Gold Threatened As Old Nemesis Awakens From Slumber

As global growth decelerates, sentiment is weakening while the dollar is rising.

When both growth and inflation are rising, the Fed tends to get hawkish.

While gold signaled easy conditions last year, there is a risk the Fed goes too far today.

Last week, we wrote that weakness in the US dollar is masking growing risks. As equities, commodities and corporate credit are inversely correlated to USD, investors need to pay attention to the risk of a US dollar rebound.

Since early 2017, gold prices have gradually strengthened. As the precious metal serves as a barometer for US dollar liquidity, the clear message from gold was that monetary conditions were too loose. As we explained in our last commentary on the US dollar, ex-US growth is a critical factor for the currency. When global growth is strong, cross-border lending rises in response. As the world's reserve currency, the US dollar is the most heavily borrowed currency for cross-border lending purposes (i.e. the Eurodollar market). While other currencies may offer lower interest rates, the dollar is most easily accessible as US capital markets are unsurpassed in size or sophistication. As more and more dollars chase international investment opportunities, the currency weakens as a result. As both yields and the dollar weaken during boom times, gold tends to strengthen.

What a difference a year makes

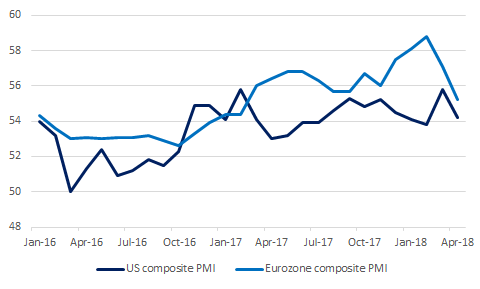

In recent history, investors have aggressively chased the riskiest investments (such as high-technology or emerging markets stocks) thanks to "globally synchronized growth". Optimism became particularly feverish as Eurozone economic growth (both actual and expected) accelerated above US growth. Markit Composite PMIs, a measure of sentiment across manufacturing and services businesses, is shown below for reference:

Ex-US growth expectations fall down to earth

Source: Markit, MarketsNow

As can be seen above, Eurozone growth expectations peaked in February 2018. At the time, the difference between US and Eurozone future growth expectations were also the highest.

Today, the picture has darkened considerably as future growth expectations in the Eurozone and Japan fall sharply. While official data from China suggests continued growth, a downturn in China-sensitive assets (such as industrial metal prices and the Australian dollar), also suggests a weakening outlook. By comparison, US growth continues to look relatively healthy. While the US economy has experienced a few hiccups, most forward-looking indicators remain sanguine.

Rising growth + rising inflation = watch out for the Fed

Today's economic backdrop of rising growth and rising inflation is ideal for the Fed. When both factors are working in the Fed's favor, the institution can point to strong data in order to justify higher interest rates. Unsurprisingly, US bond yields have strengthened, with 10-year Treasury bonds currently yielding more than 3%. Astute observers of inflation will (correctly) point out that bond yields have in fact been rising since September 2017. Why did the dollar weaken and gold manage to strengthen in recent history despite rising bond yields? Why would gold behave differently today?

The answer is a change in global risk sentiment. When growth expectations hit a fever pitch in December 2017/January 2018, the US dollar sold off sharply. As sentiment moderates while ex-US growth decelerates, the USD liquidity pump is running dry - meaning that fewer borrowed dollars are chasing international investments. Naturally, this reduces the downward pressure on the currency that we saw recently. For precious metals investors, this raises the risk that gold will weaken thanks to a rebound in the US dollar.

From too loose to too tight?

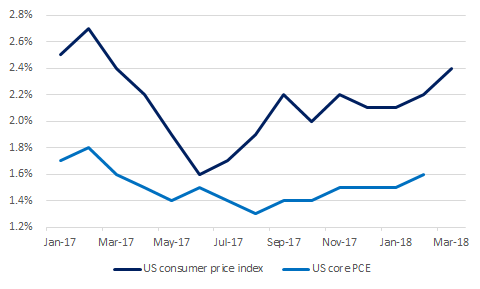

After one of the longest expansions in history, the outlook for the current economic upswing is weakening. While this is reflected in financial markets (most stock markets have peaked and are now falling), the Fed tends to be behind the curve given its dependence on backwards-looking data. This is particularly the case as US inflation continues to accelerate. An overview of US headline inflation and Core Personal Consumption Expenditures (the Fed's preferred measure of inflation) are shown below:

Up and away: US headline inflation accelerates to 2%+

Source: US Bureau of Economic Analysis, MarketsNow

While falling cross-border lending is already tightening financial conditions, there is an incremental risk that the Fed will tighten conditions even further by raising rates or providing hawkish forward guidance. As a barometer for US dollar liquidity, this is the biggest risk for gold investors today. Our call is that the dollar will ultimately strengthen later this year, alongside a significant slowdown in global growth. For now, we maintain a neutral medium-term outlook on the dollar, and a bullish medium-term outlook on gold. Once the dollar ultimately enters a bullish trend, we expect gold prices to fall accordingly.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Follow MarketsNow and get email alerts