Gold Weekly: The Bull Market Has Just Begun

Gold undermined by hawkish Fed minutes.

Speculators turned slightly bullish on gold for the first time in four weeks, the CFTC shows.

ETF investors bought more gold, albeit a small pace, according to FastMarkets' estimates.

Expect negative macro forces for the precious metals complex to prove transient.

The bull market in gold has just begun. I long IAU with a very long-term approach (>12m).

Source: Stock photo.

Introduction

Welcome to my Gold Weekly. In this article, I will mainly discuss my views about the gold market. To do so, I will analyze the recent changes in net speculative positions on the Comex (based on the CFTC) and ETF holdings (based on FastMarkets' estimates) and draw some conclusions about investor and speculator behavior. I conclude the article by sharing my trading positioning.

While the CFTC statistics are public and free, the data about gold ETF holdings are from FastMarkets, an independent metals agency that tracks ETF holdings across the precious metals complex.

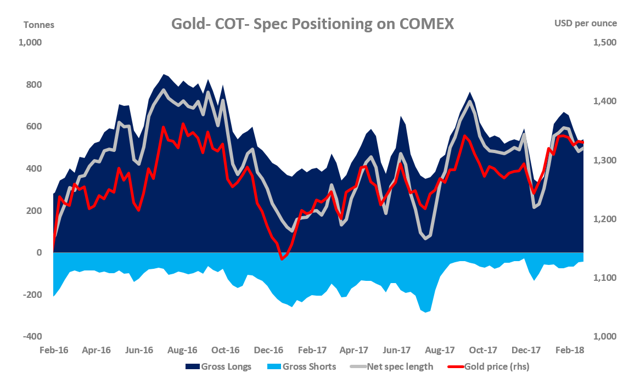

Speculative positioning

Source: CFTC.

According to the latest Commitment of Traders report provided by the CFTC, money managers lifted their net long position for the first time in four weeks over the reporting period (Feb. 13-20), during which spot gold prices edged 0.1% lower from $1,332 per oz to $1,330.

The net long fund position - at 497.41 tonnes as of Feb. 20 - rose 16.15 tonnes or 3% from the previous week (w/w). This was driven mainly by long accumulation (for the first time in 4 weeks) of 11.95 tonnes, and slightly reinforced by short-covering (for a 2nd week in a row) of 4.20 tonnes.

The net long fund position is up a solid 191.92 tonnes or 63% since the start of the year after rising 182.55 tonnes or 149% in the whole of 2017.

Gold's spec positioning is still quite long, with its net spec length at 64% of its historical record.

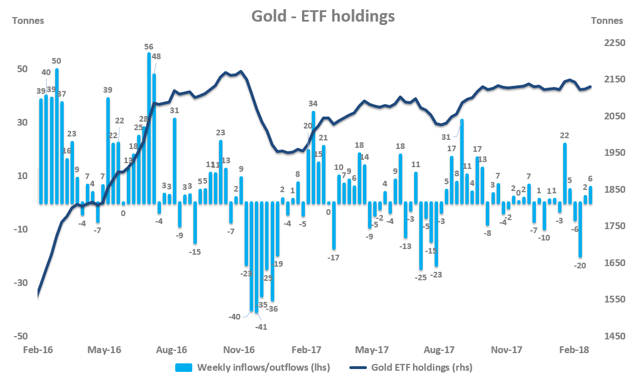

Investment positioning

Source: FastMarkets.

ETF investors bought roughly 6 tonnes of gold over Feb 16-23, while spot gold prices weakened 1.2% from $1,332 per oz to $1,331 oz over the corresponding period.

This was the 2nd week of net inflows into gold ETFs although the amount of net buying remained too small to offset the selling pressure of 26 tonnes in the first half of February.

Last week, the largest part of inflows came from the SPDR Gold Trust ETF (NYSEARCA:GLD) (+5 tonnes or 0.6% w/w). But the ETF buying/selling remained muted with the largest daily increase of 3.44 tonnes occurring on Tuesday, Feb. 20. This reflects a lack of conviction from ETF investors to take a clear stance on the yellow metal for now.

ETF investors are net sellers of 15 tonnes of gold since the start of February after buying 22 tonnes in January, pushing gold ETF holdings slightly up by 7 tonnes in the year to date.

Gold ETF investors were net buyers of 173.38 tonnes in 2017 (+9% from 2016) and 472.44 tonnes in 2016 (+32% from 2015).

As of Feb. 23, 2018, gold ETF holdings totaled 2,130 tonnes, according to FastMarkets' estimates.

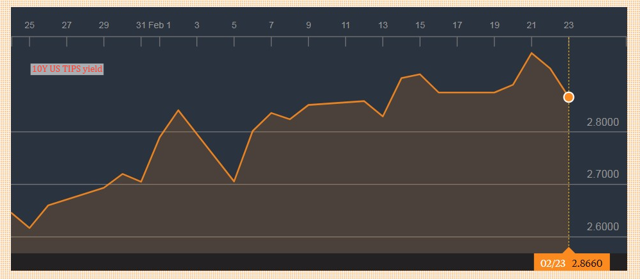

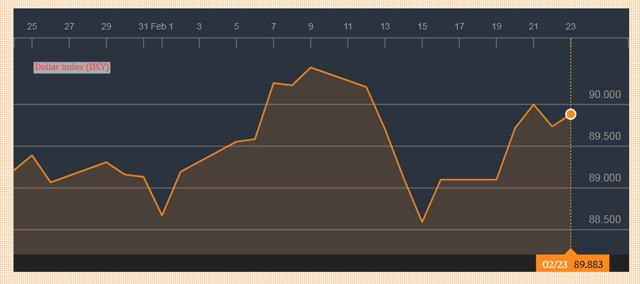

Macro backdrop for gold

The macro backdrop for gold is presently slightly unfriendly, principally stemming from the hawkish vibes from the Fed. The release of the January FOMC meeting minutes (on Feb. 21) triggered a sharp sell-off in the U.S. bond market. Since inflation expectations remained steady, U.S. real rates (10-year U.S. TIPS yield as a proxy) pushed higher, which also exerted upward pressure on the dollar in the process, as can be seen below.

Source: Bloomberg.

The stronger dollar and higher U.S. real rates were behind the downward pressure in gold prices.

The hawkishness from the Fed was reflected in a stronger conviction from the FOMC that U.S. economic growth will improve over the medium term, in part thanks to the fiscal stimulus. In this regard, the FOMC upgraded its GDP forecasts compared to its previous projections made in December 2017. Also, the FOMC appeared more confident that inflation will move toward their 2% target, comforted by the recent pickup in inflation dynamics. Against this backdrop, most FOMC members concurred that a "stronger outlook for economic growth raised the likelihood that further gradual policy firming would be appropriate." The Fed's rhetoric was sufficient to steepen the expected path of Fed funds rate, pushing the market's probability of a March hike to 86%, vs 82% before the publications of the minutes.

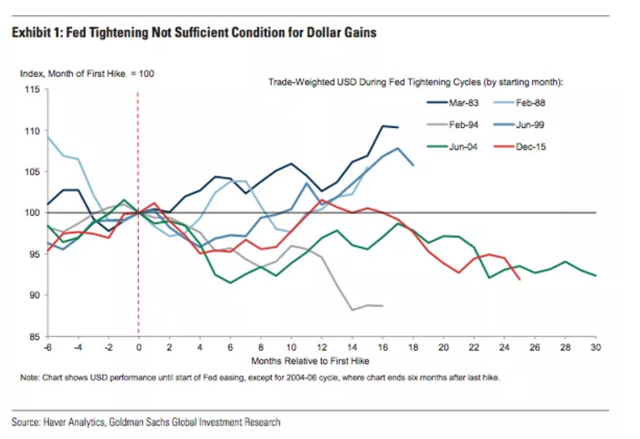

This unfriendly macro backdrop for the precious metals complex put gold prices under downward pressure. But from a broader perspective, I am of the view that this negative macro backdrop is transitory. On the one hand, the fact that the dollar and U.S. real rates have failed to sustain their uptrend post Fed minutes proves in part my point. On the other hand, as Goldman Sachs illustrates elegantly in the chart below, a Fed tightening cycle is not a condition sine qua non for a stronger dollar.

Source: Goldman Sachs.

As can be seen above, half of the six tightening cycles since 1980 (including the present one) have been associated with a weaker dollar and the other half with a stronger dollar. The current tightening cycle has been associated with dollar weakness and I expect this to prevail.

Indeed, I think that the dollar is likely to see more weakness in the course of 2018 due to, one, the presence of stronger inflation dynamics (as the latest data -- e.g., average hourly gains for January -- starts revealing) and, two, a somewhat unwillingness from the Fed to respond too aggressively. In fact, the Fed is likely to take its time before admitting that inflation is indeed back. And the combination of these two forces is likely to translate into additional dollar weakness.

To sum up, the current unfriendly macro backdrop for gold should prove transient, leading me to believe that the major uptrend in gold prices will prevail in the course of this year and beyond.

Trading positioning

To play my bullish gold thesis, I implemented a long position in the iShares Gold Trust ETF (IAU) at the start of the year (Monday, Jan. 29, 2018). I bought IAU at $12.89 but I concur that the price action has been disappointing of late, principally owing to transitory negative macro forces.

Source: Trading View.

That said, the technical picture remains very healthy while momentum-based indicators are still positive.

Although IAU pulled back a bit last week, it remains firmly above its uptrend from the uptrend since the 2017 low (red line).

Since negative macro forces can persist for a little longer, I remain conservative in my IAU trading, setting a sufficiently wide stop-loss of $10.81 (i.e., -16% from my entry point), which corresponds to the 2016 low. While this level is unlikely to be tested, I prefer to maintain a defensive approach at the moment in so far as the bull market is slowly emerging.

For investors interesting in gold, I would suggest to adopt a conservative approach and be extremely patient. Gold needs time but its price action in recent years has been decent (+13% in 2017, +8% in 2016). In this regard, gold is likely to gain increasing interest from macro investors, which is likely to result in more pronounced gains in the years ahead, as this has been the case of base metals in the previous two years.

As most readers know, I have an initial profit target at $19.00 (+48% from my entry point), which corresponds to the all-time high. Depending on the price action of gold in the coming months, I could be tempted to increase the size of my position. But for now, I remain conservative.

While I am strongly of the view that a new bull market in gold has begun, I don't see massive gains in the immediate term. I bought IAU earlier this year, planning to hold my position for a long period of time. And thanks to its relatively low expense ratio of 0.25%, compared with 0.40% for GLD, my long-term gains won't be capped.

For the sake of transparency, I will update my trading activity on my Twitter account and post my trade summary at the end of each report.

Final note

My dear friends, thank so much for showing your support by pressing the "Follow" button and sharing this article. I look forward to reading your comments below.

Disclosure: I am/we are long IAU.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.