Gold: the Ultimate Recession Hedge 20 Years after Brown Bottom? / Commodities / Gold & Silver 2019

The new Alchemist went out at the end of July. And making the choice from its articles is always hard. What gems can we learn from the latest publication of the LBMA? We invite you to read our today’s article and find out!

The new Alchemist went out at the end of July. And making the choice from its articles is always hard. What gems can we learn from the latest publication of the LBMA? We invite you to read our today’s article and find out!

Gordon’s Brown Bottom, 20 Years On

The first article we would like to summarize for you is “Gordon’s Brown Bottom, 20 Years On” by Adrian Ash, Director of Research at BullionVault.

July 2019 marked 20 year since the Brown Bottom. If you did not hear about it, in July 1999, the UK began its infamous gold auctions, more than halving the nation’s gold reserves in three years. The decision, and its timing, is a mysterious error. One thing is that it was announced two months in advance which sent prices 10 percent lower before the first sale began. Why would a seller want to do that?

Another matter is that Gordon Brown, who was then the Chancellor, sold gold near its cheapest in history. Selling near bottom is a common but grave investment error that costs the British people billions of pounds.

However, can we really blame Brown? After all, the metal had lost 80 percent of its real worth from the 1980 peak. In April 1999, Switzerland narrowly passed a referendum revoking the franc’s role as the last gold-backed currency, paving the way for the sale of 1,300 tons. The gold standard was definitely ended and the gold prices plunged to near two-decade lows. Gold looked as barbarous relict, so can we be surprised by all that negative sentiment?

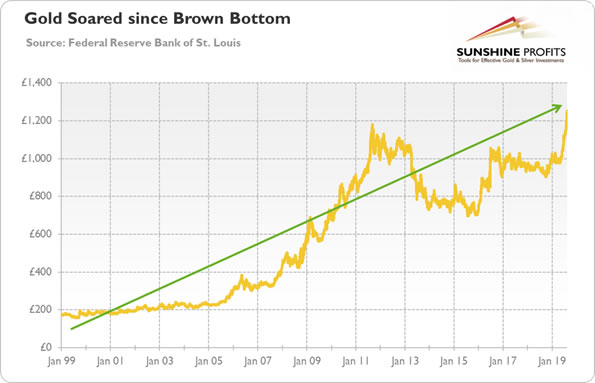

But what if Brown’s decision wasn’t a mistake? Ash writes that “the gold sales decision and timing look wilful, if not vindictive” and that it was a political decision strongly opposed by the Bank of England. According to the BoE data, more than a fifth of the UK Treasury’s own gold was out on loan in 1999, so maybe the UK gold sales were conducted to kill any price rise, helping short sellers? Another popular theory is that Brown was rushing to sell gold, because he wanted to take the UK into the new euro currency. Anyway, bullion prices trade now more than six times higher in the British pound, as the chart below shows, confirming that the rumors of the death of gold have been greatly exaggerated.

Chart 1: Gold prices (London P.M. Fix, in £) since the Brown Bottom.

Is Gold the Ultimate Recession Hedge

The second article we comment on today is the piece entitled “Is Gold the Ultimate Recession Hedge?” by Ronald-Peter Stoeferle, from Incrementum AG.

The economic expectations have continuously deteriorated in recent months, while the recessionary risk is increasing. Now, the question is how does the gold price perform in recessions. The Stoeferle’s answer is “very well”. Indeed, gold posted significant average gains across the entire recessionary cycle both in U.S. dollars and in euros, in its every phase. The mean gain of gold in U.S. dollars during the 1970s American recession is 20.8 percent.

Gold’s great performance should not be surprising. After all, investors purchase gold as a safe haven in times of crisis but also – anticipating monetary and fiscal stimuli – as an inflation hedge. Hence, one should expect gold to record substantial gains and act as a recession hedge in the future as well.

Actually, the next downturn may be even more beneficial for gold. This is because the global debt is higher, while the monetary policy options on the table are broader, and real interest rates are lower. The two last recession led the Fed to cut interest rates by more than 500 basis points, but the federal funds rate stands now at 2.00-2.25 only, leaving the U.S. central without the ammo. It means that either the central banks will be impotent, or they will cut interest rates below zero, or they will resume quantitative easing, or even introduce new unconventional monetary policies. More extreme monetary policy ideas are expected to support gold prices.

If you enjoyed the above analysis, we invite you tocheck out our other services. We provide detailed fundamental analyses of thegold market in our monthly Gold Market Overview reports andwe provide daily Gold & Silver Trading Alerts with clearbuy and sell signals. If you’re not ready to subscribe yet and are not on ourgold mailing list yet, we urge you to sign up. It’s free and if you don’t likeit, you can easily unsubscribe. Sign uptoday!

Arkadiusz Sieron

Sunshine Profits‘ MarketOverview Editor

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Arkadiusz Sieron Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.