Gold Weekly: 'Buy The Dips' Regime Set To Prevail For BAR ETF

GraniteShares Gold Trust (BAR) has delivered a flattish performance over the past week, despite a marked deprecation in the dollar, contrary to our expectations.

We attribute the lack of upside in BAR to a speculative de-grossing, after the speculative community held for some months a significantly net long position in Comex gold.

But the stability of gold ETF buying, despite the rebound in global risk-taking appetite, suggests that macro investors continue to view gold as a reliable haven. This is BAR 1positive.

A look at gold's seasonal rules.

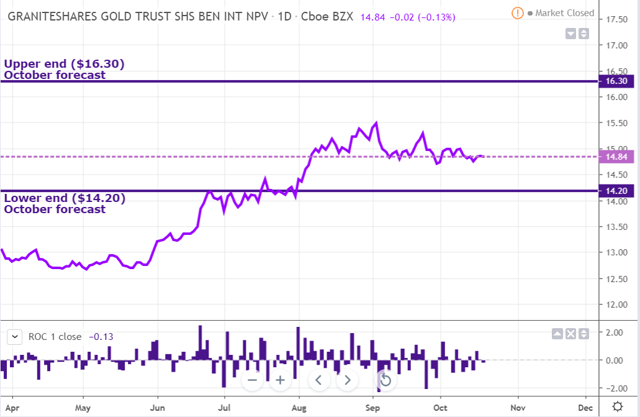

We maintain our trading range of $14.20-$16.30 for BAR this month, although we contend that the window is narrowing for the upside we envision.

Thesis

Welcome to Orchid's Gold Weekly report. We discuss gold prices through the lense of the GraniteShares Gold Trust ETF (BAR).

BAR has delivered a flattish performance over the past week, despite a marked deprecation in the dollar. The dollar index (DXY) sold off 1.2% last week, its worst performance since June, due to renewed optimism in Europe following a possible Brexit deal.

We attribute the lack of upside in BAR to a speculative de-grossing, after the speculative community held for some months a significantly net long position in Comex gold.

But the stability of ETF inflows into gold, despite the rebound in global risk-taking appetite, suggests that macro investors continue to view gold as a reliable hedge against a future correction in risk assets.

As we view the recent bout of speculative selling as transient, we continue to approach BAR from the long side, willing to eagerly buy the dips.

We maintain our trading range of $14.20-$16.30 for BAR this month, although we contend that the window is narrowing for the upside we envision.

Source: Trading View, Orchid Research

About BAR

BAR is directly impacted by the vagaries of gold spot prices because the Funds physically holds gold bars in a London vault and custodied by ICBC Standard Bank. The investment objective of the Fund is to replicate the performance of the price of gold, less trust expenses (0.20%), according to BAR's prospectus.

The physically-backed methodology prevents investors from getting hurt by the contango structure of the gold market, contrary to ETFs using futures contracts.

Also, the structure of a grantor trust protects investors since trustees cannot lend the gold bars.

BAR provides exposure which is identical to established competitors like GLD and IAU, which are nevertheless much more costly to hold over a long period of time. Indeed, BAR offers an expense ratio of just 0.20% while IAU and GLD have an expense ratio of 0.25% and 0.50%, respectively.

Speculative positioning

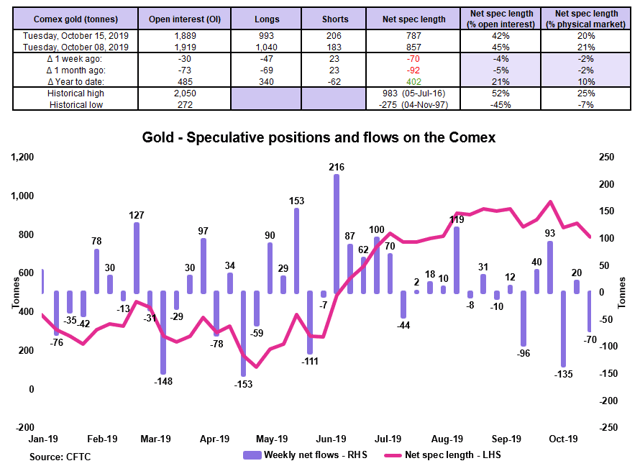

Source: CFTC, Orchid Research

The net long position held by non-commercials in Comex gold dropped by 70 tonnes (4% of OI) over the latest reporting period of October 8-15, during which the Comex gold spot price weakened by 1.8%.

Despite the wave of spec selling over the past month (~70 tonnes or 5% of OI), the net spec length remains elevated at 42% of OI, close to its historical high of 52% of OI.

There is more room for additional speculative selling in the very near term, especially if momentum indicators turn more negative. But given our view that the dollar and US real rates should continue to move lower on more Fed easing, the speculative community should remain bias toward the long side in gold over the medium term.

Implications for BAR: Although we acknowledge the risk of spec selling in immediate term due to momentum, specs should remain stretched on the long side in the medium term. This is potentially negative for BAR in the immediate term, but positive over the medium to long term.

Investment positioning

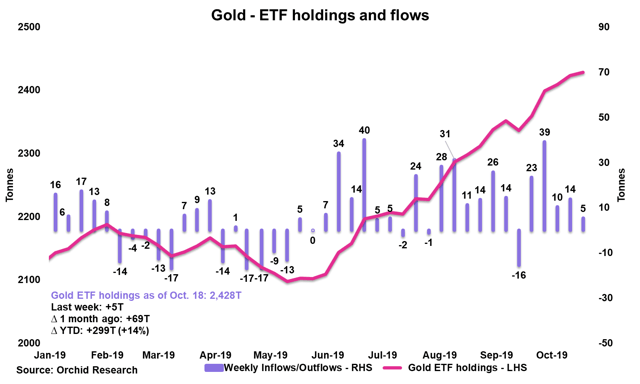

Source: Orchid Research

ETF investors bought 5 tonnes of gold last week (October 11-18), marking a 5th straight week of net inflows.

While the year-to-date pace of ETF buying (299 tonnes) is smaller than that of speculative buying, gold ETF holdings tend to be relatively stickier, in so far as the majority of ETF investors aim at holding gold for the long term.

In contrast, the majority of speculators use leverage and trade gold with a relatively short time horizon.

We expect investors to continue to buy gold at a steady pace and even accelerate their buying in case of a sudden price dip, which could be triggered by an abrupt bout of speculative selling.

Implications for BAR: ETF inflows into gold have exerted marked upward pressure on gold spot prices, which in turn has benefited BAR.

Gold's seasonal rules

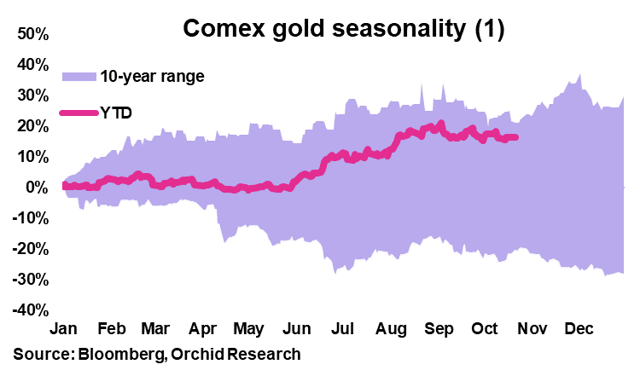

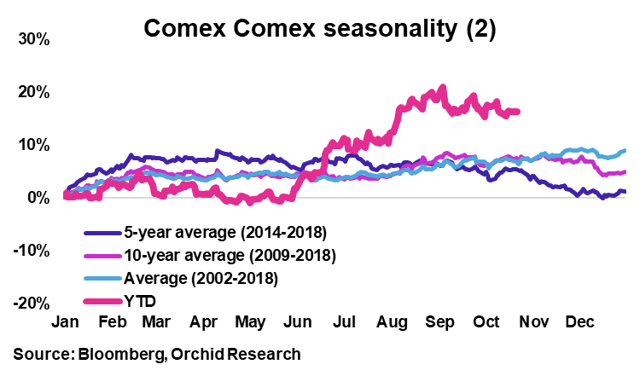

Since the start of the year, Comex gold has traded toward the upper end of its 10-year trading range, signalling a bullish configuration (1).

While it initially underperformed its seasonal rules in H1, the yellow metal has broken its seasonal patterns to the upside since the start of H2 (2).

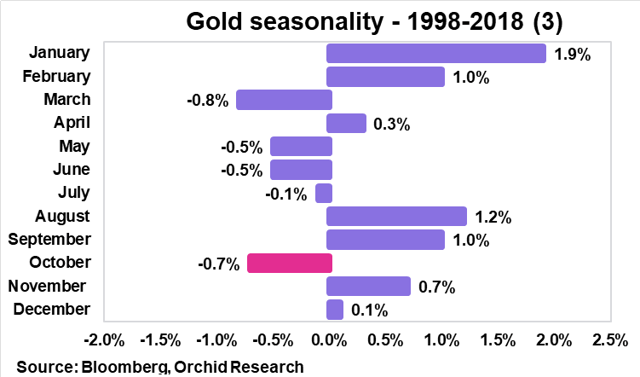

In October, Comex gold has a tendency to perform poorly, having delivered an average negative return of 0.7% over the past ten years (3).

Having said that, the yellow metal seems to have entered a bullish regime, suggesting that Comex gold could continue to outperform its seasonal rules in Q4 2019.

Closing thoughts

While we contend that the heavy net long position in Comex gold held by the speculative community is a downside risk to BAR in the immediate term, we believe that the overall gold market will remain in a "buy on the dips" regime, chiefly because we are late in the US economic cycle and investor demand for safe have will continue to grow as economic growth softens and policy easing intensifies.

While we maintain our October high forecast of $16.30 per share this month, we concur that the window is narrowing.

Did you like this?

Click the "Follow" button at the top of the article to receive notifications.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Our research has not been prepared in accordance with the legal requirements designed to promote the independence of investment research. Therefore, this material cannot be considered as investment research, a research recommendation, nor a personal recommendation or advice, for regulatory purposes.

Follow Orchid Research and get email alerts