Gold Weekly: Demand Driven By Late U.S. Cycle Concerns

Gold's rally has eased somewhat so far in February after a strong January.

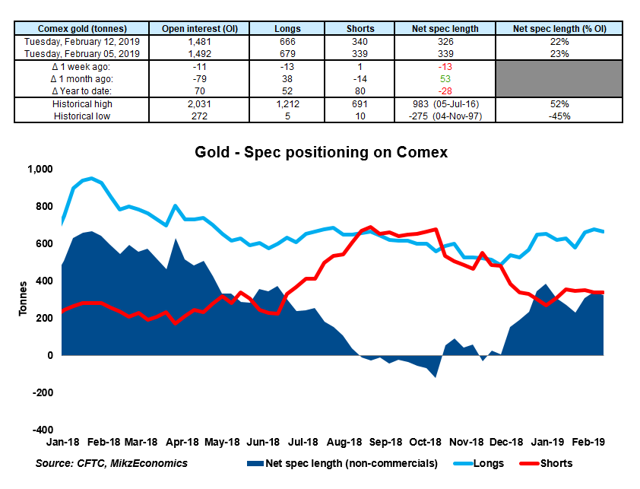

Net long positions in Comex gold are a little down in the year to February 12, the CFTC shows.

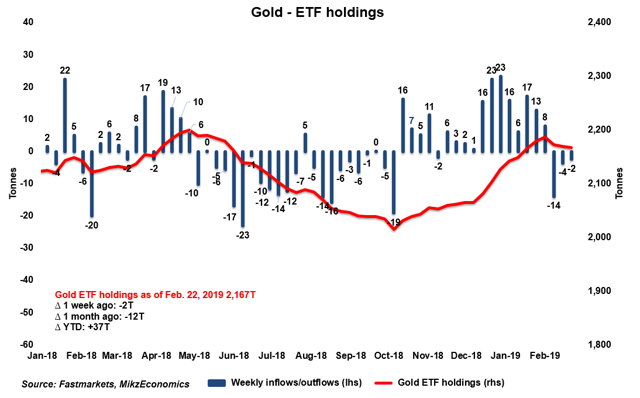

ETF investors took profit for a third straight week.

With the US business cycle approaching its end (~90% complete, according to SG), monetary demand for gold should increase notably in the course of 2019.

Cycle 2, Bac Cam (Saatchi Art)

Introduction

Welcome to my Gold Weekly.

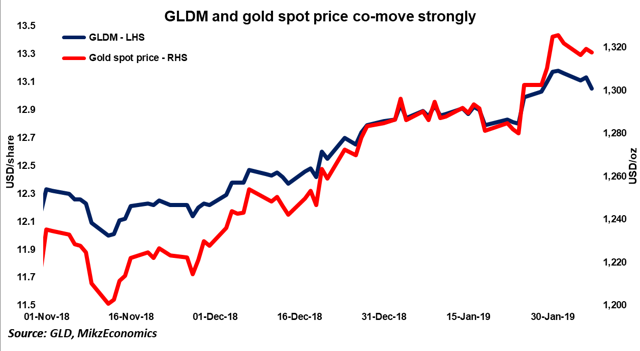

In this report, I wish to discuss mainly my views about the gold market through the World Gold Shares SPDR Gold Minishares Trust ETF (GLDM). GLDM is directly impacted by the vagaries of gold spot prices because the fund physically holds gold bars in a London vault in the custody of HSBC (NYSE:HSBC).

To do so, I analyse the recent changes in speculative positions on the Comex (based on the CFTC) and ETF holdings (based on Fastmarkets' estimates) in a bid to draw some interpretations about investor and speculator behavior. Then, I discuss my global macro view and the implications for monetary demand for gold. I conclude the report by sharing my trading positioning.

Speculative positions on the Comex

The CFTC statistics are public and free. The CFTC publishes its Commitment of Traders report (COTR) every Friday, which covers data from the week ending the previous Tuesday. In this COTR, I analyze the speculative positioning, that is, the positions held by the speculative community, called "non-commercials" in the legacy COTR, which tracks data from 1986.

It is important to note that the changes in speculative positioning in the gold futures contracts do not involve physical flows because it is very uncommon for speculators to take delivery of physical on the futures contracts that they trade. Due to the use of leverage by speculators, the changes in speculative positions in gold futures contracts tend to be much greater than the changes in other components of gold demand like ETFs or jewelry.

As a result, the impact on gold spot prices tends to be relatively more important and volatile, which, in turn, affect the value of GLDM because the latter physically holds the metal in vaults in London and, therefore, have a direct exposure to spot gold prices.

Gold ETF positions

The data about gold ETF holdings are from Fastmarkets, an independent metals agency which tracks ETF holdings across the precious metals complex. Fastmarkets tracks on a daily basis a total of 21 gold ETFs, which represent the majority of total gold ETF holdings. The largest gold ETFs tracked by Fastmarkets are the SPDR Gold Trust (GLD), whose holdings represent nearly 40% of total gold ETF holdings, and the iShares Gold Trust (IAU), whose holdings represent roughly 15% of total gold ETF holdings.

Speculative positioning

Source: CFTC

According to the latest Commitments of Traders (COT) data from the CFTC, the speculative community has cut its net long position in Comex gold by 28 tonnes in the year to February 12.

This has been due to fresh shorting (80 tonnes), partly offset by fresh buying (52 tonnes).

The net spec length represents 22% of its open interest, implying plenty of room for further speculative buying in the course of 2019, given its historical high of 52% of its open interest.

Against this, I expect more speculative buying in the near term, bar a notably negative turn in the macro environment for gold (i.e., stronger dollar + stronger US real rates).

An increase in net long speculative positions in gold should push Comex gold spot prices.

Due to the structure of GLDM (the Fund physically holds gold bars), an appreciation in gold spot prices should result in a concurrent increase in the value of the World Gold Shares SPDR Gold Minishares Trust ETF.

Investment positioning

Source: Fastmarkets

ETF investors slashed their holdings for a third straight week last week. Outflows were concentrated in GLD (-4 tonnes).

ETF investors have liquidated about 12 tonnes of gold since the start of the month after buying 64 tonnes of gold in January.

I view February's net outflows as mere profit-taking because conservative investors are inclined to secure some profits after the run-up in spot gold prices (+4% year to date).

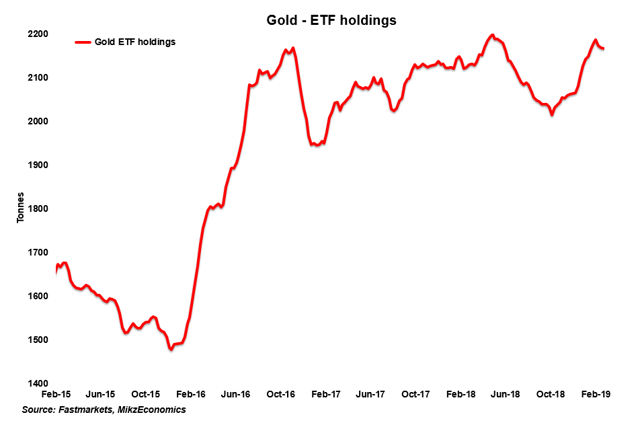

Source: Fastmarkets

On the year, ETF investors are net buyers of 40 tonnes of gold. Except platinum for which investors have boosted their holdings by 15% so far this year, the strongest ETF buying interest is in gold.

Investor sentiment toward gold has improved notably since late last year, probably because an increasing number of market participants have become cognizant of the financial repercussions of the nearing end of the US business economic cycle.

In this regard, SocGen (OTCPK:SCGLF) estimates that "we are now entering the last 10% of the current business cycle." To wit:

The current expansionary phase started in July 2009 and so will celebrate its tenth birthday this summer. Given our in-house view, we assume in our calculations that the next recession will happen in the middle of the first semester of 2020, at end-March.

This environment tends to induce investors to position their portfolios in a more defensive way. As such, I believe that gold ETF inflows are likely to increase in the course of 2019.

Stronger ETF buying for gold will produce an appreciation in Comex spot gold prices in virtue of the classical supply/demand relationship.

As gold spot prices move higher, the value of GLDM, which holds physical gold bards, will naturally increase as the value of the gold held by the Fed increases.

GLDM - World Gold Shares SPDR Gold Minishares Trust ETF - Review

Source: MikzEconomics

GLDM is directly impacted by the vagaries of gold spot prices because the fund physically holds gold bars in a London vault and custodied by ICBC Standard Bank Plc.

GLDM offers the lowest expense ratio of just 0.18% among its peers. GLD, IAU, and BAR have an expense ratio of 0.50%, 0.25%, and 0,20%, respectively. From a purely cost perspective, GLDM is the most competitive gold ETF, in my opinion.

GLDM's average spread is 0.08% over the past two months, which is a touch lower than that of its competitor IAU, at 0.09%.

GLDM's average daily volume (over the past 45 trading days) is ~$4.5 million, which is much lower than that of IAU, at ~$126 million. But unless you are an institutional investor, liquidity conditions are sufficient.

According to the official website, stricto sensu:

All of the Trust's physical gold is held by the custodian; namely ICBC Standard bank, in its London vault except when the gold has been allocated in the vault of a sub-custodian.

In such instances, ICBC Standard bank has agreed that it will use commercially reasonable efforts to promptly transport the gold from the sub-custodian's vault to the ICBC Standard's London vault, at ICBC Standard's cost and risk.

The gold bar list is updated at the end every working day (EST), on the website below the "Bar list" section.

The Trust has entered into an agreement with ICBC, the Trust's Custodian, which will ensure that all of the Trust's gold is held in allocated form at the end of each working day.

Final note

While I am aware of some concerns among some Seeking Alpha readers regarding the presence of physical gold in the vaults, it seems to me that the presence of gold in the vaults cannot be refutable. For investors preferring to be able to touch the actual gold, which is not possible in an investment in GLDM shares, owning physical gold may be a more suitable situation. The risk of loss/theft is, however, very real.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Boris Mikanikrezai and get email alerts