Gold Weekly: Time To Invest In The Lowest-Cost Physical Gold ETF, BAR

Gold is off to a quiet start to the week on contradictory macro forces.

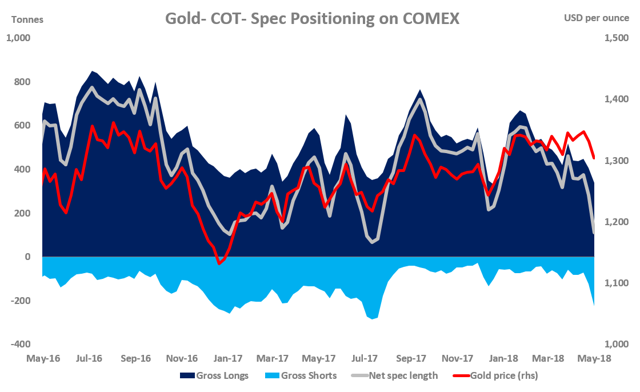

Speculators cut massively their net long positions over April 24-May 1, the CFTC shows.

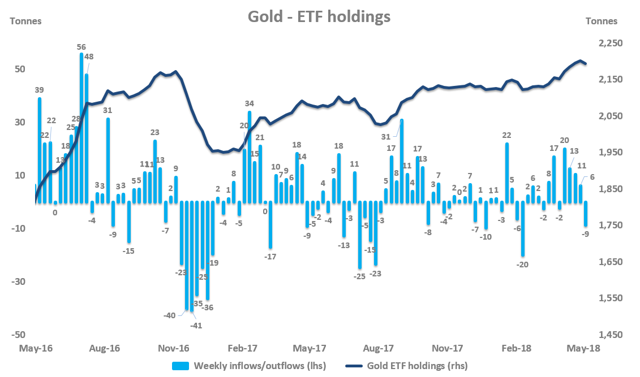

ETF investors sold gold last week for the first time in 5 weeks, FastMarkets estimate.

Gold-bulls enjoyed 2 good macro news. But their actual impact was rather disappointing.

I made a change in my trading positioning. Time to focus on BAR - the lowest-cost physical gold ETF.

Source: Pinterest.

Introduction

Welcome to my Gold Weekly.

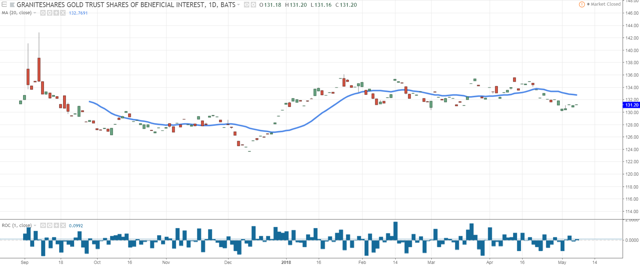

In this report, I wish to discuss mainly my views about the gold market through the GraniteShares Gold Trust ETF (NYSEARCA: BAR).

To do so, I analyze the recent changes in speculative positions on the Comex (based on the CFTC) and ETF holdings (based on FastMarkets' estimates) in a bid to draw some interpretations about investor and speculator behavior. Then I discuss my global macro view and the implications for monetary demand for gold. I conclude the report by sharing my trading positioning.

While the CFTC statistics are public and free, the data about gold ETF holdings are from FastMarkets, an independent metals agency which tracks ETF holdings across the precious metals complex.

Speculative positioning

Source: CFTC

According to the latest Commitment of Traders report (COTR) provided by the CFTC, money managers cut massively their net long positions over the reporting period (April 24-May 1), during which time spot gold prices weakened 2.0% from $1,331 per oz. to $1,305.

The net long fund position - at 111.46 tons as of May 1 - tumbled by a substantial 171.07 tons or 61% from the previous week (w/w). This was primarily driven by short accumulation (+102.48 tons w/w) and reinforced further by long liquidation (-68.59 tons w/w).

The net long fund position in gold is now down 194.03 tons or 64% in the year to date after increasing by 183 tons in 2017.

Gold's spec positioning is very light by historical standards. The net spec length is at just 14% of its historical record and 66% lower than its long-term historical average of ~325 tons.

This means that there is a lot of room for speculative buying to emerge in the course of the year.

In the near term, however, speculative selling may continue until the spec positioning becomes too stretched on the short side due to the growing presence of momentum-based sellers. Having said that, if the present speculative selling wave fails to push gold prices much lower, gold sellers may throw in the towel, producing a short-covering rally sooner than expected.

Bottom line: Gold's spec positioning is too light and as such, warrants a normalization. Consequently, I am more comfortable wearing my bull rather than my bear shoes.

Investment positioning

Source: FastMarkets

ETF investors were net sellers of ~9 tons of gold last week, during which time spot gold prices dropped 0.6% from $1,324 per oz. to $1,315.

This marked the first weekly drop in gold ETF holdings in 5 weeks.

Outflows from gold ETFs were concentrated on Tuesday 1 May (-4.08 tons) and Friday 4 May 2018 (-3.56 tons). No strong ETF activity was of note during the rest of week.

Gold ETF outflows came chiefly from the SPDR GLD ETF (-7.07 tons or -0.8%).

ETF investors have sold around 7 tons of gold so far in May after buying 48 tons in April, marking the largest accumulation since September 2017 (+61 tons).

In the year to date, ETF investors are net buyers of ~70 tons, corresponding to an increase of 3.3% in total gold ETF holdings.

As a reminder, gold ETF investors were net buyers of 173.38 tons in 2017 (+9% from 2016) and 472.44 tons in 2016 (+32% from 2015).

As of May 4, 2018, gold ETF holdings totaled 2,193 tons, up 116 tons or 6% y/y.

Macro backdrop for gold

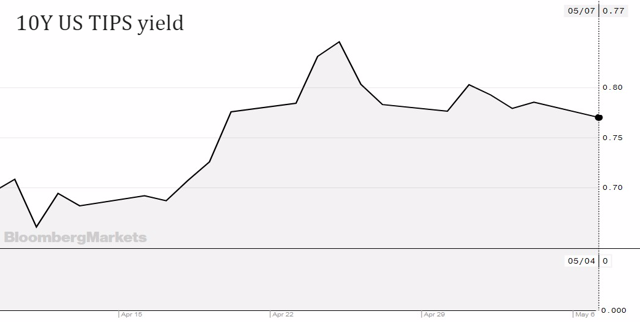

The weakness in gold since mid-April is essentially owing to its negative macro backdrop in which the dollar (DXY) and US real rates (10Y US TIPS yield) have moved higher, as can be seen below.

Source: Bloomberg

Interestingly, US real rates have witnessed some downward pressure since late April, which is due to (1) a renewed fall in US nominal rates on negative US macro data surprises and (2) a rise in inflation expectations on a super strong oil rally.

But given the even stronger appreciation in the dollar, gold has been unable to breathe and financial players have expressed more conviction to short it (as I showed in the "speculative positioning" section).

That said, bulls enjoyed 2 good news last week: a dovish Fed meeting (concluded on May 2) and a disappointing US jobs report for April (released on May 4).

Dovish Fed

As I detailed in my latest Silver Weekly, the Fed proved to be more dovish than the market had expected. In its latest monetary policy statement, the Fed refrained from showing a clear conviction that a rate increase would be imminent. Rather, the Fed emphasized on its gradual approach to raising rates. It also sounded more dovish on economic growth, which helped stabilize Fed tightening market expectations.

Disappointing US jobs report

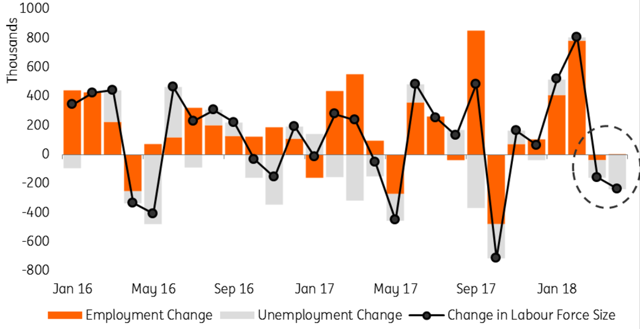

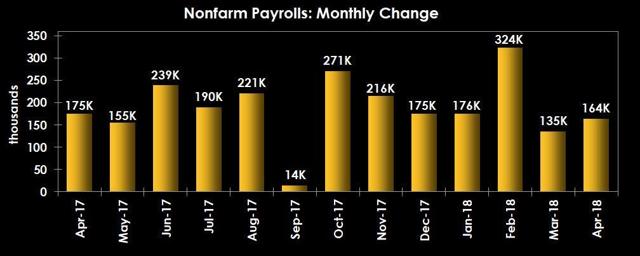

Non-farm payroll employment increased 164K in April, much below market expectations of 190K. On the bright side, job gains were revised to 135K in March (vs an initial estimate of 103K).

Source: Econoday

Average hourly earnings (a proxy for wage/inflation pressure) posted a small 0.1% m/m increase, below market expectations of a 0.2% gain, and down from downwardly revised 0.2% m/m gain (0.3% previously) in March.

Source: Danske

Although the unemployment rate fell to a multi-year low of 3.9% (vs expectations of 4.0% and down from 4.1% in March), this was primarily the result of a drop in the labor force, which is not necessarily positive.

Source: Smith Economics

Despite these two "gifts" for gold-bulls, the macro backdrop for the yellow metal has failed to turn materially friendlier. In fact, the dollar has been bought on the dips (as its speculative normalization continues) while US real rates have weakened only marginally.

Against this, gold has managed to stabilize somewhat above its 200 DMA but has failed to impress on the upside, making gold-bulls (including me) even more frustrated.

Trading positioning

While I remain constructive toward gold's prospects for 2018 and beyond, I decided to change my trading positioning this week.

While I previously moved from GLD to IAU late in January as a result of the lower expense ratio proposed by IAU, I decided this month to switch to BAR.

BAR offers an even lower expense ratio of 0.20% (vs 0.25% for IAU and 0.50% for GLD), making BAR the lowest cost physical gold ETF currently listed on the market.

My Tweet below sumps up the new parameters of my BAR trade.

What's the BAR technical picture telling us?

Source: Trading View

Unfortunately, not too much because its launch is too recent so there is not enough historical data. Nevertheless, it is fair to say that momentum is for now unfriendly as BAR remains below its 20 daily moving average. Also, lower lows have been made since the start of the year, which suggests that bears are still in control of the trend.

Nevertheless, BAR is presently at the lower hand of its trading range and a support seems to have been found at $130. While it is too early to assert that the bottom is in for the year, I remain presently optimistic as long as the support at $130 is not firmly breached.

For the sake of transparency, I will update my trading activity on my Twitter account and post my trade summary at the end of each report.

Final note

My dear friends, thank so much for showing your support by clicking the "Follow" orange button beside my name on the top of the page and sharing/liking this article. I look forward to reading your comments below.

![]()

Disclosure: I am/we are long BAR.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Boris Mikanikrezai and get email alerts