Gold Weekly: We Turn More Cautious

GLDM does not enjoy significant upward pressure from the escalating US-China trade/tech dispute due to contradictory consequences.

Gold's positioning has improved markedly since mid-May, predominantly due to speculative demand.

The technical picture deteriorates.

We revise our month-end forecast for GLDM from $13.45/share to $13.00/share.

Introduction

Welcome to Orchid's Gold Weekly report. We discuss gold prices through the lenses of the World Gold Shares SPDR Gold Minishares Trust ETF (GLDM) because we think that is the best pure-play ETF to assert exposure to spot gold prices.

GLDM is directly impacted by the moves in spot gold spot prices because the fund physically holds gold bars in a London vault and custodied by ICBC Standard Bank.

GLDM offers the lowest expense ratio of just 0.18% among its peers. Its older brother, the SPDR Gold Trust ETF (GLD), has an expensive ratio of 0.50%.

We have turned more cautious on GLDM, mainly because the escalating trade/tech spat between the US and China has contradictory forces on the gold price - a positive one from a reduction in investment appetite but also a negative one from an appreciation in the dollar.

With the technical picture sending mixed signals, we have tempered our bullishness and revised our forecasts lower.

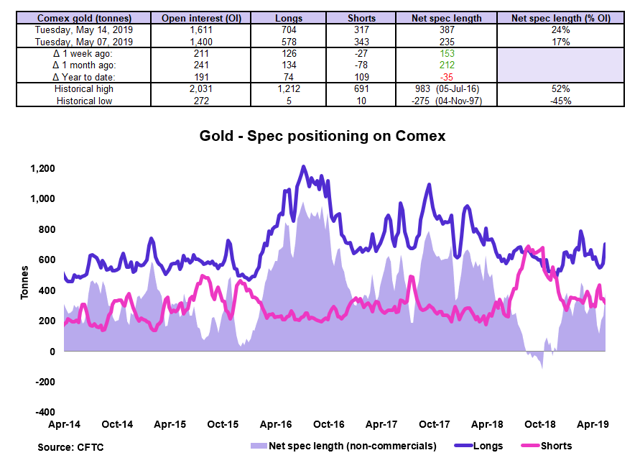

Speculative positioning

Source: CFTC

Speculators lifted markedly their net long exposure to Comex gold in the week to May 14, at the strongest pace since October 2018.

The net spec length (in % of OI) moved to 24% on May 14, from 17% on May 7, and a year-to-date low of 8.5% on April 23.

The recent wave of speculative buying has been primarily fueled by the significant escalation in the trade and tech spat between the US and China, which elicited a surge in demand for protection against a sharp fall in equities in the months ahead.

Since gold's spec positioning remains far from being stretched on the long side, the upside potential in gold prices is significant.

Implications for GLDM: Should risk-off mood continue on tense US-China relations, speculators are likely to lift significantly their net long positions in Comex gold. This will produce an appreciation in spot gold prices, thereby lifting the value of GLDM.

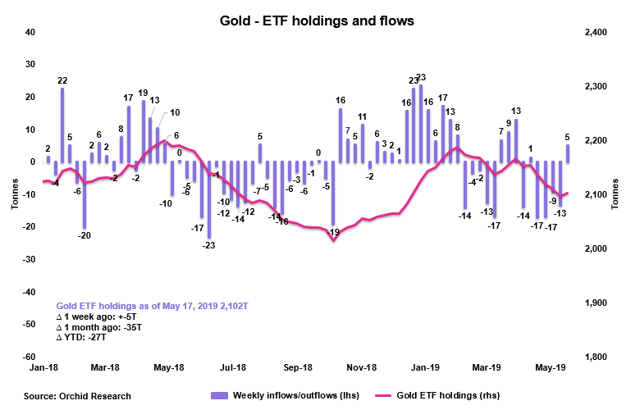

Investment positioning

Source: Orchid Research

ETF investors turned net buyers of gold last week, for the first time in 5 weeks.

ETF investors added a small 5 tons to their gold holdings over May 10-17 (corresponding to a marginal increase in 0.2% in total gold holdings). This reduced the month-on-month net outflow to 35 tons from 55 tons the previous week.

The SPDR GLD captured most of the gold inflows, with nearly 3 tons added to the Fund (+0.4%). In contrast, GLDM received a marginal 0.22 ton (+1.4%)

Inflows were concentrated on Monday (May 10) due to the violent sell-off in US equities (-2.4% on the day), which scared investors and prompted them to hide in gold.

As US equities stabilized in the second half of the week and the dollar strengthened, ETF investors took some profit.

Whether ETF inflows into gold are sustainable in near term remains uncertain in so far as macro investors seem comfortable with buying the dips, perhaps driven by a seeming optimism that 1) the Fed put will save them and 2) US President Trump will make sure to soften his rhetoric toward China in case of a too pronounced decline in domestic equity prices.

Implications for GLDM: Recent gold ETF inflows have been too small to impact significantly the monetary demand for gold. As such, gold spot prices are unlikely to be impacted, leaving GLDM's value essentially unch.

Macro

Positioning in gold has improved of late, primarily because of the renewed interest in speculative buying on the Comex.

However, we reiterate that the escalation in the US-China trade/tech spat has two contradictory effects on gold prices: 1) a positive one via an increase in the level of risk aversion and a concurrent surge in safe-have demand and 2) a negative one via a stronger dollar and a weaker yuan (thereby reducing gold demand in the world excluding the US, including China - world's largest gold consumer).

Technicals

The bullish breakout identified last week has turned out to be "fake".

In recent days, it seems that the positive impact from risk-off sentiment has more than counterbalanced the negative impact from a stronger dollar, resulting in increasing strength in spot gold prices and GLDM.

Here is the chart from last week

Source: Trading View

And below the chart from this week

Source: Trading View

GLDM is now below its 20 DMA, suggesting that the 1-month trend is negative.

As long as GLDM remains below its downtrend line from the year-to-date high, we prefer to remain cautious.

Conclusion

Given the mixed impact of the US-China trade/tech spat on gold prices and the deterioration in the technical picture, we have turned more cautious on GLDM. Accordingly, we revised lower our GLDM forecast to $13/share by month-end from $13.45/share previously.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Our research has not been prepared in accordance with the legal requirements designed to promote the independence of investment research. Therefore, this material cannot be considered as investment research, a research recommendation, nor a personal recommendation or advice, for regulatory purposes.

Follow Orchid Research and get email alerts