Gold Weekly: No Downside Tail Risks Priced Into GLDM Despite U.S.-China Trade Tensions

Gold prices are undermined by the lack of safe-haven demand despite increased US-China trade tensions.

Gold's spec positioning deteriorated markedly over May 14-21; ETF investors were on the sidelines last week.

GLDM is poised to rebound next month, once downside tail risks begin to be priced into risk assets.

Introduction

Welcome to Orchid's Gold Weekly report. We discuss gold prices through the lense of the World Gold Shares SPDR Gold Minishares Trust ETF (GLDM) because we think that is the best pure-play ETF to assert exposure to spot gold prices.

We remain cautious toward GLDM at present, principally because we recognize that investors remain risk-on despite US-China trade tensions. As the need of protection is overlooked, gold's positioning deteriorates, undermining GLDM.

However, we think that the complacency across risk assets is unlikely to last. Should US equities start to price downside tail risks from increased US-China trade tensions, financial conditions would tighten markedly, and the Fed would have to respond. In this context, GLDM would benefit from surging haven demand and dovish Fed expectations.

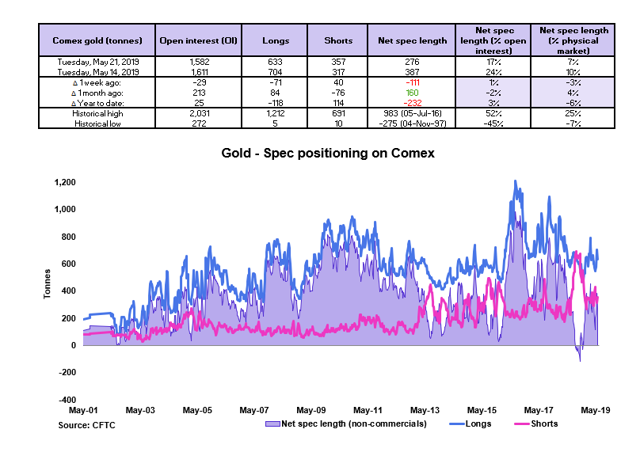

Speculative positioning

Source: CFTC

Speculators notably cut their net long position in Comex gold over May 14-21. Non-commercials reduced their net long position by 111 tonnes, which represents 3% of the gold physical market.

So far this year, non-commercials have liquidated 232 tonnes of gold, corresponding to 6% of the physical market.

Against this intense wave of speculative selling, it is not a surprise to see gold prices struggling.

At 17% of OI, gold's net spec length is close to its historical average of 16% of OI (since 1986).

Unless risk assets begin to price more downside tail risks from increased US-China trade tensions, gold's speculative positioning is likely to deteriorate further due to the stronger dollar.

Implications for GLDM: A deterioration in gold's spec positioning would produce selling pressure in Comex gold, pushing spot gold prices lower, thereby undermining the value of GLDM.

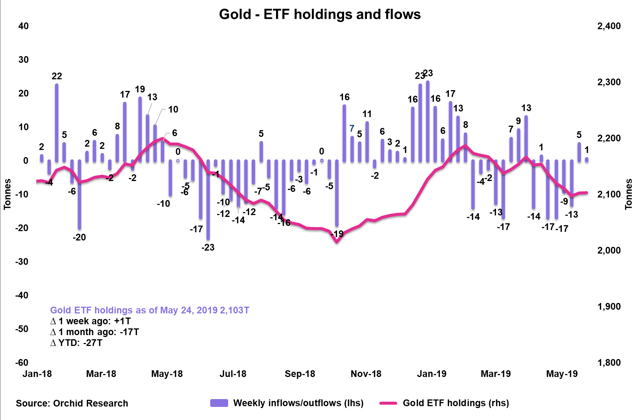

Investment positioning

Source: Orchid Research

While ETF investors have paused their gold selling activity of late, they have not aggressively bought gold.

Last week, gold ETF holdings increased marginally by 1 tonne. The SPDR GLD (GLD) received nearly 3 tonnes of net inflows whereas the iShares Gold Trust (IAU) experienced a net outflow of ~1 tonne.

There is some complacency across the financial markets. Investors are not inclined to hedge their portfolios against a prolonged sell-off in equities in the coming months stemming from US-China trade/tech tensions.

As long as equity investors maintain their "buy on the dips" mentality, gold ETF inflows are likely to be muted or even negative.

Implications for GLDM: Gold ETF flows have been modest recently, which is unlikely to have a material impact on spot gold prices and therefore on the value of GLDM.

Downside tail risks from US-China trade tensions not priced by equity markets.

The lack of buying interest in gold clearly shows the degree of complacency across the financial markets, despite a challenging macro picture stemming from increased US-China trade tensions.

So far, US equities have remained resilient, experiencing only a modest de-rating. In fact, they do not seem to have priced any potential downside tail risk stemming from a continuing escalation of the US-China trade dispute.

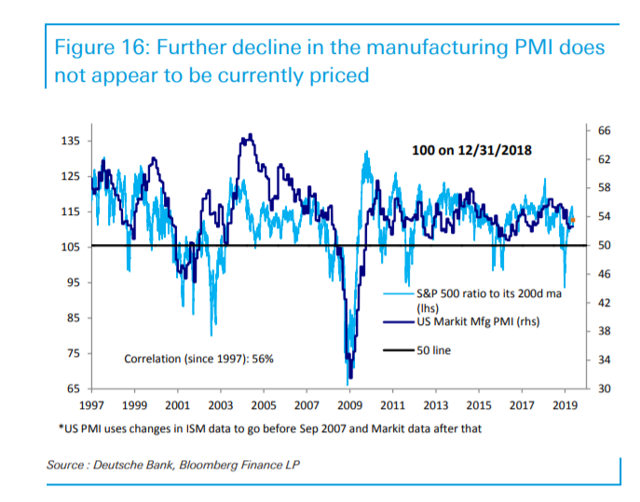

Our friends from Deutsche Bank illustrate this point in the below chart, comparing the SP500 ratio to its 200 DMA and the US manufacturing PMI.

Source: DB

As Deutsche Bank notes:

Growth indicators could weaken further given the unexpected increase in trade risks and uncertainty. However, as highlighted by our Equity strategists, further decline in the manufacturing PMI does not appear to be currently priced (left graph below). Thus, equity markets should not be immune to downside surprises to growth.

Against this backdrop, we feel that US equities could surprise to the downside in the near term, triggering a tightening of financial conditions and forcing the Fed to turn more dovish. Gold would benefit from stronger haven bids and more dovish Fed expectations.

Technicals

Source: Trading View

GLDM remains below its downtrend from its 2019 high of $13.45 per share.

On the bright side, it has reconquered its 20 DMA, which could stabilize its market action.

The key challenge for GLDM, in our view, is to firmly break above this downtrend line to produce a potentially bullish breakout.

Once this happens, we would turn more constructive toward GLDM.

We expect GLDM to trade at $13/share in June.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Our research has not been prepared in accordance with the legal requirements designed to promote the independence of investment research. Therefore, this material cannot be considered as investment research, a research recommendation, nor a personal recommendation or advice, for regulatory purposes.

Follow Orchid Research and get email alerts