Gold Trend Analysis, Elliott Waves and Silver Ratio / Commodities / Gold & Silver 2020

Gold / SIlver Ratio

Gold price of $1560 divided of by the silver price of $18.07 results in a ratio of 86.3! The historic norm is for around 50. No I am not saying that Silver should trade to a ratio of 50 to Gold anytime soon. I will cover the prospects for the Silver price in a separate analysis.

So either Silver is CHEAP or Gold is EXPENSIVE, probably a mixture of both, which implies to expect Gold price weakness..

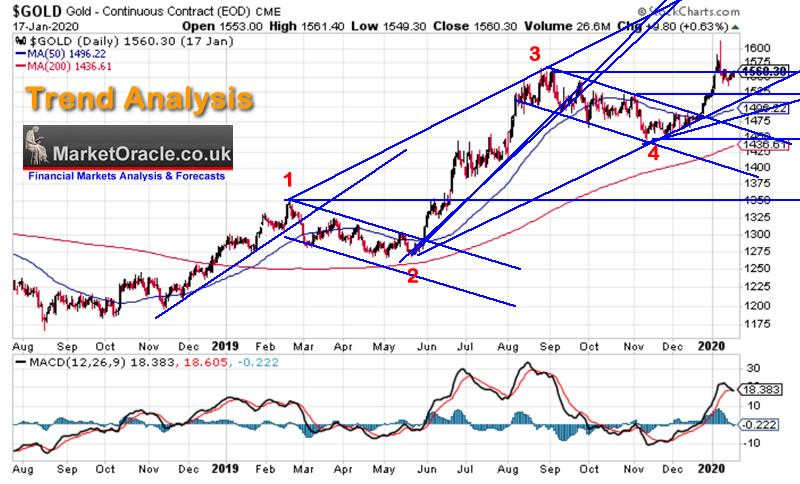

Trend Analysis

Gold breached $1566 and is now consolidating in advance of the next leg higher back through $1566 and then beyond the $1613 high set a couple of weeks ago.

MACD - The MACD shows that Gold is overbought and entering a corrective phase in terms of time at least i.e. the gold price may not fall much from where it currently trades, but neither is it likely to blast higher.

RESISTANCE : Gold is trading very near resistance of $1566 and then $1613. However the whole area from $1530 to $1630 is longer term resistance, which implies to expect choppy price action.

SUPPORT : Immediate support is at $1520 and then $1500. So downside looks very limited.

ELLIOT WAVES: Look very bullish, i.e. implies Gold is in impulse wave 5 that could run for another couple of months. So contrary to most of the above analysis.

The rest of this analysis has first been made available to Patrons who support my work: Gold Price Trend Forecast 2020

Gold Price Trend Forecasts 2019 ReviewSEASONAL ANALYSISQE4EVERUS DOLLARLONG-TERM TREND ANALYSIS Gold / SIlver RatioTrend Analysis ELLIOT WAVESGold Price Trend Forecast 2020 ConclusionSo for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Recent analysis includes :

The Coronavirus Stocks Bear Market Begins, When Will it End?Coronavirus Pandemic Stock Market ImplicationsCoronavirus Global Calm Before the Viral Storm - China Infection Statistics Probability AnalysisUK Coronavirus COVID-19 Pandemic Trend Forecast to End March 2020Will CoronaVirus Pandemic Trigger a Stocks Bear Market 2020?Silver Price Trend Forecast 2020Gold Price Trend Forecast 2020 British Pound GBP Trend Forecast 2020 AI Stocks2019 Review and Buying Levels Q1 2020Stock Market Trend Forecast Outlook for 2020Scheduled Analysis Includes:

UK Housing market seriesMachine Intelligence Investing stocks sub sector analysisBitcoin trend forecastEuro Dollar FuturesEUR/RUBUS House Prices trend forecast updateAnd ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your Analyst

By Nadeem Walayat

Copyright © 2005-2020 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.