Gold - Uncertainty Will Continue To Support The Yellow Metal

Gold trades just under $1500 per ounce and continues to correct.

Phase one of the trade deal is not a done deal.

Brexit looks promising, but still could be a political nightmare.

Iran and the Middle East - a hornet's nest.

Falling rates are bullish for gold - GDXJ is a leveraged play on gold's upside.

Gold broke out above its critical level of technical resistance in June. The price of the yellow metal rose above the July 2016 high at $1377.50 and has not returned to that price. Gold moved to the upside in what was almost a perfect bullish storm for the precious metal. Falling interest rates, fears, and uncertainty surrounding the ongoing trade war between the US and China, and a host of other factors caused investors and traders to go for the gold. Gold is a haven of safety during uncertain times.

After reaching almost $1560 per ounce in early September, the price pulled back. However, it has remained above $1450 per ounce. After trading in a $331.30 range for a half-decade, gold is now at a new level on the upside. The bull market in gold began at the start of this century. After the Bank of England liquidated half of its reserves at prices down to $250 per ounce, gold turned higher. These days, central banks around the world are net buyers of the metal at prices that are six times higher than where the Bank of England sold.

The gold market is trading around the $1500 per ounce level these days and is waiting for the next event that will determine its path. The many issues facing the world continue to cause me to believe that gold is heading higher. The next leg in the bull market in gold could take it to a new record high in dollar terms and above the $2000 per ounce level. Gold mining stocks tend to outperform the price of gold futures on a percentage basis during bull markets. The VanEck Vectors Junior Gold Miners ETF product (GDXJ) can serve as a leveraged product because capital tends to flow to companies that explore for gold as the price rises.

Gold trades just under $1500 per ounce and continues to correct

Since the early September peak at $1559.80 per ounce, the price of gold has corrections and continued to lean towards the downside last week.

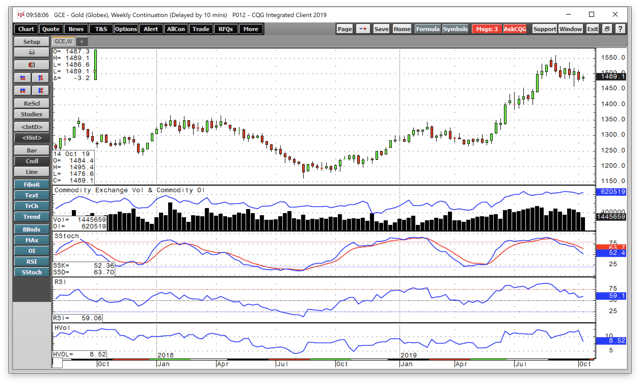

Source: CQG

As the weekly chart highlights, the price dropped to its most recent low at $1458.30 per ounce on the continuous futures contract on October 1 and was at the $1490 level last week. However, gold has been trading around the $1500 per ounce level since hitting the low earlier this month, which has become the pivot point for the yellow metal. From a technical perspective, the total number of open long and short positions at around 620,000 contracts last week has declined from the high at 658,944 contracts on September 24 but remains at an elevated level. The decline of around 39,000 is a sign that some weaker longs have exited risk positions over the past weeks. While price momentum and relative strength indicators are both in neutral territory, they are leaning lower with the price of the precious metal. Weekly historical volatility has dropped from the highs of 2019 at 12.55% to 8.52% last week as the price continued to correct and consolidate.

While gold moved lower from the early September high, the price is well-above the breakout price at $1377.50, which is now critical technical support for the yellow metal. The selling in gold last week came on the back of recent good news on many fronts. However, the many issues facing the world continue to provide the potential for sudden surprises that could send buyers back into the gold market in the blink of an eye.

Phase one of the trade deal is not a done deal

On Friday, October 11, Chinese and US negotiators appeared to agree on a "phase one" deal on trade. The agreement would de-escalate the trade war and lead to Chinese purchases of US agricultural products and a freeze on any tariffs increases scheduled over the coming weeks. The markets cheered the news, but on Monday, October 13, China poured a bit of cold water on the optimism.

The Chinese said that they need more discussions with US negotiators. They warned the markets should not pop any celebratory champagne until both sides sign a "phase one" deal. Given the history of Chinese backtracking and sudden escalations in the trade war by the US, the shift between optimism and pessimism surrounding the protectionist environment is likely to continue over the coming weeks. President Trump needs a political victory as the 2020 election draws nearer, but he still has time to position for a better deal. He would not likely take any backtracking by China well over the coming weeks.

The gold market has moved higher during escalations in the trade war. A deal could send gold lower, but another period of increased protectionist policies would likely cause an increase in buying and a higher price for the yellow metal.

Brexit looks promising, but still could be a political nightmare

On Tuesday, October 15, it appeared that there was progress in the negotiations between Prime Minister Boris Johnson and the European Union on a final deal for Brexit. While the deadline for the UK's membership in the EU is on October 31, October 18-19, is the line in the sand for a deal. The UK Parliament voted, and the Supreme Court ruled that if the Prime Minister cannot reach an agreement with the EU by October 19, he will need to request an extension until at least the end of January 2020.

The Prime Minister has only been in office for weeks after replacing Theresa May. He pledged to take the UK out of the EU by the end of October with or without a deal on Brexit. However, the Parliament made a hard Brexit legally impossible. Therefore, the Prime Minister has worked furiously to do a deal. A breakthrough on the issues surrounding the Irish border that would establish a dual customs zone could be a compromise for both sides. A Brexit would be a victory for the Prime Minister and would likely lead to a win in any upcoming general election. It would also calm the uncertainty in markets surrounding Brexit and could cause further selling in the gold market. There has been no Brexit deal acceptable to the UK Parliament since June 2016. There are no guarantees that Boris Johnson will pull a rabbit out of his hat that will allow him to keep his promise to the voters in the United Kingdom. On Saturday, October 19 in a rare weekend session of the Parliament the legislature will consider and vote on Boris Johnson's Brexit deal.

Iran and the Middle East - a hornet's nest

Iran continues to be the most significant issue facing the Middle East when it comes to the potential for provocative actions. The September 14 attack on Saudi oil production is the most recent incident. As US sanctions continue to choke Iran's economy, the potential for more hostile actions remains elevated.

The region remains a political and military hornet's nest. The US withdrawal from Syria and Turkey's military actions over recent days is a reminder of the tenuous nature of the region.

Tension in the Middle East and an increase in hostilities and atrocities that draw the US and other nations into the region would provide support for the price of gold. The odds of peace in the Middle East are at the lowest point in memory.

Falling rates are bullish for gold - GDXJ is a leveraged play on gold's upside

The Federal Open Market Committee of the US Federal Reserve will meet on October 29-30 to determine the next move when it comes to monetary policy. The markets are looking for another 25-basis point cut in the Fed Funds rate, but that is hardly a given these days.

The recent Fed minutes revealed division within the committee when it comes to the path of short-term rates. The vote at the September meeting was 7-3 in favor of a rate cut. Two of the dissenters, Eric Rosengren of the Boston Fed and Esther George of the Kansas City Fed, said that they believe the current state of the US economy does not warrant interest rate cuts. Both voted against the July 31 rate reduction and are likely to oppose any move to cut the Fed Funds rate on October 30. James Bullard of the New York Fed went the other way because he favored a 50-basis point reduction in September.

While business investment and manufacturing data have slowed, and inflation remains below the Fed's 2% target rate, a case for further rate cuts is strong. However, unemployment is at the lowest level in fifty years, and GDP growth remains moderate. If the Fed decides to pause and not lower the short-term rate, it could weigh on the price of gold. A 25-basis point rate cut would likely support the price of the yellow metal.

I continue to believe that gold will fund a low that is higher than the critical level of technical support at $1377.50 per ounce. Therefore, I would look to add to long positions in gold on price weakness over the coming weeks. On any significant move to the downside, I would favor purchasing an instrument to turbocharge returns when a recovery occurs. Gold mining stocks tend to outperform gold on the upside and underperform on the downside. Junior gold mining stocks often magnify the results of the leading gold mining shares. The VanEck Vectors Junior Gold Miners ETF product holds many of the leading junior gold mining shares, including:

Source: Yahoo Finance

GDXJ is a highly liquid tool with $4.18 billion in net assets and an average of over 18.2 million shares changing hands each day. The product charges an expense ratio of 0.54%.

In 2019, the price of gold rose from a low at $1266 to a high at $1559.80 per ounce or 23.2%.

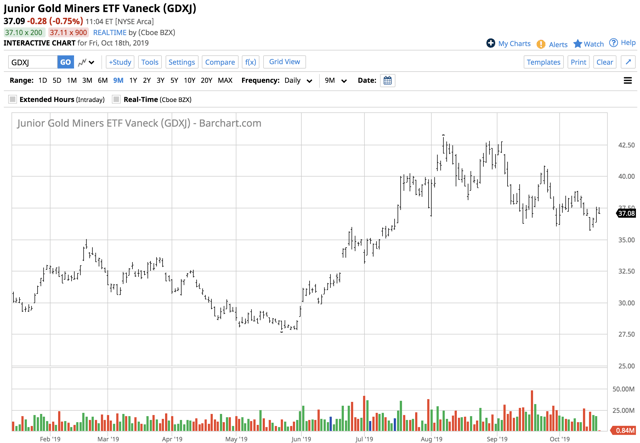

Source: Barchart

The chart shows that over around the same period, GDXJ rose from $27.80 to $43.10 per share or over 55%. If gold takes off on the upside, GDXJ could explode higher as the companies held in the ETF are leveraged gold prospectors and miners that attract speculative buying during bull market periods. Conversely, a deeper correction in gold would likely lead to underperformance in GDXJ compared to the gold futures market on a percentage basis.

For those looking to magnify results, even more, JNUG is a triple leveraged bullish instrument that turbocharges GDXJ on the upside. JDUST is the bearish product that appreciates as the price of GDXJ drops.

I believe that the many issues facing markets across all asset classes will cause gold to find a higher low and move to levels above the early September high. Gold is an asset that attracts buying during periods of fear and uncertainty, and there is plenty of potential for scary periods on the horizon.

The Hecht Commodity Report is one of the most comprehensive commodities reports available today from the #2 ranked author in both commodities and precious metals. My weekly report covers the market movements of 20 different commodities and provides bullish, bearish and neutral calls; directional trading recommendations, and actionable ideas for traders. I just reworked the report to make it very actionable!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The author always has positions in commodities markets in futures, options, ETF/ETN products, and commodity equities. These long and short positions tend to change on an intraday basis.The author is long gold

Follow Andrew Hecht and get email alerts