Gold Withstands the Storm. Will Miners Drag It off the Raft? / Commodities / Gold and Silver 2022

In line with bearish bets, miners havethrown a match. Gold, however, doesn’t want to leave the ring without a fight.How long will it stay high?

While gold remains relatively firmdespite stock market turbulence, rising real yields, and bearish technicalindicators, even a confluence of headwinds hasn’t been able to knock the yellowmetal off its lofty perch. However, mining stocks haven’t been so lucky. Withmy short position in the GDXJ ETF offering a great risk-reward proposition, thejunior gold miners’ underperformance has played out exactly as I expected.

Moreover, with major spikes in volumepreceding predictable sell-offs (follow the vertical dashed lines below), I’ve warned on severaloccasions that the GDX ETF is prone to tipping its hand – we saw this volumespike in January, which was the 2022 top (as of today). In addition, withmining investors’ power drying up by the day, the medium-term looks equallyunkind.

Please see below:

OnWednesday, gold miners fell. Even though they declined by just $0.06, it wasprofound. The miners were following gold higher during the early part ofWednesday’s (Feb. 9) session, but they lost strength close to the middlethereof and were back down before the closing bell.

Ifthe goldprice reversed and thendeclined during the day, that would have been normal. However, gold stayed up.

This tells us that thebuying power has either dried up or is drying up.

Wheneveryone who wanted to get into the market is already in it, the price can doonly one thing (regardless of bullish factors) – fall. Those who are already incan then sell. Monitoring the markets for this kind of cross-sector performanceis one of the more important goldtrading tips.

Look,I’m not saying that declines now are “guaranteed”. There are no guarantees inthe markets. There might be buyers that haven’t considered mining stocks thatwould now enter the market, but history tells us that this is unlikely.Instead, declines are very likely to follow.

Yesterday’s big daily decline confirmedmy above comments. Gold miners declined much more than gold did, and they didso at above-average volume. The latter indicates that “down” is the truedirection in which the precious metals market is heading.

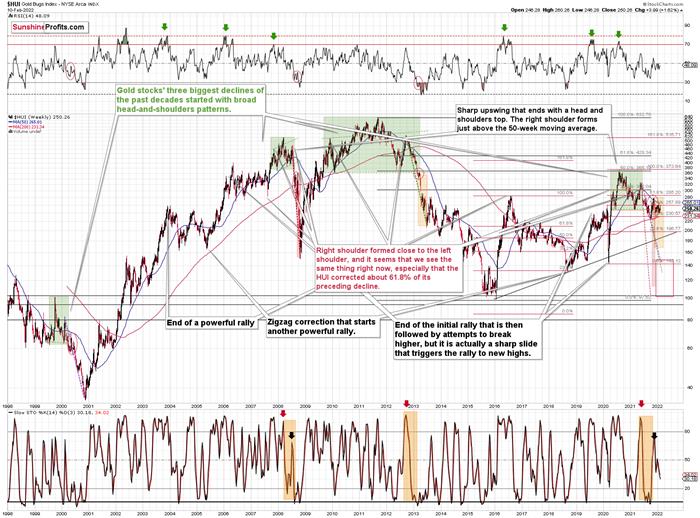

To that point, the HUI Index providesclues from a longer-term perspective. When we analyze the weekly chart, ithighlights investors’ anxiety. For example, after hitting an intraweek high ofroughly 260, the HUI Index ended the Feb. 10 session at roughly 250 – just 3.99up from last Friday – that’s an intraweek reversal.

Furthermore, with the index still in amedium-term downtrend, shades of 2013 still profoundly bearish, and sharpdeclines often preceded by broad head and shoulders patterns (marked withgreen), there are several negatives confronting the HUI Index. As such, a sharpdrawdown will likely materialize sooner rather than later.

Please see below:

Finally, the GDXJ ETF is the gift thatkeeps on giving. For example, with lower highs and lower lows being part of the juniorminers’ roughly one-and-a-half-year journey, false breakouts haveconfused many investors. However, while I’ve been warning about the weaknessfor some time, more downside is likely on the horizon. To explain, I wrote onFeb. 10:

Iemphasized before that juniors hadn’t moved above their 50-day moving average,and that they stayed below their rising blue resistance line. Consequently – Iwrote – the downtrend in them remained clearly intact.

Yesterday’sreversal served as a perfect confirmation of the above. The previous breakdownswere verified in one of the most classic ways. The silverprice has been quitestrong recently, which is also something that we see close to the local tops.

The reversals in miningstocks, the situation in gold, outperformance of silver, ANDthe situation in the USD Index (the medium-term support held) together paint avery bearish picture for the precious metals market in the short and mediumterm.

All in all, if the weakness continues, Iexpect the GDXJ ETF to challenge the $32 to $34 range. However, please notethat this is my expectation for a short-term bottom. While the GDXJ ETF mayrecord a corrective upswing at this level, the downtrend should continuethereafter, and the junior miners should fall further over the medium term.

In conclusion, gold showcased its steadyhand throughout the recent volatility. However, mining stocks have crackedunder the pressure. With the latter’s underperformance often a bearish omen forthe former, the yellow metal’s mettle may be tested over the medium term. Assuch, while the long-term outlooks for gold, silver, and mining stocks remainprofoundly bullish, a final climax will likely unfold before their secularuptrends continue.

Thank you for reading our free analysistoday. Please note that the above is just a small fraction of today’sall-encompassing Gold & Silver Trading Alert. The latter includes multiplepremium details such as the targets for gold and mining stocks that could be reached in the next few weeks. If you’dlike to read those premium details, we have good news for you. As soon as yousign up for our free gold newsletter, you’ll get a free 7-day no-obligationtrial access to our premium Gold & Silver Trading Alerts. It’s really free– sign up today.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.