Gold Without Emotions

A unique situation is emerging in the gold market now.

Neither the dollar nor the real interest rate has dropped so much that this could explain the current price of gold.

For the steady growth of the gold price, one still needs something more.

A unique situation is emerging in the gold market now, which means either the complete elimination of the well-established dependencies between the price of gold, the U.S. dollar and the level of the U.S real interest rate, or that the price of gold is critically overestimated at the moment.

By and large, there are two main drivers that traditionally have a strong impact on the price of gold - this is the U.S. real interest rate and dollar.

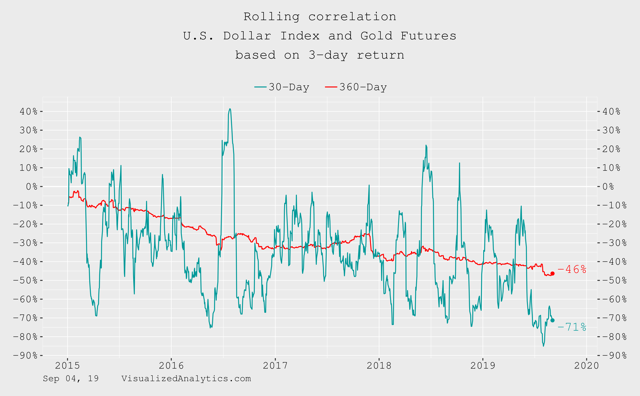

In the case of the dollar, I can prove it by demonstrating the long-term correlation between gold and the U.S. dollar index:

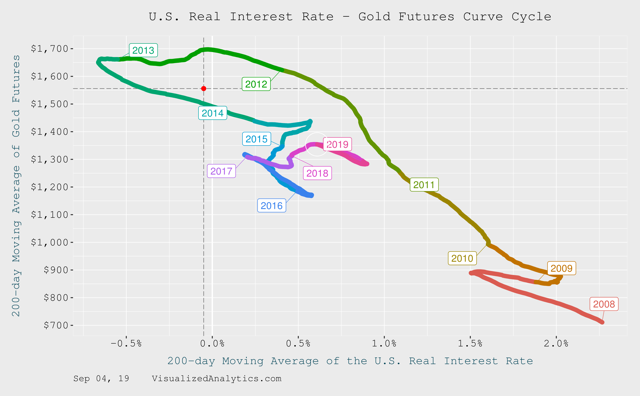

And, in the case of the US real rate, even a visual assessment proves that the level of the real interest rate has a considerable impact on gold. I want to note that this indicator incorporates two indicators: the 10-year Treasury yield and the rate of inflation in the United States:

So, at my glance, it would be right to say that gold is a mirror image of the US real rate and dollar.

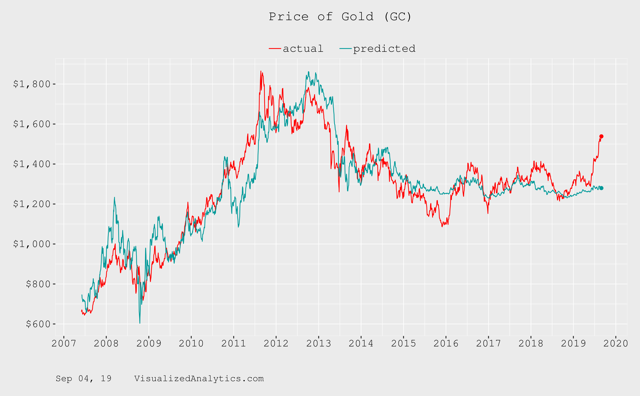

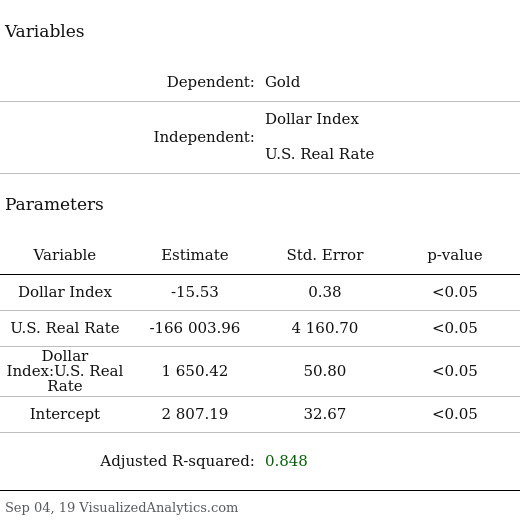

And now let's look at gold, assuming that its price is a function in which the independent variables are the U.S. dollar index and the U.S. real interest rate. And let's build a statistical model that predicts the price of gold based on the U.S. dollar index, the level of the U.S. real interest rate, and the combined effect of these two parameters.

When building the model I used data for the last twelve years and I want to admit that the quality of such a model turns out to be really high:

Here is the model itself:

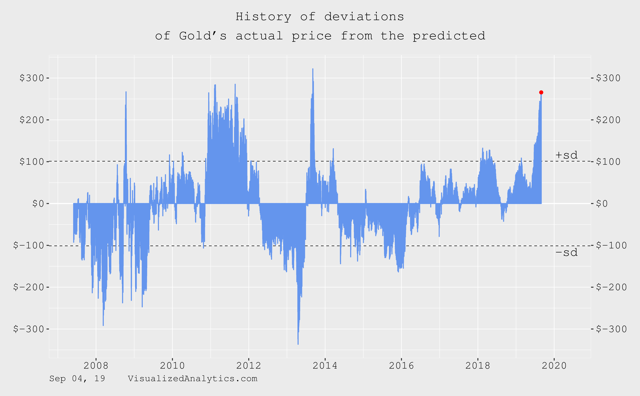

And here is the history of deviations of the actual gold price from the predicted level:

Please note that in the framework of my model over the past twelve years, the actual price of gold has deviated from the predicted level as much as now, only three times. And in two cases, these deviations were short term.

Please note that in the framework of my model over the past twelve years, the actual price of gold has deviated from the predicted level as much as now, only three times. And in two cases, these deviations were short term.

Putting it all together...

Honestly, I do not know in which direction the gold price will change in the near future. But if you look at the gold market without emotions, it should be recognized that for the last two months, this market has been growing in advance. I mean, that is neither the U.S. real interest rate nor the U.S. dollar index has dropped so much that this could explain the current price of gold.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I don't have a trade position regarding Gold. And I believe that to be an advantage in terms of analysis because I am able to consider indicators impartially without subliminal motivation to see positive or negative sides even if they don't exist.

Follow Oleh Kombaiev and get email alerts