Gold Weekly: We Remain Patient In The Immediate Term

BAR is unchanged from a week ago, comforting our cautious expectations.

Gold's spec positioning lightened marginally in the week to Aug. 13, keeping us cautious in the immediate term.

Gold ETF inflows continued in the week to Aug. 19, mainly driven by increased market fears proxied by the rising VIX.

BAR: We stay on the sidelines, willing to reassert upside exposure in case of a drop to $14.20/share - a 5% decline from its current level.

Introduction

Welcome to Orchid's Gold Weekly report. We discuss gold prices through the lenses of the GraniteShares Gold Trust ETF (BAR), which replicates the performance of gold prices by holding physical gold bars in a London vault in the custody of ICBC Standard Bank.

BAR is trading at the same level than a week ago (~14.96/share) when we published our previous weekly note, comforting our cautious approach for the rest of the month.

Because spec positioning has not lightened sufficiently in our view, we believe that the recent consolidation since August 15 has further room to run in the immediate term.

We think that central bankers, most notably Fed Chair Jay Powell, who gather in Jackson Hole at the end of this week to discuss "challenges for monetary policy", are likely to sweeten even more their dovish rhetoric to boost risk appetite, which could, therefore, result in a temporary decline in haven demand. That said, we contend that a resulting depreciation in the dollar should contain the downside pressure on gold prices.

Against this backdrop, we maintain our patient attitude toward BAR, willing to reassert upside exposure to it in case of a drop to $14.20.

Source: Trading View, Orchid Research

About BAR

BAR is directly impacted by the vagaries of gold spot prices because the Fund physically holds gold bars in a London vault and custodied by ICBC Standard Bank. The investment objective of the Fund is to replicate the performance of the price of gold, less trust expenses (0.20%), according to BAR's prospectus.

The physically-backed methodology prevents investors from getting hurt by the contango structure of the gold market, contrary to ETFs using futures contracts.

Also, the structure of a grantor trust protects investors since trustees cannot lend the gold bars.

BAR provides exposure which is identical to established competitors like GLD and IAU, which are nevertheless much more costly to hold over a long period of time. Indeed, BAR offers an expense ratio of just 0.20% while IAU and GLD have an expense ratio of 0.25% and 0.50%, respectively.

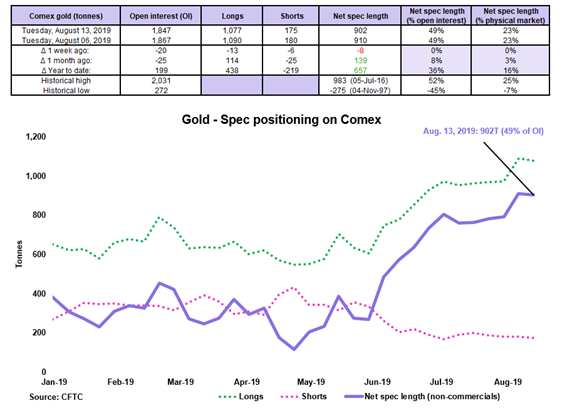

Speculative positioning

Source: CFTC, Orchid Research

Speculators left their net long exposure to Comex gold broadly unchanged in the week to August 13.

The lack of spec buying pressure corroborates the point we made last week:

We are getting very close to the historical high of 52%, suggesting that positioning is now stretched on the long side and there is little room left for additional speculative buying."

The risk of de-grossing in the net long spec position in Comex gold is elevated, in our view, making us cautious over the immediate trajectory of gold spot prices.

Implications for BAR: Given the elevated risk of net speculative selling on the Comex due to a too heavy net long positioning among the speculative community, gold spot prices are vulnerable to a potential sell-off, which, in turn, would pressure BAR lower.

Investment positioning

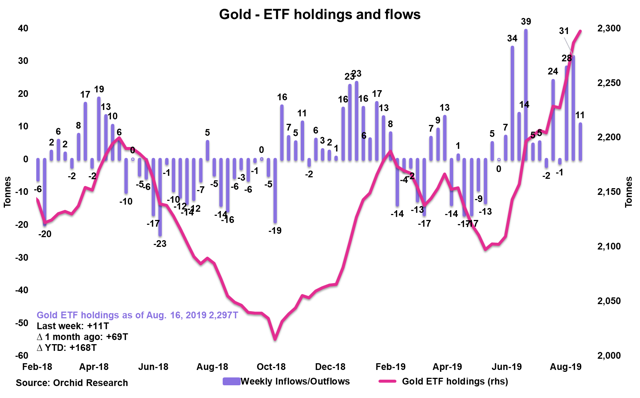

Source: Orchid Research

ETF investors were net buyers of gold in the week to August 16, for a third week in a row.

ETF investors added 11 tonnes to their gold reserves over August 9-16, after buying a cumulative 59 tonnes in the prior two weeks.

Gold ETF holdings are up nearly 60 tonnes since the start of the month, after increasing by 38 tonnes in July and 92 tonnes in June.

In the year to date, ETF investors have accumulated 168 tonnes of gold, marking a sharp increase of 7% in gold ETF holdings, thereby pointing to a very positive sentiment in favor of the bullion.

Looking forward, we expect ETF inflows to continue, reflecting a pick-up in haven demand after the recent break above 20 in the VIX, pointing to increased market fears.

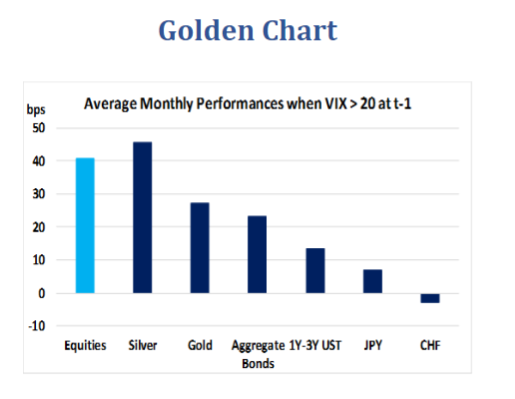

In a recent study conducted by Economic Perspectives, Yvan Berthoux et al (August 1, 2019) examines the average monthly performance since 1990 for several assets when the VIX breaks above its key level of 20.

Source: Economic Perspectives

As the chart illustrates clearly, gold (alongside silver) tends to deliver a solid return on average after the VIX rises above 20.

Interestingly, the VIX broke above 20 for a third time in a row in mid-August, which could point to more ETF inflows into gold in the coming weeks, which would boost gold prices.

Source: Trading View, Orchid Research

Implications for GLDM: Increased market fears, evident in the recent rise in the VIX, are conducive to stronger investment demand for gold because investors seek safety. Gold ETF buying is positive for gold prices and thus for BAR.

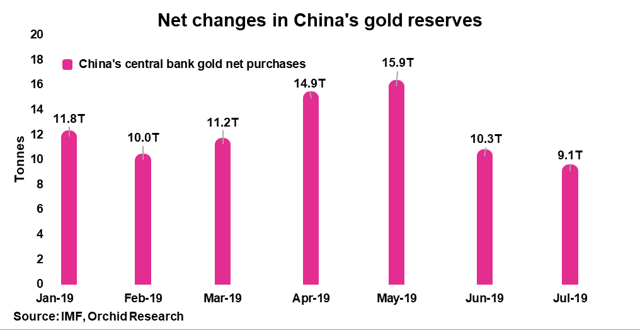

China continues to add gold to its official reserves

Central bank gold buying is likely to remain buoyant in H2 2019, after a net purchase of 374.1 tonnes among major central banks in H1 2019, according to WGC's estimates.

The latest IMF statistics show that the Chinese central bank continued to accumulate gold in July, adding 9.1 tonnes to its official gold reserves. This marks the 8th month of uninterrupted net purchases by the PBOC.

Since the start of the year, the PBOC has accumulated about 83 tonnes of gold.

We believe that PBOC's gold purchases reflect a willingness to boost the central bank's stability by strengthening its balance sheet, which gives a clear signal to the market that China is in charge of the foreign exchange value of the yuan.

We view central bank gold buying as a long-term trend, which should underpin the long-term appreciation in gold spot prices. Although we contend that gold spot prices may experience pockets of volatility in the coming months, central bank's attitude toward gold should prevent any sell-off from being sustained.

Central bank's appetite for gold is, therefore, very positive for BAR.

Closing thoughts

While we are constructive on our gold outlook for the rest of the year, we still remain cautious in the very near term (at least until the end of the month), mainly because spec positioning has become too stretched on the long side, making gold looking like "an overcrowded trade".

Against this, we would not be surprised to see a purge in the gold market, that is, an abrupt sell-off in gold spot prices associated with an increase in speculative net selling on the Comex. In such a scenario, we would take advantage of the sell-off to reassert upside exposure to gold prices.

As a result, we would be induced to rebuild a long position in BAR in case of a drop to $14.20 per share, a nearly 5% decline from its current level.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Our research has not been prepared in accordance with the legal requirements designed to promote the independence of investment research. Therefore, this material cannot be considered as investment research, a research recommendation, nor a personal recommendation or advice, for regulatory purposes.

Follow Orchid Research and get email alerts