Gold Weekly: My Expectations For 2019

Gold shines in this friendly macro environment.

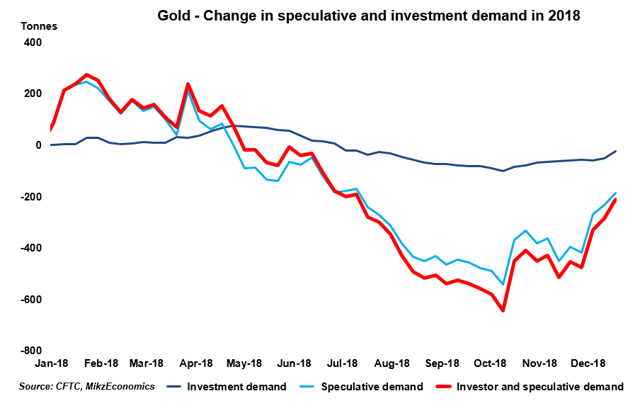

While ETF investment demand for gold was stable in 2018, speculative demand dropped sharply.

Monetary demand for gold should rise strongly in Q1 2019 due to gold's insurance qualities.

Trading momentum is positive for gold, signaling a continuation of the rally in near term.

Consider GLDM to play the appreciation in gold prices.

Expect, Maryna Suprun (Saatchi Art)

Introduction

Welcome to my Gold Weekly.

Let me start this introduction by expressing all my wishes to you and yours for 2019. My most important wish is health.

In this report, I wish to discuss mainly my views about the gold market through the World Gold Shares SPDR Gold Minishares Trust ETF (GLDM). GLDM is directly impacted by the vagaries of gold spot prices because the fund physically holds gold bars in a London vault in the custody of HSBC bank.

To do so, I analyse the recent changes in speculative positions on the Comex (based on the CFTC) and ETF holdings (based on Fastmarkets' estimates) in a bid to draw some interpretations about investor and speculator behavior. Then, I discuss my global macro view and the implications for monetary demand for gold. I conclude the report by sharing my trading positioning.

Speculative positions on the Comex

The CFTC statistics are public and free. The CFTC publishes its Commitment of Traders report (COTR) every Friday, which covers data from the week ending the previous Tuesday. In this COTR, I analyze the speculative positioning, that is, the positions held by the speculative community, called "non-commercials" in the legacy COTR, which tracks data from 1986.

It is important to note that the changes in speculative positioning in the gold futures contracts do not involve physical flows because it is very uncommon for speculators to take delivery of physical on the futures contracts that they trade. Due to the use of leverage by speculators, the changes in speculative positions in gold futures contracts tend to be much greater than the changes in other components of gold demand like ETFs or jewellery.

As a result, the impact on gold spot prices tends to be relatively more important and volatile, which, in turn, affect the value of GLDM because the latter physically holds the metal in vaults in London and, therefore, has a direct exposure to spot gold prices.

Gold ETF positions

The data about gold ETF holdings are from Fastmarkets, an independent metals agency which tracks ETF holdings across the precious metals complex. Fastmarkets tracks on a daily basis a total of 21 gold ETFs, which represent the majority of total gold ETF holdings. The largest gold ETFs tracked by Fastmarkets are the SPDR (R) Gold Shares (NYSEARCA:GLD), whose holdings represent nearly 40% of total gold ETF holdings, and the iShares Gold Trust (IAU), whose holdings represent roughly 15% of total gold ETF holdings.

Thesis

Despite a strong gain of 5% in December (and 7% in Q4 2018), gold delivered a negative performance of 1.6% last year.

This was the primary result of a negative macro backdrop for the yellow metal, evident in the rise in the dollar and US real rates, triggering a decline in monetary demand for gold.

Source: St. Louis Fed

While investor demand for gold was stable last year (contraction in H1 and expansion in H2), speculative demand for gold dropped noticeably (even though it rebounded in the Q4 2018), as the chart below illustrates.

Source: MikzEconomics

Although some investors (including myself) have been disappointing by the performance of gold, it is important to acknowledge its resilience in the face of negative macro winds.

This year, the maturation of the US economic cycle, which just turned 10 years old, is set to result in a weaker dollar and lower US real rates, judging by historical standards. As such, macro forces should turn friendly again for the yellow metal.

This induces me to maintain my bullish view on gold for 2019.

Speculative positioning

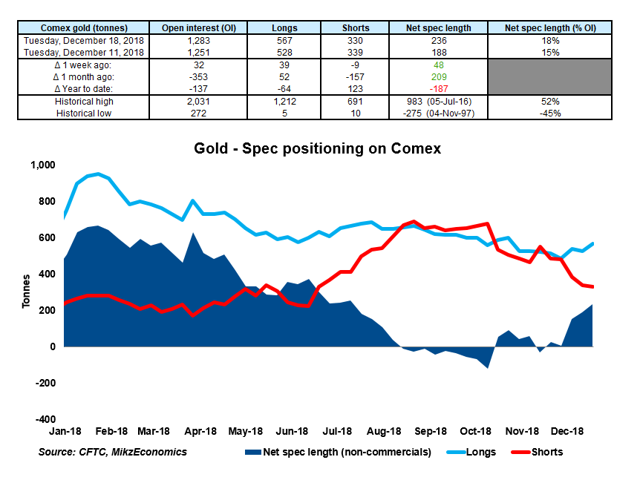

Source: CFTC

Due to the US government shutdown, the latest Commitment of Traders report (COTR) provided by the CFTC was released on December 21, 2018, covering data for December 11-18.

Over this latest reporting period, the net spec length jumped 48 tonnes or 26%, marking a third straight week of net speculative buying. This was mainly driven by fresh buying, suggesting that the speculative normalization process has started its second phase. The first phase, which started early in December, was characterized by short-covering.

However, the net spec length dropped 187 tonnes in 2018 (up to December 18). The strong rally in Comex gold prices since December 18 suggests that speculative buying has accelerated into the end of last year.

Judging by historical standards, there is plenty of room for additional speculative buying from here. The net spec length is just at 52% of its historical record.

In this context, I expect a significant increase in speculative demand for Comex gold in the first quarter of 2019, which should push Comex gold spot prices higher, and ergo, drive the value of the World Gold Shares SPDR Gold Minishares Trust ETF proportionally higher.

Investment positioning

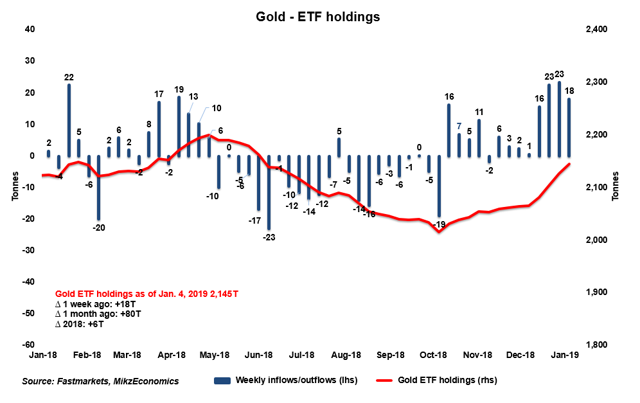

Source: Fastmarkets

ETF investors boosted their gold holdings by around 65 tonnes in December, according to Fastmarkets.

In the first week of 2019, ETF investors were net buyers of 5 tonnes of gold, suggesting that investor sentiment regarding gold continues to improve.

The pace of gold ETF buying has accelerated since last December, as the chart above illustrates. In addition to the stalling dollar and falling US real rates, the surge in global risk aversion prompted investors to boost their gold buying due to gold's insurance qualities.

Although the financial markets have stabilized recently due to a more "careful" Fed, volatility is likely to trend higher, and episodic bouts of sell-off are to be expected in the course of 2019. This should produce a worrisome environment for US investors, thereby supportive of monetary demand for gold.

In this context, I expect ETF investors to continue to boost their gold buying in the coming weeks.

Trading positioning

Given the positive trading momentum in gold and the notable improvement in the technical picture (bullish crossover pattern on the daily chart since mid-December, monthly close above the 20 monthly moving average in December, and recapture of the uptrend line from the 2015 low since the start of 2019), I expect the rally in gold prices to continue in the first quarter of the year.

To play a rally in gold prices, I propose the World Gold Shares SPDR Gold Minishares Trust ETF.

GLDM - World Gold Shares SPDR Gold Minishares Trust ETF - Review

GLDM is directly impacted by the vagaries of gold spot prices because the fund physically holds gold bars in a London vault and custodied by ICBC Standard bank.

According to the official website, stricto sensu:

All of the Trust's physical gold is held by the custodian; namely ICBC Standard bank, in their London vault except when the gold has been allocated in the vault of a sub-custodian.

In such instances, ICBC Standard bank has agreed that it will use commercially reasonable efforts to promptly transport the gold from the sub-custodian's vault to the ICBC Standard's London vault, at ICBC Standard's cost and risk.

The gold bar list is updated at the end every working day (EST), on the website below the "Bar list" section.

The Trust has entered into an agreement with ICBC Standard Bank plc, the Trust's Custodian, which will ensure that all of the Trust's gold is held in allocated form at the end of each working day.

The investment objective of the fund is to replicate the performance of the price of gold, less trust expenses (0.18%), according to GLDM's factsheet.

The physically-backed methodology prevents investors from getting hurt by the contango structure of the gold market, contrary to ETFs using futures contracts.

According to the prospectus, stricto sensu, GLDM is:

Easily Accessible: listed on the NYSE Arca

Secure: The shares represent fractional, undivided interests in the Trust, the sole assets of which are physical gold bullion and, from time to time, cash.

Cost Effective: The ETF allows investors to buy gold at a much lower cost than if they had to purchase, store and insure their physical gold by themselves.

GLDM offers the lowest expense ratio of just 0.18 among its peers. GLD, IAU, and BAR have an expense ratio of 0.50%, 0.25%, and 0,20%, respectively.

GLDM's average spread (over the past 60 trading days) is 0.08%, which is a touch lower than that of its competitor IAU, at 0.09%.

GLDM's average daily volume (over the past 45 trading days) is ~$4.5 million, which is much lower than that of IAU, at ~$126 million.

Final note

While I am aware of some concerns among some Seeking Alpha readers regarding the presence of physical gold in the vaults, it seems to me that the presence of gold in the vaults cannot be refutable. For investors preferring to be able to touch the actual gold, which is not possible in an investment in GLDM shares, owning physical gold may be a more suitable situation. The risk of loss/theft is however very real.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in BAR over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Boris Mikanikrezai and get email alerts