted: "The Campbell Shear target is where more than 13 million ounces of Gold has been produced historically from the Con and Giant mines. This is the main reason I joined Gold Terra one year ago." Fair enough.

The second person with a distinguished career in mining is Joe Campbell, the chief operating officer (COO) of Gold Terra Resource, and quite a successful geologist. He has with over 40 years of global experience in exploration and mining, founded the company as TerraX in 2008, and was instrumental in the acquisition of the Yellowknife City Gold project. He is the COO of the company since October 2019, before this he was the executive chairman from June 2018 to October 2019 until Panneton came on board, and before this he was the president and chief executive officer from 2008 to June 2018.

Before Gold Terra/TerraX, Campbell had a successful corporate career with Noranda and Western Mining Corporation, and ran his own geo-consulting company for 15 years after this. Highlights of his career include the discovery of the Touquoy gold deposit in Nova Scotia (now owned and operated by St Barbara after its acquisition of Atlantic Gold in 2019), the definition of a 250 million tonne (Voisey's Bay contains about 140Mt for comparison) nickel laterite deposit in Cuba (Pinares de Mayari), and the discovery of the Meliadine gold deposit in Nunavut (now owned, operated and ramping up towards a 365koz per annum nameplate capacity mine by Agnico Eagle) which he managed through to prefeasibility study (PFS) stage.

At the helm of Gold Terra Resource can be found CEO David Suda, who has a different background, coming from the trading side of the mining industry. He is a financial services professional with 11 years of experience in capital markets including predominantly sales and trading, but also investment banking, marketing and corporate strategy.

Prior to joining Gold Terra, Mr. Suda was managing director at Beacon Securities Ltd. for four years heading up the institutional trading desk. He also worked at Paradigm Capital for just under six years in resource-focused equity trading. Mr. Suda started his career at RA Chisholm as a commodity trader.

Despite not having the decades of experience of Panneton and Campbell, Suda is the one that brought Panneton into the company, designed the strategy to turn the company from a sleeper, with a strong technical team and significant asset, into a much more active company, and he provided easier access to the markets for capital raises and increased investor awareness. Panneton joined the company because of its asset and the Campbell Shear potential, and subsequently he is the one who did the deal with Newmont.

Gold Terra Resource has its main listing on the TSX Venture, where it's trading with YGT.V as its ticker symbol. With an average volume of about 277,701 shares per day, the company's trading pattern is liquid at the moment, and I expect this to improve when good drill results come in and the company manages to meaningfully expand the existing resource.

The company currently has 181.33 million shares outstanding (fully diluted 197.7 million), 10.9 million warrants and several option series to the tune of 5.5 million options in total. Here is the breakdown of warrants and options, relevant on September 15, 2020:

As can be seen, all warrants are set to expire this year, and amounts and exercise prices aren't something to materially impact the number of outstanding shares. The same goes for the option series. It seems to me that management has a nice incentive to at least increase the share price to levels well above C$0.30-0.435. Such a share price is still pretty cheap in my view compared to the assets owned by the company, as I will try to explain later on.

A current share price of C$0.28 results in a market cap of C$50.77 million. Management has decent skin in the game, as they hold 6.1% together with the Board, the majority held by Gerald Panneton (5.25 million shares, and no stock options), Suda and Campbell. Major shareholders are SSI Asset Management holding 5.4%, RBC Global Asset Management holding 3.4%, Konwave AG holding 1.1% and Gabelli holding 1.1%. As I often see them presenting at the Sprott Conference, Sprott Global, who does fairly stringent due diligence, is probably also a loyal shareholder. Management stated when asked: "Due to the high quality of the Yellowknife project and strong management team with its track record of success in value creation, Gold Terra has been able to attract the highest quality investors even in challenging market conditions."

The company is followed by one brokerage analyst from Beacon Securities Limited.

The company currently has about C$3.5 million + C$2.88 million (see Feb 16, 2021 news release) in the treasury. Gold Terra has raised C$7.13 million in an oversubscribed financing closed in July of last year and are raising C$2.88 million at the moment, through a non-brokered private placement at C$0.36, with no warrant, and the usual four month and one day hold period. As it is flow-through, all proceeds will be used for exploration purposes, and more specific will be used to expand the current 10,000 meter drill program at the Campbell Shear target to over 20,000 meter. This round is expected to close on or about March 4, 2021.

I also looked into the compensations of management, and it appears Gold Terra Resource is run fairly lean. Part of this is the presence of CFO Mark Brown, who provides CFO/corporate secretary services for various other juniors in order to keep costs and fees at the lowest possible levels. I know Mark for many years now, and I have never seen him active for juniors that are lifestyle companies or have high burn rates through excessive G&A.

The chart of Gold Terra Resource looks like this:

Share price; 5 year time frame (Source: Tmxmoney.com)

As most gold developers gradually sold off during the neutral to negative sentiment during 2018 and 2019 after the short 2016-2017 gold bull market, so did Gold Terra, bottoming out in the 20c Cdn range during the COVID-19 crash in March 2020. After the generous U.S. stimulus package was approved soon after, most mining equities, alongside most other equities and stock markets in general, staged a robust recovery and so did Gold Terra to a degree.

Unfortunately, as gold lost terrain quite unexpectedly after the last US$900 billion stimulus package got approved in December (many anticipated a weaker U.S. dollar which in normal circumstances would have resulted in a higher gold price), most gold related mining equities returned a significant part of the gains and Gold Terra was no different. Looking at the long term chart, anywhere between C$0.20, which I view as the absolute bottom since it was black swan-initiated with lots of overselling, and C$0.30 seems like a healthy entry point in my opinion, as fundamentals of the company keep improving under Suda's leadership.

3. Yellowknife City Gold Project

The Yellowknife City Gold Project is a gold exploration project located in the southern part of Northwest Territories. As the location is pretty Nordic, Yellowknife's climate is subarctic in nature, with cold winters (-10 to -45?C) and mild to warm summers (+10 to +30?C), but Gold Terra Resource doesn't have to deal with winter breaks too much, as drilling can continue despite snowfall. Only surface geological mapping cannot be completed from November to late April.

The most mineralized parts of the project have been found in the most deformed and altered rocks within the claim sets. The gold in the deposits is hosted in shear zones that transect mafic volcanic and metasedimentary rocks and are considered orogenic gold deposits. To specify a bit further, the gold mineralization in the Yellowknife Gold Belt can be described as Greenstone-hosted quartz-carbonate vein deposits. This is typical for these type of deposits, according to the NI43-101 report:

"This type of gold deposit is characterized by moderately to steeply dipping, laminated fault-fill quartz-carbonate veins in brittle-ductile shear zones and faults, with or without fringing shallow dipping extensional veins and breccias. Quartz vein textures vary according to the nature of the host structure (extensional vs. compressional). Extensional veins typically display quartz and carbonate fibres at a high angle to the vein walls and with multiple stages of mineral growth, whereas the laminated veins are composed of massive, fine-grained quartz. When present in laminated veins, fibres are subparallel to the vein walls.

Individual vein thickness varies from a few centimetres up to 5 metres, and their length varies from 10 up to 1000 m. The vertical extent of the orebodies is commonly greater than 1 km and reaches 2.5 km in a few cases. The gold-bearing shear zones and faults associated with this deposit type are mainly compressional and they commonly display a complex geometry with anastomosing and/or conjugate arrays. The laminated quartz-carbonate veins typically infill the central part of, and are subparallel to slightly oblique to, the host structures. The shallow-dipping extensional veins are either confined within shear zones, in which case they are relatively small and sigmoidal in shape, or they extend outside the shear zone and are planar and laterally much more extensive."

The most important takeaway from this geotechnical description is in my view the district scale, the potential at depth and a complex geometry.

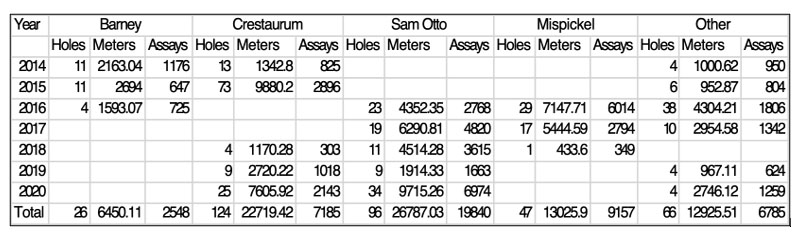

The company holds 100% of the project, subject to certain underlying royalties on most of the patented land parcels, on average 1.5%, and Osisko Gold Royalties has an option on a significant part of the claims to purchase up to a 3% total NSR, Osisko's NSR depending on existing royalties. Various parties have conducted exploration on the property, among those the former owners of the nearby Con and Giant gold mines. The project has seen quite a bit of drilling, and the company itself has done the most work on it, and completed 359 diamond drill holes for a total of 81,908 meters of core, of which 296 diamond drill holes for a total of 61,481 meters of core were completed between 2014 and 2019, and 63 diamond drill holes for a total of 20,067 meters of core in 2020.

Drill Meterage

2014

2015

2016

2017

2018

2019

2020

Prospect Total

AES

0

0

277.38

0

0

0

0

277.38

Banting

-

-

0

918.9

0

0

0

918.9

Barney

2,163

2,694

1593.07

0

0

0

0

6450.18

Berry Hill

-

-

0

0

0

737.22

0

737.22

Campbell North

0

0

0

0

0

0

1273.97

1273.97

Crestaurum

1342.8

9880

0

0

1170.28

2720.22

7605.92

22718.42

Dave's Pond

0

0

583.96

2577.83

1518.9

0

0

4680.69

Hebert-Brent

0

952.87

784.41

0

0

0

0

1737.28

Homer

1000.62

0

1145.11

0

0

0

0

2145.73

Jackson Lake

0

0

0

451.15

0

0

0

451.15

Mispickel

0

0

7147.71

5444.59

433.6

0

0

13025.9

Pinto

0

0

432.16

0

0

0

0

432.16

Ryan Lake

0

0

0

0

0

229.89

0

229.89

Sam Otto

0

0

3768.39

3712.98

2995.38

1914.33

9715.26

22106.34

South

0

0

1462.43

0

0

0

0

1462.43

Southbelt

0

0

0

1584.53

0

0

1472.15

3056.68

VSB

0

0

202.72

0

0

0

0

202.72

2014

2015

2016

2017

2018

2019

2020

Annual Total

4506.53

13643.87

17397.34

14689.98

6118.16

5601.66

20067.3

81907.04

Drilling since December 2019 has been divided more or less equally between Sam Otto and Crestaurum, two important mineralized zones of the project. Keep in mind that Sam Otto has seen roughly the same amount of drilling as Crestaurum, although Sam Otto has much more ounces, but more on this soon. The location of the project can be seen on the map below left, the map below right zooms in on the resource area and the focus of the current drill program:

Sam Otto and Crestaurum are located on the Greenstone belt, just like the Con and Giant mines more to the south. Sam Otto is a wide (up to 120 meters) shear containing sericitic alteration and finely disseminated sulphides (pyrite, arsenopyrite) with a range of 0.10-5.0 g/t Au, averaging 0.50-1.50 g/t Au over 30-120 meter drill widths. Sam Otto is the largest mineralized system yet discovered on the project. It is unusual for its consistent low grade gold relative to the other mineralized zones discovered on the project. Wide zones (10s of meters) grade >1 g/t Au yet assays greater than 3 g/t Au are rare, and no assays to date have been greater than 20 g/t Au. Consistent grades with high continuity in broad shear zones look ideal to drill out and build tonnage upon.

Crestaurum is a narrow discrete shear hosting multi-stage quartz veining systems within mafic volcanics and mafic intrusive hosts (like the Con Mine mineralization). High grade gold occurs in quartz veining over 1-5m intervals, plunges steeply and appears to be controlled by poorly understood crossing features. Other types of mineralized zones contain 1-5 g/t Au to sub-gram Au.

Such a geological concept sounds complex because of the veining and crossing features, and such a deposit is in my view drill-intensive to define, and it is not easy to build out large tonnage, which showed when taking into account the number of discovered ounces to date, and the amount of drilling. When management was asked about this, they stated, "The coming resource update will inform future plans for exploration at Crestaurum in the future."

Gold Terra Resource published a maiden 43-101 compliant resource estimate in November 2019 on the Yellowknife City Gold project, containing 735koz Au Inferred. The extensive table of the mineral resource can be seen here:

The cut-off grade for the open pit resource is 0.5g/t Au, and for the underground resource 3.0g/t Au, and are based on a gold price of US$1300/oz Au. Gold recoveries of 90% are based on preliminary test work completed on the Crestaurum and Sam Otto deposits. Both the pit constrained and underground average grades are economic at US$1300/oz Au (1 g/t OP and 5 g/t UG are the thresholds for US$1200-1300/oz gold), so economics for a deposit like this will likely be pretty good at a higher base case gold price, as is justified at a current gold price of about US$1780/oz Au.

The resource increases as well at a higher gold price, as for example a gold price of US$1550-1600/oz Au could result in lower cut-off grades and thus a higher number of ounces, as illustrated by the cut-off sensitivity in the NI43-101 report, where I estimated the corresponding cut-off grades for such a gold price (only the sensitivities for the 2 largest deposits Crestaurum and Sam Otto are shown here):

Such lower cut-off grades would hypothetically result in an additional 132koz Au, upping the resource from 750koz Au Inferred to 882koz Au Inferred, and hereby closing in a bit more on the important, industry-standard threshold of 1M oz Au. The company is looking to potentially expand the resource to a multi-million ounce resource. As mentioned earlier, Sam Otto contains more than double the ounces of Crestaurum, but has seen roughly the same amount of drilling, I wondered why this was the case, and why management is still drilling Crestaurum at roughly the same size drill program as it did at Sam Otto last year. Also keep in mind that the mineralization at Crestaurum seems to be more complex and therefore needs more drilling to define adequately.

The main goal according to management is to find another Campbell Shear, which hosted approximately 5 of the 6 million ounces of gold produced at the former Con Mine, and is currently one of the highest priority targets to add additional high-grade ounces to the current YCG mineral resource. The Campbell Shear zone and associated structures such as the Con Shear are exceptional due to the high-grade nature of the lode deposits (approximately 20 g/t Au at the Con Shear, and 15 g/t Au at the Campbell Shear). The phase 1 Campbell Shear drilling covers only a small portion of the nearly 70 km of strike length on the southern and northern extensions of the shear system that hosts the former Con and Giant gold mines, which historically produced over 14 million ounces of gold.

About 5.1M oz was mined from the Con mine, this is notable because Gold Terra is currently drilling on the doorstep of that mine. Management stated, "The Campbell Shear north of the Giant mine (believed to be the up dip extension of the Campbell at the Con offset by the West Bay fault) requires more targeting work after the drilling of two holes which intersected the Campbell shear stratigraphy in the current winter. The Campbell Shear is believed to extend for over 20km through this portion of the property and likely further north. The claims around the Giant mine are owned by the Federal government. Gold Terra has claims that butt up against this area, and north of the Con mine is the city of Yellowknife."

As can be seen, although the Con and Giant mines are separated by about 5km, it is believed by experts that both mines are part of the same mineralized system, only to be displaced by major faults. This is not all. Among others, Kelly (1993) believes that the Con-Giant system continues northwards to the Gold Terra property in the form of the North Giant Extension ("NGX") structure. According to him, the argument can be made that the Con-Giant system persists at least to the southern boundary of the property, and this is where Sam Otto and Crestaurum are located.

Notwithstanding this, management thinks that the Con-Giant system also extends to the south, more specific the southern extension of the Campbell Shear. For this reason, the company signed an option agreement on September 8, 2020, with Newmont, the current owner of the Con Mine claims. I view this deal as a potential game-changer for the company, as the mineralized potential seems of another magnitude, as Panneton has stated publicly. The terms are as follows:

"In Phase one, Gold Terra can earn a 30% interest by spending a minimum of CDN$3M in exploration expenditures over a period of three (3) years on the Newmont Exploration Property. Gold Terra will manage, fund and operate the program. Upon completing Phase one earn-in, the parties will form a joint venture.

In Phase two, Gold Terra can earn an additional 30% interest, for a 60% cumulative interest in the joint venture, by solely funding all expenditures and completing a pre-feasibility study (PFS) outlining a mineral resource containing at least 750koz Au on the Newmont Exploration Property itself, and a combined 1.5 Moz Au on both the Newmont Exploration Property and the mineral claims in the immediate area which are already owned by Gold Terra. Gold Terra has a period of up to four (4) additional years to complete the Phase two earn-in and will also manage and operate the Phase two program.

Provided that Gold Terra completes Phase two earn-ins, Newmont has a one time, back-in right to earn back a 20% interest in the joint venture, such that Newmont would then hold a 60% interest and Gold Terra would hold a 40% interest. The back-in right is triggered if a discovery of at least 5Moz Au in all mineral resource categories is made within the Newmont Exploration Property and is exercisable by Newmont by providing certain cash reimbursements and payment to Gold Terra."

It is a good thing Gold Terra manages, operates, but most importantly funds the program, in my view. This way it has full control over speed of progress and the increase of ounces. This is very important in a JV as otherwise the majority JV partner could, for example, refuse to disclose drill results, or stall drilling outright in order not to trigger certain milestone JV terms, playing a long-term agenda designed simply to exhaust the junior and get the property as cheaply as possible in the end, already with a very good view on mineralization potential although not proven yet by the drill bit. This scenario isn't the case at all so although the interest for Gold Terra doesn't go to my preferred 100% ownership, a 60% interest in, for example, a 4Moz Au deposit advanced to PFS is worth a lot of money, as I will show in my peer comparison later on.

This is all with a long-term horizon in mind, so let's have a look at the deposits already defined first. The shape of the various deposits is more or less conceptualized by a set of steeply dipping lenses, that have significant strike and go almost vertical, as can be seen at this 3D model:

The Crestaurum deposit has a likewise typology:

The company also included a first 3D model of a probable mine plan in the NI43-101 report, and this shows the starter pit model for Sam Otto (and sub deposit Dave's Pond):

Regarding the open pit potential of Sam Otto, when looking at maps in the NI43-101 report, I noticed the property is littered with lakes and other water bodies, as can be seen here:

Sam Otto and Crestaurum are located right next to lakes, so I wondered if mineralization could extend under such water bodies, complicating exploration, permitting and construction. According to management, there are no issues: "Water bodies in the area are generally small and shallow. We have been able to explore mineralization through a variety of techniques including drilling from the ice in winter as we did for example at Sam Otto in winter 2020."

I further noticed a large amount of exploration (not being drilling) completed on the property by its predecessor TerraX Minerals. Almost all possible testing has been conducted over the last five years or so: rock sampling, a LiDAR survey, a spectrometer survey, a biogeochemical survey, an airborne VTEM survey, a ground magnetics test, sediment sampling, an airborne Magnetic, Radiometric and Dighem survey, an airborne Residual Magnetic Intensity survey, Airborne High Resolution Helicopter-borne Aeromagnetic and Radiometric Survey and a few more surveys. The resulting data seems to confirm the targets and resource areas, but everything has to be confirmed with drilling of course, as unfortunately there is no one-on-one relationship with such testing and actual mineralization, far from it.

I was curious why Terrax completed so much testing, and I also wondered if the structural analysis being done in 2020 on the Campbell Shear Con/Giant mine area, to better understand the controls on the high-grade gold lodes, had actually resulted in useful information. Management had the following remarks on this: "We have taken all data from TerraX's past exploration programs as well we have compiled the information with historical data. In addition to this Gold Terra has done additional work such as surface magnetics to refine targeting for the 2021 drill program. The compilation of all data from the area around the Con Mine and the South Belt has been critical in devising a drilling program that is focused to make the next discovery on the extension of the Campbell Shear.

With regards to exploration, Gold Terra is focusing more on drilling, and the next paragraph will zoom in on this subject.

4. Exploration Focus

100 gram*meters Au are pretty high grade, as the average grade for the entire mined out deposit is 16g/t Au, the majority being 5 20gram*meters Au. When doing a quick estimate and simplifying the Con deposit as a lense/sheet with dimensions 1000*1000*4m*gravity of 2.75t/m3 and an average grade of 16g/t Au, it resulted in 5.7Moz Au, so close enough to the 5Moz Au actually produced accounting for dilution and losses. This means that the average intercept drilled through the deposit should return 4m @16g/t >64gram*meter, but the majority is much lower, meaning the high-grade pods need to compensate to the tune of 4m @ 50-60g/t Au or even higher. The historical drill results being completed outside the Con deposit at 1000m depth or less didn't return such results yet, although sufficient to be economic, like the historical hole Y88 returning 5.27m @ 13.72g/t Au.

It seems drilling at depth is the way to track down these high-grade pods, surrounded by lower grade halos. Although drilling isn't very expensive in this area, as drill costs are C$200/m (according to management drilling costs have come down significantly from C$250/m), a 1,000m hole would cost C$200k all in, which is not cheap, and if the Campbell Shear dips, Gold Terra might need to drill even deeper. I was interested to hear the view of management on this, and how they plan to target potential high-grade mineralization at depth: "A systematic approach is in place. Prudent use of historical data indicates that gold mineralization begins nearer to surface. Our first phase of drilling will test the mineralization down to depths of 300-600m below surface at approximately 200m spacing over nearly 2km of strike. Upon assessing the results, we will plan the next phase to drill deeper."

In the Phase 1 program, the company planned to drill 12,000 meters (up to 19 holes) testing over 1.2 kilometers of strike extension of the Campbell Shear at 125-150m spacing, at vertical depths between 250 and 600 meters to extend known gold mineralization. Depending on the results of this first program, a deeper phase 2 program will be planned, which will include a series of holes testing the Campbell Shear at 800 meters depth. The current state of affairs is, according to the January 25, 2021, news release:

o"During November-December, two holes were drilled for a combined total of 1,472 metres from Gold Terra's 100% owned Yellowknife City Gold property with holes extending onto the Newmont Option area (assay results pending).

oThe company received the amended LUP on January 11th, which allows Gold Terra to drill on the Newmont Option area.

oDrilling began on January 18th with 6 holes totaling approximately 3,800 metres below existing known mineral resources at -300 metres vertical depth.

oBased on the results of the first pass, a further 6,000 metres of drilling is planned at greater depth."

For further clarification, the LUP stands for a Land Use Permit. The original permit was amended to include the Con Mine area claims and leases that form the Newmont Option. The amended LUP permits drilling on the Newmont Option with similar conditions. The timely issuance of the LUP has allowed Gold Terra to expedite the start of its current drilling program.

Management expects the assay results to be available in a four to six week time frame.

It is my feeling that the fireworks, if there is significant mineralization present, could likely begin with this phase 2 drill program. So far, any hint on a potential resource increase is pure speculation, but in case Gold Terra might delineate 1Moz Au or (much) more as management hopes, a peer comparison could shed some light to future valuation potential for the stock.

5. Peer comparison

In order to get something of a grasp on upside potential for the share price, I usually revert to peer comparisons based on Enterprise Value (EV)/ounces of gold (oz Au) ratios and Market cap/Net Asset Value (P/NAV) ratios. For NAV a project needs an economic study to be completed, generating Net Present Values (NPVs), but Gold Terra isn't that advanced so obviously I can't compare on this metric. Notwithstanding this, the following peer comparison is useful to indicate future potential, when a PEA/PFS/FS would be completed for example. In general as a continuous reminder for investors, a peer comparison as a valuation method isn't perfect as every single company has a unique set of parameters and should actually be analyzed in full and normalized as far as this is possible of course, and EV/oz doesn't say anything about profitability of the project yet, potential high capex, potential permitting issues, capability of management, etc., but with some comments to go with such a peer comparison it provides at least an indication, which is my intention.

I picked a number of well-known companies, all having at least a NI-43-101 compliant resource, all of them in Canada or the USA, gold-focused, and as Gold Terra has a combination of open pit and underground, I rounded up a group with likewise projects. For further understanding, I also added open pit only and underground only projects. The latter group is particularly of interest as much of the exploration potential of Gold Terra is believed to be at depth, although most of the currently defined ounces are open pittable.

And:

When we look at Marathon Gold as an example of a company with a 4Moz Au project and a recent PFS, it trades at a market cap of C$598M, at an EV/oz ratio of 133.8. As the EV/oz ratio of Gold Terra is already pretty high for an explorer, it seems a lot of investors have always appreciated the Con/Giant analogy concept with its district-scale potential, relatively high-grade (starter) open pittable ounces component, and recently the company turnaround and the backing of Gerald Panneton. Notwithstanding this, if a multi-million ounce deposit could actually be defined in the foreseeable future, and economics could be favorable at a US$1500/oz Au base case, there is no doubt in my mind a significant rerating could be expected with the current market cap of just C$41.7M, when looking at more advanced and larger projects:

As can be seen, the P/NAV ratio of solid gold projects with strong internal rate of returns (IRRs) tends to approach or even surpass the value of 1, when a project nears production. In order to have a look at the future discounted cash flow potential of a project, or in short the NPV value, a quick back of the envelope estimation of production potential could help. In the conservative scenario that all exploration goals of management (2-5Moz targets) would more or less go south, and we outline a hypothetical low end resource of 1.2Moz Au, and 1Moz Au of this could be included in a PEA, we could still get a 10 year life of mine (LOM) at an average 100koz per annum. Assuming a capex ratio of $50,000/tpd with half the production being open pit, and a throughput of 3000tpd, we get a capex of US$150M. Assuming an AISC of US$750/oz including royalties, and a corporate tax of 35%, we get to an after-tax NPV8 of US$235M and an after-tax NPV5 of US$288M, both at a gold price of US$1500/oz Au:

The IRR of this scenario is a pretty solid 39.2%, and even at a currently extremely conservative gold price of US$1250/oz Au, the after tax IRR would be 23.2%, whereas for construction package financiers the threshold usually is 20%, so the project would be robust enough if the gold price would drop off close to these levels. But my guess is we can probably all agree this will not happen anytime soon with the Biden US$2 trillion stimulus coming up, and negative real interest rates here to stay for the first few years at least. Of course, when the company manages to prove up a multi-million ounce deposit, the NPV multiplies and so do future valuation targets.

But this is all theoretical for the time being, as Gold Terra is a long time from construction and production, but the idea is to give you an impression of future valuation potential. For now, management is focused on expanding the resource as much as possible, and the only way to prove up resources is to delineate them by lots of drilling, and this is exactly what is happening now.

6. Conclusion

After turning around the company, David Suda has aligned himself with one of the big names in the industry, Gerald Panneton who discovered and built the Detour Mine, one of the largest gold mining operations in Canada. With C$7.1 million raised in the summer of last year, Gold Terra has been executing on two drill programs since, the current one focusing on the extension of the Campbell Shear in its recently arranged Newmont JV, being located very close and on strike to a zone that produced 5M oz Au in the past. As this extension has seen very little exploration until now, and geological conditions look favorable, management has high hopes of finding serious mineralization, even to the tune of 2-5M oz Au. Even if they don't reach those numbers, a pretty interesting and economic smaller resource is likely to provide investors with a solid foundation. But somehow I don't think Panneton came on board for and attached his name to something that didn't have all the geological hallmarks of a future impressive discovery in the making.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

[NLINSERT]Disclaimer: The author is not a registered investment advisor, and currently has a long position in this stock. Gold Terra Resource is a sponsoring company. All facts are to be checked by the reader. For more information go to www.goldterracorp.com and read the company's profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Streetwise Reports Disclosure:

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts and graphics provided by the author.