Gold: The Burden Of Proof Is On The Bulls

Gold still pressured by U.S. dollar in the immediate term.

The odds of a short-covering rally this week have increased, though.

Gold's upcoming test of the 200-day MA could serve as the catalyst.

As per our recent discussions, gold has been pressured by a strengthening dollar born of higher Treasury rates. The currency component of gold's price is making it difficult to remain a bull right now, although a short-covering rally remains a distinct possibility. In today's report, we'll examine the obstacles facing the bulls and see what is needed for them to reverse gold's latest setback. Until these improvements are seen for gold, however, I continue to recommend a cash position for conservative traders.

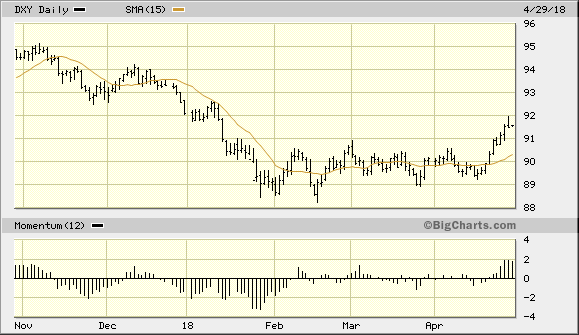

Although the gold price rose 0.5% on Friday thanks to a pullback in both U.S. Treasury yields and the U.S. Dollar Index (DXY), the bullion price remains under its key 15-day moving average. Gold also finished last week nearly 1 percent down for its second consecutive weekly decline and the biggest weekly decline of the last four. The gold sellers continue to enjoy a slight advantage after last week's reversal of gold's immediate-term (1-4 week) buy signal from late March. However, the combination of the dollar edging lower after its recent rally and the U.S. 10-year Treasury yield retreating below 3 percent could give the gold price a boost in the coming week.

Source: BigCharts

While the stage is undoubtedly being set for an eventual short-covering rally, I don't advise buying gold with both hands right now. There is still too much risk from the residual selling pressure from a stronger dollar, and the market hasn't yet confirmed an immediate-term bottom since gold remains under its 15-day moving average. Moreover, it's not uncommon for a secondary sell-off to follow close on the heels of an initial gold price decline, especially in the case of a market that has witnessed diminished forward momentum as gold has in recent weeks. It's safer then to let the market bottom out first and absorb the initial layer of overhead supply than to anticipate a bottom by entering the market and suffer another potential decline.

Analysts who are bearish on gold right now point out the fact that exchange-traded funds which are backed by gold and gold mining shares have been heavy sellers in recent days . In the latest week, a popular gold mining stock ETF witnessed a major outflow. The VanEck Vectors Gold Miners ETF (GDX) saw a $508.9 million dollar outflow last week, which represents a 6.0% decrease week-over-week (from 373,152,500 to 350,602,500), according to BNK Invest. The gold bulls consider this to be a bullish statistic based on the contrarian observation that ETF managers, who are often behind the market curve, have apparently begun the process of capitulation, thereby pushing gold ETF prices lower and often resulting in a rapidly "sold out" market condition. The aforementioned statistic suggests the possibility of a technical rally for gold and the gold mining shares at some point in the coming days.

In order to validate this outlook, gold must rally at least two days back above its 15-day moving average soon. A strong bounce in gold's price is preferable in the immediate wake of the recent sell-off, especially if there is to be the additional impetus of urgent short covering (since a sharp rally often creates a positive feedback loop as sellers rush to cover shorts). It's not too late for gold to mount a meaningful upside move but the burden of proof is squarely on the shoulders of the bulls. They must take control of the market quickly and decisively in order to shake out the shorts and regain control of the immediate-term trend.

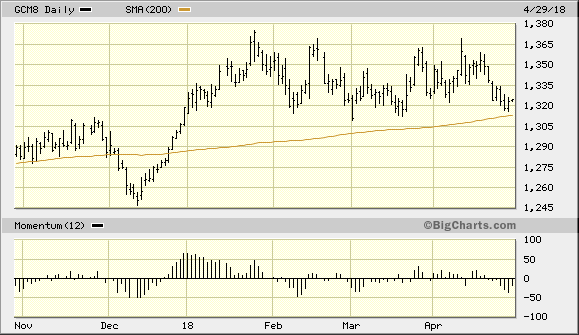

To reiterate the intermediate-term technical considerations for gold mentioned in last Friday's report, a key chart support level of interest for the June gold futures contrast is the $1,312 level which corresponds to the 200-day moving average in the daily chart. Since many fund managers follow particular trend line, the 200-day MA often takes on added psychological significance. A successful test of the 200-day MA for gold this week could act as a catalyst for the necessary short covering and give the bulls another chance at regaining control of the immediate trend.

Source: BigCharts

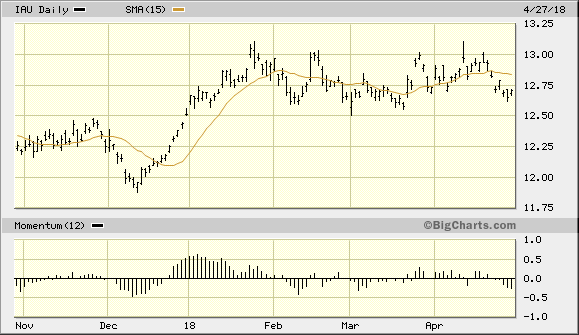

For now, though, I continue to recommend that short-term traders remain in cash after the latest whipsaw in the gold price. We exited a conservative trading position in the iShares Gold Trust (IAU), below, on Apr. 23 after our technical trading discipline confirmed an exit signal. IAU remains below its 15-day moving average but is still above the $12.50 level - the lower boundary of a 3-month trading range. Until IAU confirms a renewed immediate-term (1-4 week) buy signal, traders should keep their powder dry for now. A 2-day higher close above the 15-day MA is needed for the gold ETF to confirm a bottom, along with a reversal of the dollar's immediate-term uptrend.

Source: BigCharts

Meanwhile longer-term investors can maintain a conservative position in gold since the rising 200-day moving average, the benchmark longer-term trend line, remains intact as shown in the June gold futures chart above.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts