Gold & the USDX: Correlations / Commodities / Gold & Silver 2020

It’s crunch time for gold and the U.S.Dollar Index (USDX), as they find themselves at a crossroads. As of Wednesday,the USDX is holding its lows but wants to move up, thus invalidating itsbreakdown. And gold? Well, gold did gain a bit today, but it’s essentiallyjumping up in an elevator that’s moving down – it just doesn’t have enoughsteam to break out.

While it’s been the traditional view thatwhen the US Dollar declines, gold increases in price, we find that's not alwaysthe case when comparing historical patterns. And just to watch the price ofgold itself when making a buying decision is not enough. One needs to payattention to the price of gold in relation to moves in the USDX – that helps toindicate the bottom.

Let’s pay attention to and examine whatgold does when the USDX moves either up or down.

Yesterday we saw the first daily closebelow the September low. This means that the breakdown is not confirmed, and ifthe USDX closes below this level also today and tomorrow, it will be. However,at the moment of writing these words, the USDX is trying to rally back up – ifit is successful, gold would be likely to plunge.

Still, to be precise, since gold justmanaged to rally above the declining resistance line, it might have enoughmomentum to reach the September low (at about $1,850) before turning south onceagain.

The breakdown in the USDX is notconfirmed and it could be invalidated any hour now, but… What if it’s not? Whatif – despite invalidation being likely and the USDX moving up – what we’ve seenin the last couple of months was not the broad bottom in the USD Index, and thelatter is going to decline from here?

These are important questions. First ofall, if the above is indeed the case, it won’t mean that technicalanalysis became useless or less useful. It would mean that adifferent part of history is likely to be repeated to a certain extent, and notthe ones that I featured and referred to previously.

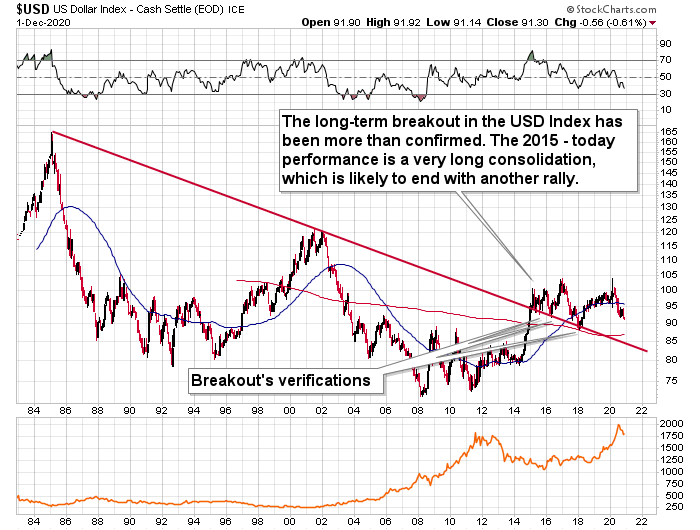

The above wouldn’t invalidate the very bullish implications of the long-term breakout in the USDX in 2015.

So, what would be likely to happen if the USDX declines in the next fewdays?

In this case, it seems likely to me thatthe USDX would repeat its 2017 – 2018 decline to some extent. The startingpoints of the declines (horizontal red line) as well as the final high of thebiggest correction are quite similar. The difference is that the correction was now smaller than it was in 2017.

Since back in 2018, the USDX’s bottom wasat about 1.618 Fibonacci extension of the size of the correction, we couldexpect something similar to happen this time. Applying the above to the currentsituation would give us the proximity of the 90 level as the downside target.

But would gold soar in this case? Well,if the early 2018 pattern was being repeated, then let’s check what happened toprecious metals and goldstocks at that time.

In short, they moved just a little higherafter the USDX’s breakdown. We marked the moment when the U.S. currency brokebelow its previous (2017) bottom with a vertical line, so that you can easilysee what gold, silver, and GDX were doing at that time. They were just before amajor top. The bearish action that followed in the short term was particularlyvisible in case of the miners.

Consequently, even if the USD Index is todecline further from here (and – again – the breakdown could be invalidatedshortly), then the implications are not particularly bullish for the preciousmetals market.

Thank you for reading our free analysistoday. Please note that the following is just a small fraction of today’sall-encompassing Gold & Silver Trading Alert. The latter includes multiplepremium details such as the downsidetarget for gold that could be reached in the next few weeks.

Thankyou for reading the above free analysis. It’s part of today’s extensive Gold& Silver Trading Alert. We encourage you to sign up for our free goldnewsletter – as soon as you do, you'll get 7 days of free access to our premiumdaily Gold & Silver Trading Alerts and you can read the full version of theabove analysis right away. Signup for our free gold newsletter today!

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.