Gold Volatility On The Rise

Waning trade-related fears have halted gold's forward progress for now.

ETF inflows slip, further eroding the immediate-term gold outlook.

Gold's longer-term recovery is still alive, though, and should continue.

While gold's intermediate-term (3-9 month) recovery is still intact, its near-term trend is coming under serious pressure. As we'll discuss in today's report, the latest spike in the volatility for gold-backed funds has resulted in a temporary exit signal for gold ETF traders. We'll discuss this here as well as the prospects for a renewed buy signal by later this month.

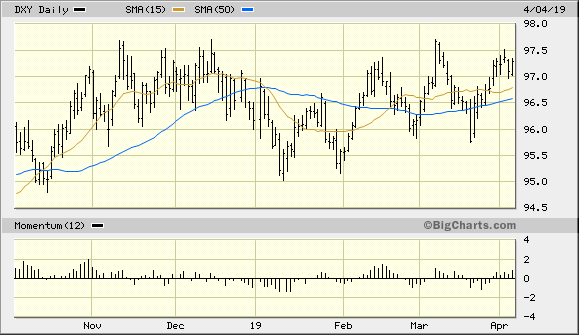

Gold price volatility has been on the rise of late and this has been the result of two major factors. The first is the recent strengthening of the U.S. dollar index (DXY), which we've discussed in recent reports. A stronger dollar tends to undermine bullion demand by making gold more expensive for buyers with foreign currencies. Shown here is the DXY in relation to its 15-day and 50-day moving averages, both of which are in the process of turning up. This is an important consideration from a technical standpoint since it reflects an increase in forward momentum in the dollar index. This in turn makes it easier for dollar bulls to push the greenback even higher, which would serve to further depress gold demand in the near term.

Source: BigCharts

The other factor weighing on gold lately has been a diminution of global trade fears. As progress is apparently being made on the U.S.-China trade front, investors have less incentive to purchase gold for safety-related reasons. Instead, equities have come back into favor in the last two weeks as investors have embraced more of a "risk on" approach in view of the improved global outlook.

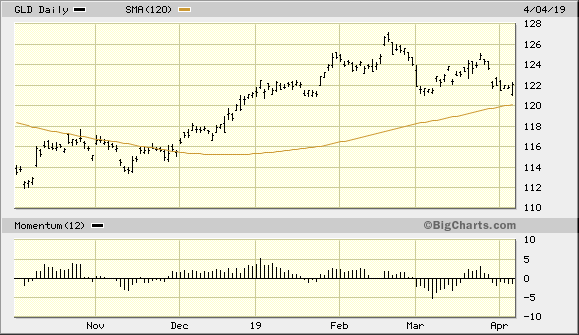

Both factors are closely related as an improved economic outlook is typically reflected in a stronger dollar. The April 4 trading session illustrated why gold is facing renewed headwinds from dollar strength. While the gold price managed to close slightly higher for the day, the SPDR Gold Shares (GLD) - the world's largest gold-backed ETF and a favorite gold proxy - was down sharply in early trading and tested the lower boundary of a 3-month trading range. As the following graph shows, GLD is also just above the 120-day moving average, which is an important long-term trend line. The following graph shows that while the recovery which began late last year is still intact, the immediate-term (1-4 week) trend is still quite shaky for the gold ETF.

Source: BigCharts

The recent decline in gold demand due to U.S. currency strength and diminished fear can be seen in the latest inflows for GLD, which fell for a third straight session on Apr. 3. The fund's holdings hit their lowest since Dec. 17 at 24.57 million ounces.

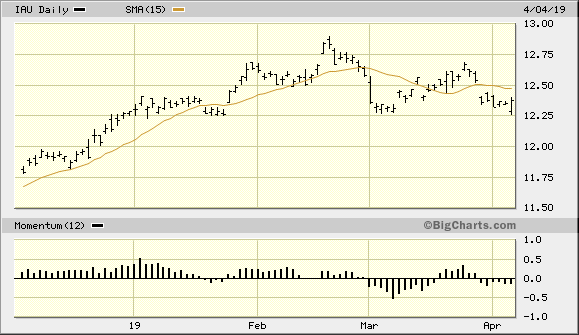

The latest increase in gold fund volatility also resulted in a rather unfortunate whipsaw to our gold ETF trading position. On Apr. 4, my recommended trading position in the iShares Gold Trust (IAU) was stopped out after the $12.30 level was violated on an intraday basis. No new trading positions in IAU are currently recommended until we see the ETF price recover back above its 15-day moving average on a 2-day closing basis (see chart below).

Source: BigCharts

Although the yellow metal's immediate-term trend is being undermined by gold's weakening currency component, its much larger recovery which began last October is still alive. One factor in support of its continuation this spring, in spite of the latest setback, is global jewelry demand for the metal. According to the consulting firm Metals Focus, global gold demand for 2019 is expected to rise to its highest level in four years, buoyed by higher jewelry purchases. The firm's Gold Focus 2019 report predicts the world to buy 4,370 tons of gold this year, which would be the most since 2015 and slightly higher than last year's 4,364 tons.

Gold jewelry consumption is predicted to increase 3 percent this year to 2,351 tons, mainly due to the world's two largest markets, China and India. The firm's Gold Focus 2019 report also predicted gold prices would average $1,310 per ounce in 2019, which is above last year's $1,268 and the highest since 2013.

While short-term volatility factors have created a headwind for the gold price, the fundamental and technical factors we've discussed in recent reports should propel the gold price higher by later this spring. What we're now seeing is likely nothing more than a temporary setback for the metal due to a combination of global trade optimism and a (temporarily) strengthening U.S. currency. However, if the pattern which has been in place since last year remains in play, we should see renewed safe-haven demand once the next U.S. corporate earnings season gets underway later this month. For now, though, gold investors should expect more turbulence as long as the dollar remains strong and global equity markets are surging.

On a strategic note, only if the dollar breaks out to a new 52-week high and continues to rise on a sustained basis would I be forced to reevaluate my bullish intermediate-term gold outlook. While I don't recommend initiating new long positions in gold or the gold ETFs right now, investors are justified in maintaining intermediate-term long positions in gold based on the prevailing fundamental and psychological factors discussed in this report. Short-term gold ETF traders, however, are now on the sidelines and should wait for gold's next confirmed breakout signal before initiating new long positions.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts