Gold Weekly: Time To Shine

Gold shines again following the dovish rhetoric from the Fed.

Gold's spec positioning is not heavily long, suggesting plenty of dry powder on the long side to deploy.

ETF investors bought gold at a remarkable rate at the start of the week, highlighting a potentially positive swift in sentiment.

We see GLDM at $13.50/share by Q2-end.

Introduction

Welcome to Orchid's Gold Weekly report. We discuss gold prices through the lenses of the World Gold Shares SPDR Gold Minishares Trust ETF (GLDM) because we think that is the best pure-play ETF to assert exposure to spot gold prices.

We are now firmly bullish on GLDM following the dovish response from the Fed following the continuing escalation of the US-China trade dispute and its implications for the US economic outlook.

We expect the dollar to remain under pressure, US real rates to continue to slide, and volatility in risk assets to push higher on continuing US growth scare. This should result in firmer demand for gold, thereby pushing GLDM higher.

Our Q2-end target for GLDM has been revised higher to $13.50 per share.

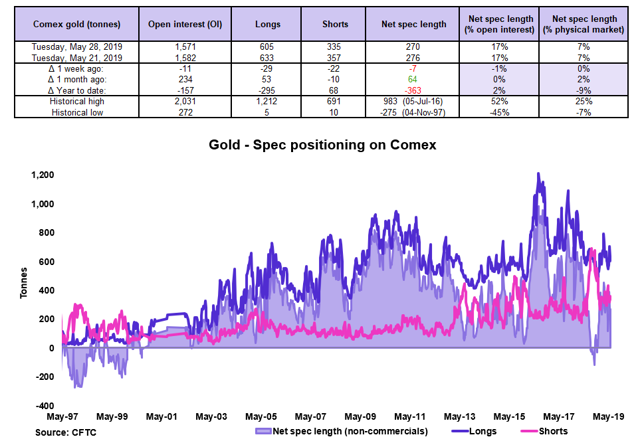

Speculative positioning

Source: CFTC

Speculators left their net long position in Comex gold broadly unchanged over May 21-28.

The net long position held by non-commercials represents only 7% of open interest, down from 27% of OI at the start of the year.

Gold prices have therefore proven resilient since the start of the year, despite the substantial amount of speculative selling (~363 tons YTD).

However, the $50/oz. or 4% increase in Comex gold spot prices since May 30 has not been captured by the latest COT report. We need to await on Friday (June 7) to see how the net spec length evolved from May 28 to June 4.

While we suspect that the net spec length increased markedly, what will matter is the magnitude.

In any case, from a positioning viewpoint, gold's spec positioning is far from being stretched on the long side. As such, there is plenty of dry powder from the speculative community to deploy on the long side.

Implications for GLDM: Should speculative sentiment toward gold improve sustainably, gold spot prices could move much higher in the short term, which in turn will boost the value of GLDM.

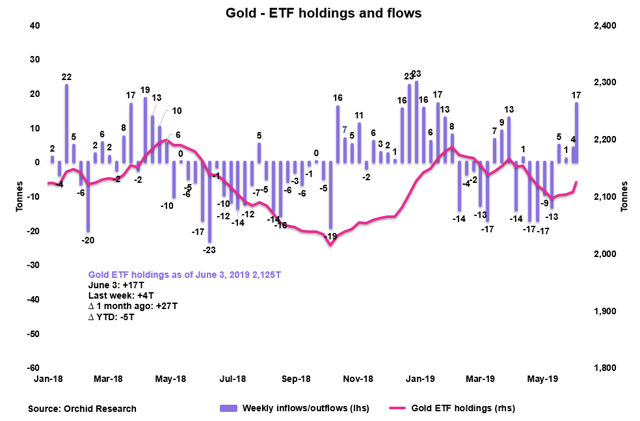

Investment positioning

Source: Orchid Research

Gold ETF holdings have increased markedly since the start of the week (+17 tons) after growing modestly by 4 tons last week.

The SPDR GLD received the largest inflow on Monday June 3, by roughly 16 tons.

Three main factors have stimulated ETF gold buying, in our view:

1) Falling US real yields

Source: Bloomberg (via John Reade)

2) Weakening dollar

Source: Bloomberg (via John Reade)

3) Rising volatility in US equities

Source: Bloomberg (via John Reade)

The combination of three bullish forces for gold is driven by a unique key macro development, namely - the escalation of a trade dispute following a more aggressive rhetoric from US president Trump. This has prompted the Fed to deliver a more dovish rhetoric as a result of increasing downside risks to the US economic outlook.

Fed Chair Powell made it clear in his latest speech today:

We do not know how or when these issues will be resolved. We are closely monitoring the implications of these developments for the U.S. economic outlook and, as always, we will act as appropriate to sustain the expansion, with a strong labor market and inflation near our symmetric 2 percent objective.

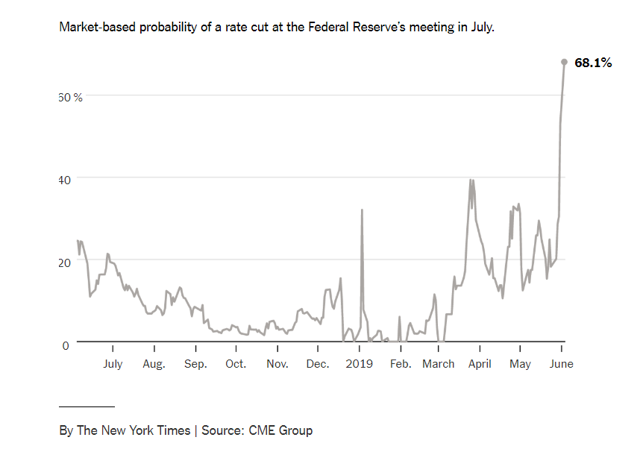

Other Fed presidents, including St Louis Fed president Bullard and Chicago Fed president Evans, were even more dovish by suggesting that a rate cut could be appropriate, in line with the recent dovish shift in market expectations toward the Fed rate outlook, as the chart below shows.

Source: CME, The New York Times

Implications for GLDM: Whether gold ETF inflows continue in the coming days remains uncertain, but this has supported the monetary demand for gold, pushing gold spot prices higher, and therefore lifting the value of GLDM.

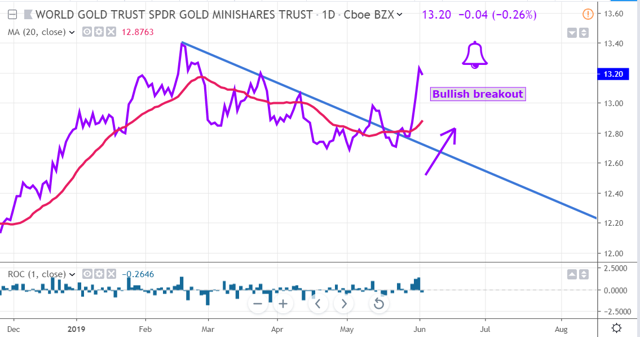

Technical view

Source: Trading View

The technical picture for GLDM has improved notably since late May.

In our previous weekly report, we noted:

The key challenge for GLDM, in our view, is to firmly break above this downtrend line to produce a potentially bullish breakout. Once this happens, we would turn more constructive toward GLDM.

The bullish breakout has materialized, which should produce marked upward pressure on GLDM in the near term.

We have revised higher our Q2-end target for GLDM to $13.5/share, compared with $13/share previously.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Our research has not been prepared in accordance with the legal requirements designed to promote the independence of investment research. Therefore, this material cannot be considered as investment research, a research recommendation, nor a personal recommendation or advice, for regulatory purposes.

Follow Orchid Research and get email alerts