Gold Tripped Up By Dollar Strength

Gold price under serious pressure as U.S. dollar index rallies.

Investors are piling into greenback as U.S. Treasury yields rise.

Gold's 30-day rally window, moreover, has closed.

Gold has had a tough go of it since last week. Despite a buoyant market for oil and fears among equity investors, gold hasn't been able to benefit from factors which would normally spark a flight to quality among investors. In today's report we'll examine gold's near-term prospects after suffering its latest bout of selling pressure. While a technical bounce is still possible, I'll make the case that gold's latest window for rallying as closed and that it's time for traders to (temporarily) pull in the horns on gold and wait for the next confirmed buy signal.

The price of gold was lower for the third straight day on Monday as the yellow metal hit a two-week low. June gold futures finished Monday's session 1.1 percent lower at $1,324. Silver prices were lower, too, by almost 3 percent as selling in the precious metals complex was intense.

Monday's weakness in the metals was blamed on diminishing political pressure after North Korea said this weekend it would suspend nuclear and missile tests before planned summits with South Korea and the United States. Recent fears of a trade war between the U.S. and China, moreover, have been somewhat alleviated in recent days.

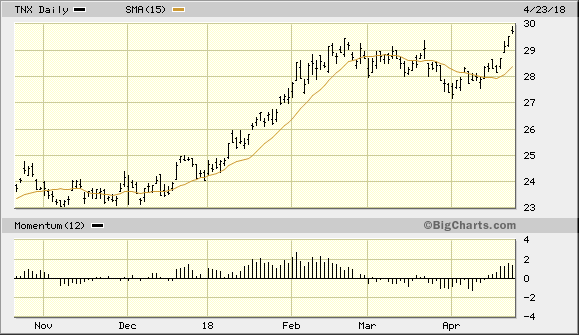

The most likely reason for investors distaste for gold lately has been the powerful rally in the U.S. dollar index. Investors have piled into the dollar in the last three trading sessions as U.S. Treasury yields approach the psychologically significant rate of 3 percent. Shown here is the 10 Year Treasury Note Yield Index (TNX) which highlights the extent of the rally in bond yields.

Source: BigCharts

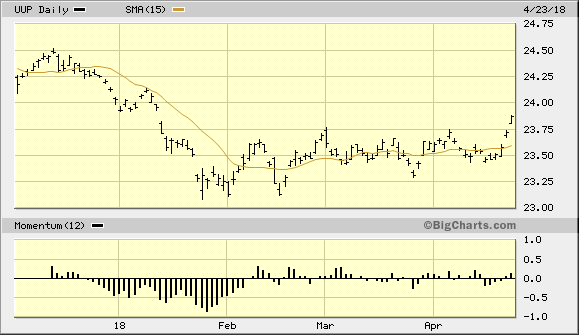

Of even greater significance to gold is the immediate-term trend of the greenback. The sharp run-up in the dollar since last week is reflected in the daily graph of the PowerShares DB US Dollar Index Bullish Fund (UUP), below. After a 3-month range-bound trend in UUP, the dollar bulls made their move to push prices above the trading range ceiling at the $23.75 level. The result was anything but bullish for gold which is priced in dollars. The gold price has consequently been under selling pressure since last Friday.

Source: BigCharts

In Monday's report I made the case that a failure of the iShares Gold Trust (IAU), my gold proxy, to rally within 30 days of its last buy signal on Mar. 23 would constitute a reversal of its previous buy. This observation is based on the 30-day Rule of the famed commodities trader, Amos Hostetter, whose rules I've incorporated into my technical trading discipline. Since the 30-day period has elapsed as of today, the rules of the discipline have necessitated selling my most recent trading position in IAU. This puts me back in a cash position for now. I recommend that conservative traders wait for the dollar rally to end before initiating any new long positions in the gold ETF. Moreover, IAU should close two days higher above its 15-day moving average to confirm that its immediate selling pressure has ended.

Source: BigCharts

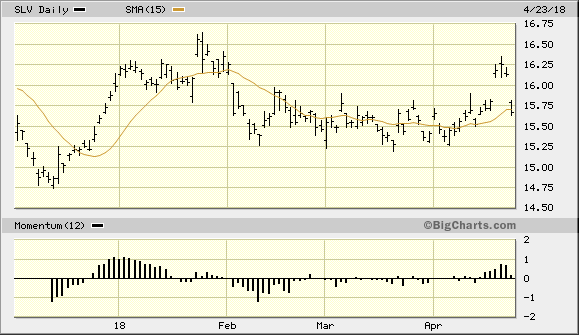

When gold is ready to kick off its next sustained rally we should also ideally receive confirmation from its close cousin silver. Normally the silver price leads gold at important junctures, but this didn't happen before gold's last rally. Instead, the silver price lagged behind gold and remains subdued for most of the last few weeks before (belatedly) rallying on Apr. 18. I argued at that time that the belated rally in the silver price wasn't enough to justify a leading signal for gold. The 3-day "island" type reversal pattern visible in the following graph of the iShares Silver Trust (SLV), my silver proxy, is a case in point. This potentially bearish chart pattern serves as a conspicuous reminder that silver has its work cut out for it before it's ready to resume a leadership position over gold once again.

Source: BigCharts

For now I recommend that traders maintain a cash position and wait for gold to confirm its next immediate-term buy signal per the rules of the trading discipline utilized in this report. That signal features a 2-day higher close above the 15-day moving average in the iShares Gold Trust (IAU), which is currently under pressure. Meanwhile longer-term investment positions in gold can be maintained as the fundamentals underscoring gold's longer-term recovery effort are still intact.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts