Gold to Silver Ratio Hits 100! / Commodities / Gold & Silver 2020

Gold is testing itsprevious 2020 highs, but silver plunged anyway, which created a very specialsituation. Namely, the goldto silver ratio just jumped to the 100 level.

This may not seem like abig deal, because ultimately people buy metals, not their ratio, but itactually is a huge deal. This ratio is observed by investors and traders alike,as it tends to peak at the market extremes. Moving to the 100 level mightindicate that we are at a price extreme. But what kind of extreme would that beif silver is declining while gold moved up?

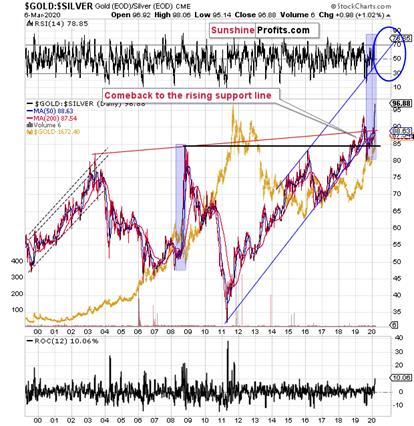

Let’stake a closer look at the gold to silver ratio chart for details.

Inearly July 2019, the goldto silver ratio topped after breaking above the previous highs andnow it’s after the verification of this breakout. Despite the sharp pullback,the ratio moved back below the 2008 high only very briefly. It stabilized abovethe 2008 high shortly thereafter and now it’s moving up once again.

Itpreviously moved up relatively slowly, but it jumped to new highs last week andtoday.

Anythingafter a breakout is vulnerable to a quick correction to the previously brokenlevels. On the other hand, anything after a breakout that was alreadyconfirmed, is ready to move higher and the risk of another corrective declineis much lower.

Themost important thing about the gold and silver ratio chart to keep in mind isthat it’s after a breakout above the 2008 high and this breakout was alreadyverified. This means that the ratio is likely to rally further. It’s not likelyto decline based on being “high” relative to its historical average. That’snot how breakouts work.

Thebreakout above the previous highs was verified by a pullback to them and nowthe ratio moved even higher, just as we’ve been expecting it to.

Thetrue, long-term resistance in the gold to silver ratio is at about 100 level.This level was not yet reached, which means that as long as the trend remains intact (and it does remain intact), the 100 level will continue to bethe likely target.

We’vebeen writing the above for weeks (hence we formatted it with italics), despitenumerous calls for a lower gold to silver ratio from many of our colleagues.And our target of 100 was just hit today. It was only hit on an intraday basis,not in terms of the daily closing prices, but it’s still notable.

Wehad been expecting the gold to silver ratio to hit this extreme close or at thevery bottom and the end of the medium-term decline in the preciousmetals sector – similarly to what happened in 2008. Obviously,that’s not what happened.

Instead,the ratio moved to 100 in the situation where gold rallied, likely based on itssafe-haven status, and silver plunged based on its industrial uses.

Despitenumerous similarities to 2008, the ratio didn’t rally as much as it did backthen. If the decline in the PMs is just starting – and that does appear to bethe case – then the very strong long-term resistance of 100 might not be ableto trigger a rebound.

Itmight also be the case that for some time gold declines faster than silver,which would make the ratio move back down from the 100 level. The 100 levelcould then be re-tested at the final bottom.

Or…which seems more realistic, silver and miningstocks could slide to the level that we originally expected them towhile gold ultimately bottoms higher than at $890. Perhaps even higher than$1,000. With gold at $1,100 or so, and silver at about $9, the gold to silverratio would be a bit over 120.

Ifthe rally in the gold to silver ratio is similar to the one that we saw in2008, the 118 level or so could really be in the cards. This means that thecombination of the above-mentioned price levels would not be out of thequestion.

Atthis time, it’s too early to say what combination of price levels will be seenat the final bottom, but we can say that the way gold reacted recently and howit relates to everything else in the world, makes gold likely to decline inthe following months. Silver is likely to fall as well and its unlikely that alocal top in the gold to silver ratio will prevent further declines.

Thankyou for reading the above free analysis. It’s part of today’s extensive Gold& Silver Trading Alert. We encourage you to sign up for our free goldnewsletter – as soon as you do, you'll get 7 days of free access to our premiumdaily Gold & Silver Trading Alerts and you can read the full version of theabove analysis right away. Signup for our free gold newsletter today!

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.