Gold Weekly: Everyone Is Buying The Yellow Metal

Gold prices have continued their advance in recent days, in light with our constructive expectations.

Speculators have adopted a "wait and see" approach toward gold over the past two weeks.

ETF investors boosted markedly their gold buying last week.

Central bank sentiment toward gold has turned positive since last year.

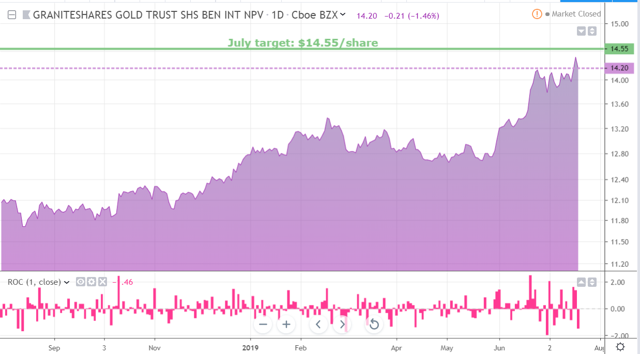

As the current environment is conducive to stronger gold prices, we expect BAR to reach $14.55 per share by the end of July, a 2.5% appreciation from its current level.

Introduction

Welcome to Orchid's Gold Weekly report. We discuss gold prices through the lenses of the GraniteShares Gold Trust ETF (BAR), which replicates the performance of gold prices by holding physically gold bars in a London vault in the custody of ICBC Standard Bank.

BAR has pushed slightly higher (+1%) since the start of July, after recording its largest monthly gain in June (+8%) since the fund was launched last year.

We believe that there is more upside for BAR in the remainder of July, considering the positive shift in sentiment from major market participants, including speculators, ETF investors, and central banks.

Against this, our July target for BAR is at $14.55 per share, representing a 2.5% appreciation from its current level.

Source: Trading View, Orchid Research

About BAR

BAR is directly impacted by the vagaries of gold spot prices because the fund physically holds gold bars in a London vault and custodied by ICBC Standard Bank. The investment objective of the fund is to replicate the performance of the price of gold, less trust expenses (0.20%), according to BAR's prospectus.

The physically-backed methodology prevents investors from getting hurt by the contango structure of the gold market, contrary to ETFs using futures contracts.

Also, the structure of a grantor trust protects investors since trustees cannot lend the gold bars.

BAR provides exposure which is identical to established competitors like GLD and IAU, which are nevertheless much more costly to hold over a long period of time. Indeed, BAR offers an expense ratio of just 0.20% while IAU and GLD have an expense ratio of 0.25% and 0.50%, respectively.

Speculative positioning

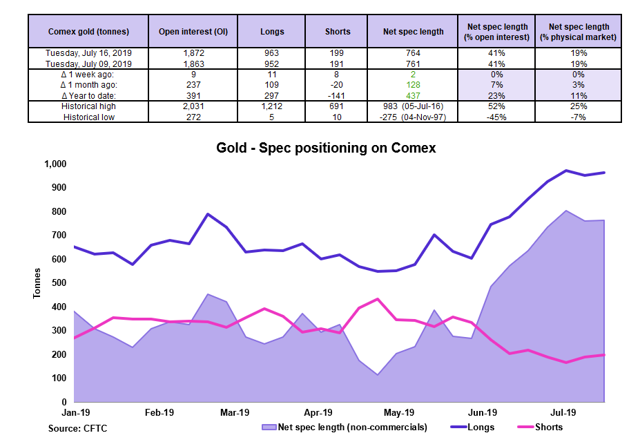

Source: CFTC, Orchid Research

Speculators left their net long exposure to Comex gold broadly unchanged in the week to July 16.

Over July 9-16, fresh buying of 11 tonnes was offset by fresh shorting of 8 tonnes.

It seems that the speculative community has adopted a "wait and see" approach over the past two weeks, after lifting significantly its net long exposure to gold since late April.

At 41% of open interest, the net spec length is getting close to its historical high of 52% of OI established in July 16.

Having that said, there is still some speculative buying potential in the near term until gold's spec positioning becomes stretched on the long side.

Putting all together, gold's speculative positioning is bullish for gold spot prices.

Speculative selling amounted to 44 tonnes over June 2-9, corresponding to 2% of open interest.

Implications for BAR: Given the potential for additional speculative buying interest in favor of spot gold prices, we believe that the current spec positioning in the gold market shows a bullish structure, which should be positive for gold spot prices, which in turn will lift the performance of BAR.

Investment positioning

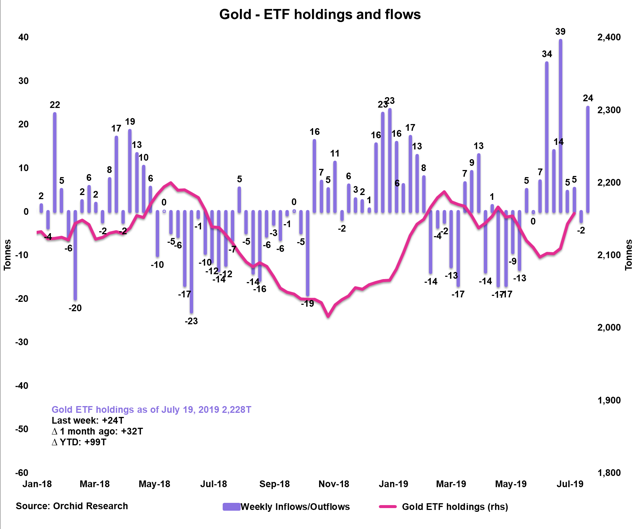

Source: Orchid Research

ETF investors boosted markedly their gold buying in the week to July 19, after taking marginal profit the prior week.

Gold ETF holdings increased by 24 tonnes over July 12-19 and increased by 32 tonnes over the past four weeks.

In the year to date, gold ETF holdings increased by 99 tonnes or 4.6%, which is significant, reflecting a positive swing in investor sentiment.

Gold ETF holdings are now at their highest since May 2013, as the chart below shows.

Source: Orchid Research

Implications for BAR: The positive swing in investor sentiment toward gold should result in additional ETF buying, which will push gold spot prices higher, which in turn will lift the value of BAR.

Central bank positioning

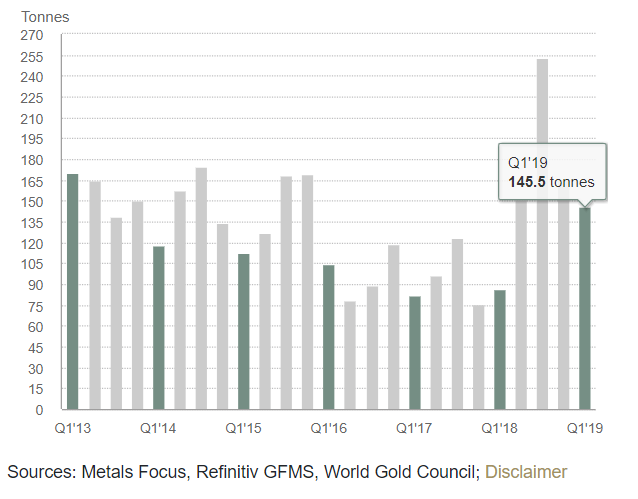

Central banks' sentiment toward gold has swung positively since last year.

In 2018, central banks boosted their gold holdings by 651 tonnes, a 74% increase compared to 2017, which marked the largest yearly central bank net buying since 1971.

The World Gold Council shows that the trend has continued since the start of the year, with already a net buying of 145 tonnes in Q1.

Source: WGC

Source: WGC

According to the WGC:

Central bank buying has been geographically diverse. Russia has been the most committed purchaser of gold - acquiring almost 275 tonnes in 2018, the largest amount ever purchased in a single year. China has been consistently adding to its reserves as well, but many other emerging market countries have been accumulating gold over the past year and more, including Hungary, Poland, Egypt, Kazakhstan and India.

According to the WGC, the drivers behind the recently positive shift in sentiment toward gold include heightened uncertainty about the global economic and geo-political outlook and second, gold's intrinsic value as a reserve asset.

We would add another driver, that is, gaining more credibility by holding tangible assets rather than purely financial assets with counterparty risks. In the case of gold, it has no sovereign risk, making the central bank's balance sheet 1) healthier, 2) stronger, and 3) more resilient against external risks.

Implications for BAR: Growing central bank buying of gold is likely to support gold prices over the long term, which will benefit BAR investors.

Closing thoughts

As we showed above, sentiment among major market participants (speculators, ETF investors, and central banks) has turned markedly positive in favour of gold in the current macro environment. This suggests that the rally in gold prices will continue in the near term.

Against this constructive backdrop, we expect BAR to reach $14.55 per share by the end of the month, which would represent an increase of 2.5% from its current level.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Our research has not been prepared in accordance with the legal requirements designed to promote the independence of investment research. Therefore, this material cannot be considered as investment research, a research recommendation, nor a personal recommendation or advice, for regulatory purposes.

Follow Orchid Research and get email alerts