Gold - Yikes!

A crazy Friday in the gold market - nothing new.

A bullish trend since August - markets rarely move in a straight line.

Gold needs to find a higher low.

Buying the dip in gold tends to be preferable to buying a rally.

Get more aggressive with leveraged products on price weakness.

Gold provided market participants with a reminder that the yellow metal loves to crawl higher and tumble lower during price corrections. The yellow metal is a unique hybrid between a currency and a commodity which means it tends to display a far lower level of volatility than other metals and commodities. Gold volatility tends to hover somewhere between the price variance level of commodities and currencies. Foreign exchange instruments often display low levels of historical volatility because of the activity of governments which manage and often manipulate rates.

Gold tends to run into selling at new highs and buying when it is moving to the downside. Therefore, many market participants find themselves buying highs and selling lows when looking for breakouts. Buying price weakness during bullish trends or selling strength when the price pattern is moving to the downside is often the optimal approach to trading or investing in the yellow metal.

After last Friday's price action, the time could be perfect for considering a leveraged tool in the gold market. If the current trend remains intact, the Velocity Shares 3X Long Gold ETN product (UGLD) could offer an excellent chance for short-term rewards.

A crazy Friday in the gold market - nothing new

Anyone who traded gold for more than a few weeks knows that the price tends to look the best on highs and worst on lows and that Friday's often wind up as highly volatile days for the precious metals when it comes to price reversals or significant moves on the up and the downside. Last Friday, March 1, was another example of the potential for volatility in the gold market on the final day of the week.

Source: CQG

The chart highlights that gold had been edging lower since the February 20 peak at $1349.80. The yellow metal held the $1320 level until Wednesday, February 27. After the price continued to fall on February 28, it set up last Friday's golden carnage that took the price below its first level of short-term support at $1304.70 which was the mid-February low and through $1300 which gave way like a hot knife through butter. Gold fell on higher than average volume of over 380,000 contracts. On Tuesday, March 5, the price of the precious metal fell to $1282.00 which was only $0.50 above 2019 low from January 24 at $1281.50 which stands as the next level of technical support on the April futures contract. If price can hold above the January 24 low and begins to recover, it will keep the bullish trend that has been in place since mid-August 2018 intact. Price momentum and relative strength indicators are heading for oversold territory on the daily chart. At the same time, open interest has turned lower in a sign that weaker longs are exiting the gold futures market during the current corrective price move.

A bullish trend since August - markets rarely move in a straight line

In mid-August, the price of gold slumped to its lowest level since early 2017 when it traded to $1161.40 per ounce.

Source: CQG

The weekly chart illustrates the bullish trend in gold since last summer. While the technical support level on the daily chart is at $1281.50, the weekly pictorial shows that the price needs to remain above $1275.30 to keep the bullish trend of higher lows and higher highs intact.

Markets rarely move in a straight line during bullish or bearish trends. Given the low volatility in gold compared to many other commodity futures markets, the yellow metal often experiences periods where the price backs and fills on moves to the upside during bullish trends. However, gold tends to respect critical support and resistance levels.

Gold needs to find a higher low

Another test for the gold market on the downside came on Tuesday, March 5 after Friday's price carnage in the yellow metal. Gold held the late January low at $1281.50 per ounce on the nearby futures contract, so far.

Gold looked heavy on Monday and Tuesday and as bad as it looked good on February 20 when April futures peaked at just twenty cents shy of $1350 per ounce. If the March 5 low at $1282 turns out to be a bottom for the yellow metal and the gold futures market runs dry of selling at around that level, we could see a sideways period where the yellow metal builds strength for another move over $1300 per ounce. One positive sign for the gold market on March 4 was that even as the price of the metal struggled at the $1290 level which was almost $10 below Friday's settlement price, and stocks were moving lower, the GDX and GDXJ gold miner ETF products both were close to unchanged on the session.

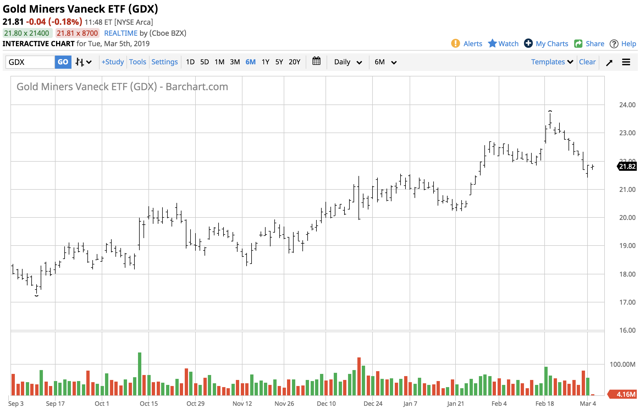

Source: Barchart

The chart shows that on Monday, March 4, the GDX basket of leading gold mining shares was higher on the day despite the lower price of the yellow metal.

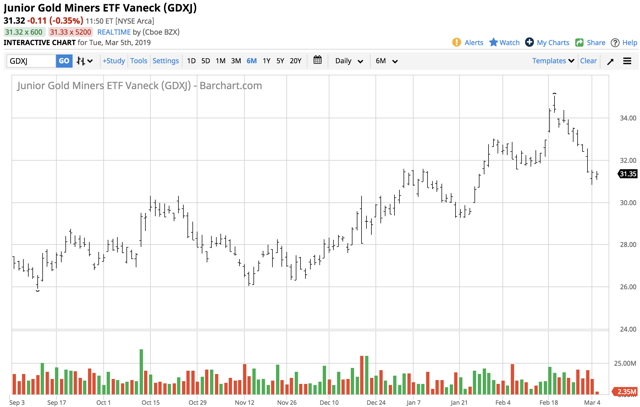

Source: Barchart

The GDXJ which is a basket of the leading junior gold mining stocks was also higher on the day in the face of a gold price that was still below the $1290 level on Monday, March 4.

The action in the gold mining stocks could have been a clue that gold's correction took the price of the precious metal to a higher low where it looked awful. Time will tell if the mining stocks sent a signal to the gold market.

Buying the dip in gold tends to be preferable to buying a rally

Anyone holding a long position in gold or gold-related assets could not help but say, Yikes, on Friday, March 1 when the price fell off the side of a corrective cliff below $1300 and on Monday and Tuesday when it continued lower to just 50 cents above the low for 2019. However, while the price action was ugly, it was as hideous as it was beautiful for longs on February 20 when it looked like it was on its way for a challenge of the 2018 peak at $1365.40 and the 2016 high at $1377.50 per ounce.

There are times when gold looks great and continues to follow through on the upside, and when it looks ugly and continues to make lower lows. However, over the past four decades, I have found that the high odds play that leads to optimal performance in the gold market is to hold your nose and buy when it looks and feels worst and sell when it looks that it is set to run away on the upside.

On Monday, March 4, and Tuesday, March 5, I held my breath as I am bullish on the prospects for gold over the coming weeks and months.

Get more aggressive with leveraged products on price weakness

I have found that the best time to become most aggressive when it comes to buying gold is when the price action is at its worst. While I usually avoid leveraged ETF and ETN instruments, when gold looks its worst, I often turn to the triple leveraged Velocity Shares 3X Long Gold ETN product. When it looks its best, the inverse product (DGLD) offers similar exposure on the downside for the price of gold. The fund summary for UGLD states:

The investment seeks to replicate, net of expenses, three times the S&P GSCI Gold index ER. The index comprises futures contracts on a single commodity. The fluctuations in the values of it are intended generally to correlate with changes in the price of gold in global markets.

UGLD and DGLD are only appropriate for short-term positions in the gold market as their leverage comes at a high price which is time decay. Both ETN products undergo periodic reverse splits which eat away at their value over time regardless of the price direction in the gold market. However, on a short-term basis, they can do an excellent job replicating triple the price move on a percentage basis in the gold market. UGLD has net assets of $144.06 million and trades an average of over 105,000 shares each day. Since more market participants favor the long side of markets, DGLD's net assets are lower at $16.33 million as is its average daily volume which is just over 52,000 shares.

Gold has looked ugly in early March as it approached a new low for 2019. For those looking to buy the dip in the yellow metal, UGLD could be a profitable tool if the gold market is going to make a quick and substantial comeback. If the price of gold recovers over the coming sessions, do not forget to take profits on the leveraged ETN products. I would use any profits to move into unleveraged instruments for those who believe that the price of the yellow metal is going to continue the bullish trend that started back in mid-August of 2018.

The Hecht Commodity Report is one of the most comprehensive commodities reports available today from the #2 ranked author in both commodities and precious metals. My weekly report covers the market movements of 20 different commodities and provides bullish, bearish and neutral calls; directional trading recommendations, and actionable ideas for traders. I just reworked the report to make it very actionable!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The author always has positions in commodities markets in futures, options, ETF/ETN products, and commodity equities. These long and short positions tend to change on an intraday basis.

Follow Andrew Hecht and get email alerts