Gold Tries to Hold Above $2000 - Hard Landing Ahead? / Commodities / Gold and Silver 2022

Gold has hit $2,000 but is stillstruggling to maintain that historical level. It has already tried 8 times -will the ninth attempt succeed? Many indications make this doubtful.

Gold is attempting to break above the$2,000 milestone, and miners are trying to break above their decliningresistance line. Will they manage to do so, and if so, how long will the rallylast?

Yesterday, gold didn’t manage to closeabove the $2,000 level and it’s making another attempt to rally above it intoday’s pre-market trading. However, will it be successful?

Given the RSI above 70 and the strengthof the current resistance, it’s doubtful.

In fact, nothing has changed with regardto this likelihood since yesterday, so what I wrote about it in the previousGold & Silver Trading Alert remains up-to-date:

Goldtouched $2,000 in today’s pre-market trading, which is barely above its2021 high and below its 2020 high. Crude oil is way above both analogouslevels.

Inother words, gold underperforms crude oil to a significant extent, just like in2003.

Interestingly,back in 2003, gold topped when crude oil rallied about 40% from its short-termlows (the late-2002 low).

Whathappened next in 2003? Gold declined, and themoment when crude oil started to visibly outperform gold was also the beginningof a big decline in gold stocks.

Thatmakes perfect sense on the fundamental level too. Gold miners’ share pricesdepend on their profits (just like it’s the case with any other company). Crudeoil at higher levels means higher costs for the miners (the machinery has to befueled, the equipment has to be transported, etc.). When costs (crude oil couldbe viewed as a proxy for them) are rising faster than revenues (gold could beviewed as a proxy for them), miners’ profits appear to be in danger; andinvestors don’t like this kind of danger, so they sell shares. Of course, thereare many more factors that need to be taken into account, but I just wanted toemphasize one way in which the above-mentioned technical phenomenon isjustified.

Back in 2003, gold stockswiped out their entire war-concern-based rally, and the biggest part of thedecline took just a bit more than a month. Let’s remember that back then, goldstocks were in a very strong medium- and long-term uptrend. Right now, miningstocks remain in a medium-term downtrend, so their decline could be bigger –they could give away their war-concern-based gains and then decline much more.

Miningstocks are not declining profoundly yet, but let’s keep in mind that historyrhymes – it doesn’t repeat to the letter. As I emphasized previously today,back in 2003 and 2002, the tensions were building for a longer time, and it wasrelatively clear in advance that the U.S. attack was going to happen. Thistime, Russia claimed that it wouldn’t attack until the very last minute beforethe invasion. Consequently, the “we have to act now” is still likely to be present,and the dust hasn’t settled yet – everything appears to be unclear, and thusthe markets are not returning to their previous trends. Yet.

However,as history shows, that is likely to happen. Either immediately, or shortly, ascrude oil is already outperforming gold.

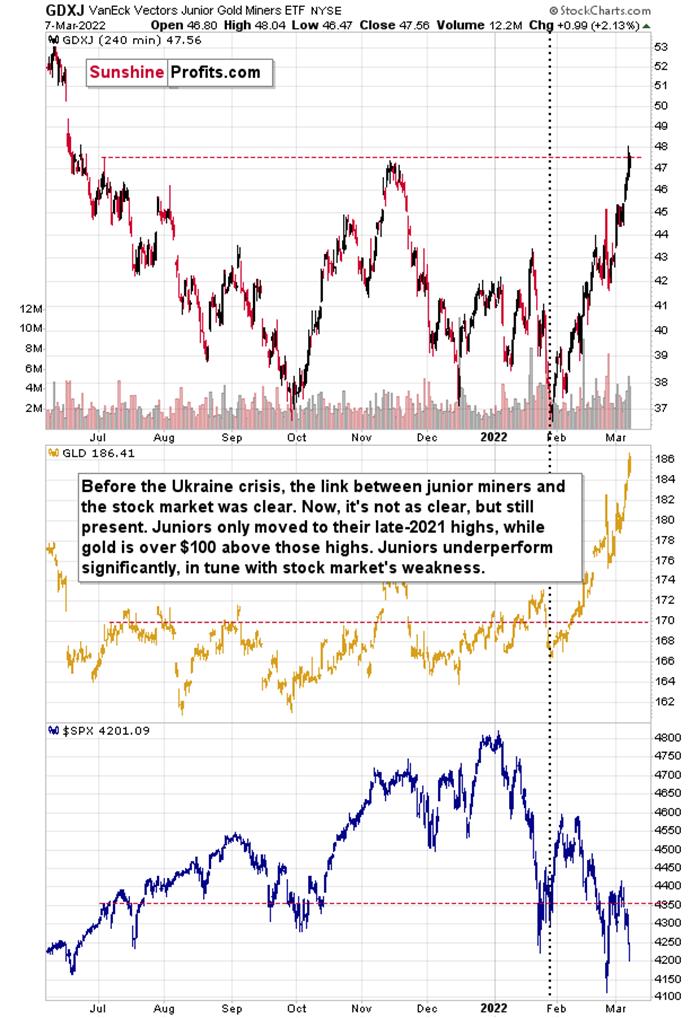

The above chart features the GDXJ ETF. Asyou can see, the junior miners moved to their very strong resistance providedby the declining resistance line. This resistance is further strengthened bythe 38.2% Fibonacci retracement, and the previous (late-2021) high. This means that it’s particularly strong,and any breakout here would likely be invalidated shortly.

Giventhe clear sell signal from the RSI indicator, a turnaround here is even morelikely. I marked the previous suchsignals to emphasize their efficiency. When the RSI was above 70, atop was in 6 out of 7 of the recent cases, and the remaining case was shortlybefore the final top, anyway.

Thisresistance seems to be analogous to the $2,000 level in gold.

Bythe way, please note that gold tried to break above $2,000 several times:twice in August 2020;twice in September 2020 (once moving above it, once moving just nearthis level);once in November 2020 (moving near this level);once in January 2021 (moving near this level);once in February 2022 (moving near this level).

Theseattempts failed in each of the 7 cases mentioned above. This is the eightattempt. Will this very strong resistance break this time?

Givenhow much crude oil has already soared, and how both markets used to react towar tensions in the case of oil-producing countries, it seems that the days ofthe rally are numbered.

Movingback to the GDXJ ETF, please note that while gold is moving close to itsall-time highs, the junior miners are not doing anything like that. In fact,they barely moved slightly above their late-2021 high. They are not even closeto their 2021 high, let alone their 2020 high. Instead, junior mining stocksare just a bit above their early-2020 high, from which their prices were morethan cut in half in less than a month.

Inother words, junior miners strongly underperform gold, which is a bearish sign.When gold finally declines – and it’s likely to, as geopolitical events tend tohave only a temporary effect on prices, even if they’re substantial – juniorminers will probably slide much more than gold.

Oneof the reasons is the likely decline in the general stockmarket.

Irecently received a question about the impact the general stock market has onmining stocks, as the latter moved higher despite stocks’ decline in recentweeks. So, let’s take a look at a chart that will feature junior mining stocks,the GLD ETF, and the S&P 500 Index.

Beforethe Ukraine crisis, the link between juniorminers and the stockmarket was clear. Now, it's not as clear, but it’s still present. Juniors onlymoved to their late-2021 highs, while gold is over $100 above those highs.Juniors underperform significantly, in tune with the stock market's weakness.

Thegold price is still the primary driver of mining stock prices – includingjunior mining stocks. After all, that’s what’s either being sold by the company(that produces gold) or in the properties that the company owns and explores(junior miners). As goldprices exploded in thelast couple of weeks, junior miners practically had to follow. However, thisdoesn’t mean that the stock market’s influence is not present nor that it’sgoing to be unimportant going forward.

Conversely,the weak performance of the general stock market likely contributed to juniorminers’ weakness relative to gold – the former didn’t rally as much as thelatter. Since the weakness in the general stock market is likely to continue,and gold’s rally is likely to be reversed (again, what happened in the case ofother military conflicts is in tune with history, not against it), junior miners are likely to decline much more profoundly than gold.

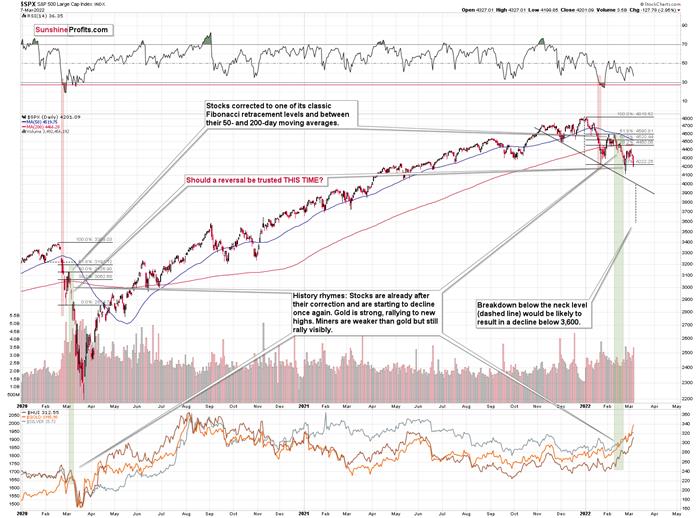

Speaking of the general stock market, itjust closed at the lowest level since mid-2021.

The key thing about the above chart isthat what we’ve seen this year is the biggest decline since 2020, and the sizeof the recent slide is comparable to what we saw as the initial wave down in2020 – along with the subsequent correction. If these moves are analogous, therecent rebound was perfectly normal – there was one in early 2020 too. Thisalso means that a much bigger decline is likely in the cards in the comingweeks, and that it’s already underway.

This would be likely to have a verynegative impact on the precious metals market, in particular on junior miningstocks (initially) and silver (a bit later).

All in all, it seems that due to thetechnical resistance in gold and mining stocks, the sizable – but likelytemporary (like other geopolitical-event-based-ones) – rally is likely to bereversed shortly. Then, as the situationin the general stock market deteriorates, junior miners would be likely toplunge in a spectacular manner.

Thank you for reading our free analysistoday. Please note that the above is just a small fraction of today’sall-encompassing Gold & Silver Trading Alert. The latter includes multiplepremium details such as the targets for gold and mining stocks that could be reached in the next few weeks. If you’dlike to read those premium details, we have good news for you. As soon as yousign up for our free gold newsletter, you’ll get a free 7-day no-obligationtrial access to our premium Gold & Silver Trading Alerts. It’s really free– sign up today.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.