Gold Weekly: Beware The Risk Of Speculative Profit-Taking

Gold prices have traded sideways in recent days, driven by a "wait and see" approach among market participants.

The risk of speculative profit-taking in Comex gold is elevated at this juncture.

But central bank and ETF gold buying should remain buoyant in H2 2019.

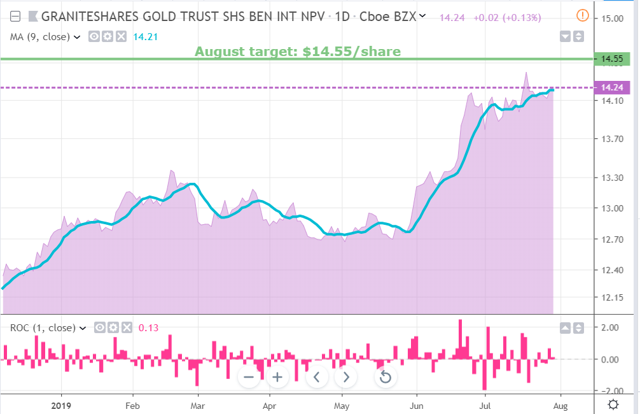

BAR: While weakness cannot be ruled out early in August, we think that BAR will post a monthly gain in August - our target is at $14.55 per share.

Introduction

Welcome to Orchid's Gold Weekly report. We discuss gold prices through the lens of the GraniteShares Gold Trust ETF (BAR), which replicates the performance of gold prices by holding physically gold bars in a London vault in the custody of ICBC Standard Bank.

BAR has barely moved since our latest weekly report, suggesting that our July target of $14.55 is unlikely to be reached.

While central bank buying is likely to remain buoyant in H2 2019 and ETF investors could further lift their gold holdings, the speculative community looks overextended.

The risk of speculative profit-taking is therefore elevated at this juncture, leading us to expect some temporary weakness early in August.

That said, we believe that BAR will post a gain in the whole of August - our target is $14.55, which corresponds to our former July target.

Source: Trading View, Orchid Research

About BAR

BAR is directly impacted by the vagaries of gold spot prices because the Funds physically holds gold bars in a London vault and custodied by ICBC Standard Bank. The investment objective of the Fund is to replicate the performance of the price of gold, less trust expenses (0.20%), according to BAR's prospectus.

The physically-backed methodology prevents investors from getting hurt by the contango structure of the gold market, contrary to ETFs using futures contracts.

Also, the structure of a grantor trust protects investors since trustees cannot lend the gold bars.

BAR provides exposure which is identical to established competitors like GLD and IAU, which are nevertheless much more costly to hold over a long period of time. Indeed, BAR offers an expense ratio of just 0.20% while IAU and GLD have an expense ratio of 0.25% and 0.50%, respectively.

Speculative positioning

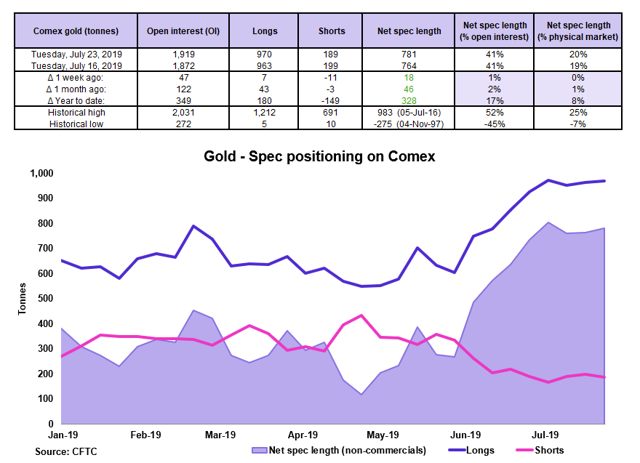

Source: CFTC, Orchid Research

Speculators left their net long exposure to Comex gold broadly unchanged in the week to July 23, for a second week in a row.

After lifting substantially their bullish bets over May-June, gold speculators have adopted a "wait and see" approach, which could suggest that the bullish camp has reached a maximum exposure.

At 41% of OI, the net spec length is getting close to the historical high of 52% of OI, which is consistent with this view.

While a further appreciation in gold spot prices caused by external factors (e.g., central bank buying, ETF purchases) could prompt the speculative community to extend even further its net long position in Comex gold, an abrupt sell-off in spot gold prices could precipitate speculative profit-taking, which in turn would intensify the downtrend in prices.

Implications for BAR: The risk of speculative profit-taking in Comex gold is elevated at this juncture, leaving spot gold prices and thus BAR vulnerable to the downside.

Investment positioning

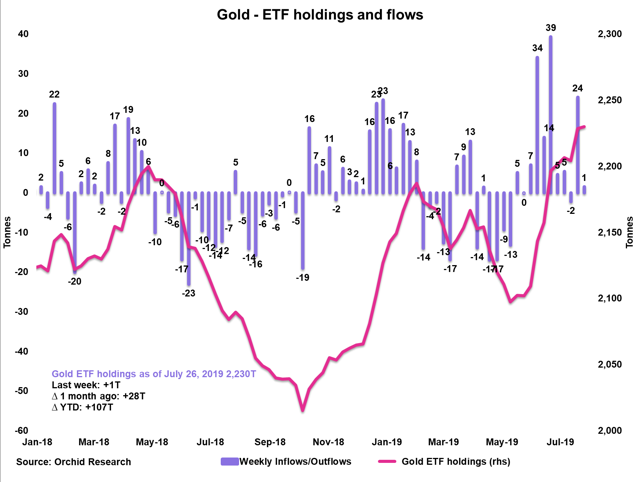

Source: Orchid Research

ETF investors were on the sidelines in the week to July 26, after buying 24 tonnes of gold in the prior week.

Gold ETF holdings are close to their highest since May 2013, having increased by a little bit more than 100 tonnes in the year to date.

This reflects a very positive sentiment among ETF investors, probably reflecting a growing fear that the US equity market has become too expensive and thus, vulnerable to a correction, hence the need to build risk-unfriendly positions like gold and other safe-haven assets.

Implications for GLDM: The robust pace of ETF inflows into gold since the start of the year has had an overtly positive impact on spot gold prices, which therefore benefits BAR.

Central bank trends

Central banks' sentiment toward gold remained positive at the start of Q3

The CRB bought 16.9 tonnes of gold in June (according to the gold reserves holdings reported by the IMF), pushing Russian official gold holdings to 2,207 tonnes.

In H1 2019, global central banks bought a combined 381 tonnes of gold, which is much higher than the net purchases of 180 tonnes made in the same period of last year, according to data from the World Gold Council (WGC).

According to a survey conducted by the WGC, 11% of major developed and EM economies are inclined to raise their gold holdings over the next 12 months.

This suggests that central bank gold buying should remain buoyant in H2 2019.

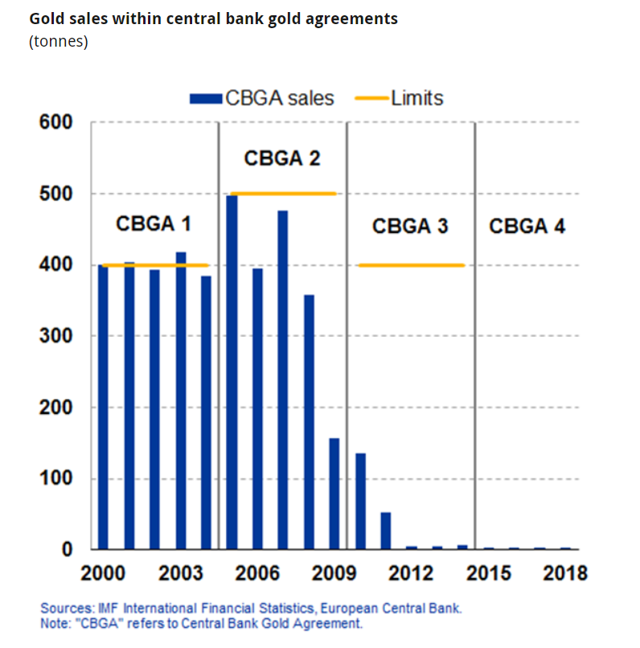

End of the Washington Agreement in September 2019

The Central Bank Gold Agreement (CBGA), also known as the Washington Agreement, which was signed by the ECB and 21 other central banks in 1999 in order to coordinate central banks' gold sales to limit turbulence in the gold market, will not be renewed this year and will expire in September 2019. This was broadly expected by the market.

Source: ECB

According to the ECB's press release:

Signatories of the fourth Central Bank Gold Agreement no longer see need for formal agreement as market has developed and matured

Signatory central banks confirm gold remains an important element of global monetary reserves and none of them currently has plans to sell significant amounts of gold.

Our view: The fact that central banks recognize that the gold market has become mature enough is bullish because it could induce other market participants, like institutional funds, to boost their exposure to gold. We view the risk of a resumption of significant sales by central banks as marginal considering the overall positive attitude among central banks toward gold, allowing them to gain credibility and reduce their counterparty risk as gold is a sovereign-risk free asset.

Closing thoughts

As we believe that the speculative community has overextended its net long position in gold, spot gold prices will be driven by demand from ETF investors and central banks. As the risk of speculative profit-taking is elevated at this juncture, we would not be surprised to see some temporary weakness in spot gold prices.

Our August target for BAR is $14.55 per share (therefore implying some upside from here), but some weakness cannot be ruled out in the very short term.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Our research has not been prepared in accordance with the legal requirements designed to promote the independence of investment research. Therefore, this material cannot be considered as investment research, a research recommendation, nor a personal recommendation or advice, for regulatory purposes.

Follow Orchid Research and get email alerts