Gold - You Can Win a Battle, but Still Lose the War / Commodities / Gold and Silver 2021

Gold had a good day yesterday, but asit hits the $1,770 resistance line, it will be anything but easy for the yellowmetal. The real test has begun.

And so, it happened. Gold moved right toits target level that seemed to be the max that it could reach, but that didn’tseem to be the most likely outcome. Just because it wasn’t the most likelyoutcome, doesn’t make it impossible. The “most likely” can happen all the time– after all its only “most likely” not “certain” or “inevitable”.

Gold declined right after itstriangle-vertex-based reversal, but it appears that the market participantsdidn’t want to give up on the bullish tone until gold finally reached itsprevious lows and highs.

Just like magnets, the strong support andresistance lines draw investors and traders, and it seems that we saw this playout once again.

Gold moved slightly above its upper border of the near-perfect flag (zigzag)pattern and this small breakout is not completed. This particular breakout isnot even close to being as important as the fact that the previous very strongresistance held yesterday (Apr. 15).

Why? Because the level that was justreached – the $1,770 level – is the level that provided strong resistance inmid-2020 (several times) and it provided strong support in late-2020 and early2021. These were mostly very important reversals, which make this price levelparticularly important.

Moreover, the currentmove higher to this level is symmetrical to what we saw in mid-2020. Consequently, even though this week’s rally might seemlike a game-changer, it very likely isn’t one.

Butminers moved higher, and they invalidated the breakdown below the neck level ofthe broad head-and-shoulders formation!

…Did they, though?

MiningStocks: GDX and GDXJ

The GDX ETF did indeed close yesterdayabove the dashed line that I used to mark the neckline of the head andshoulders pattern. One might view this as an invalidation of the breakdown, andthus a bullish sign. This doesn’t add up with gold’s inability to move aboveits critical resistance at $1,770, and we see that miners moved only to theline that’s symmetrical to the line based on the recent bottoms.

In yesterday’s intraday Alert , Iwrote the following:

Miningstocks are rallying too, but please note that they only reached their upperborder of the zig-zag pattern. Back in early January, this was exactly wherethe rally had ended. The top formed on huge volume and based on the volume thatwe already see today, it’s almost certain that the volume for today’s sessionwill be huge – just like what we saw at the January top.

Irealize that waiting for the next big slide is exhausting and discouraging, andit’s not easy to hold on to the current trading position. However, the outlookdidn’t change, and the situation continues to fit the bearish narrative despitetoday’s intraday upswing. Consequently, exiting positions now seems not onlypre-mature, but actually opposite to what appears to be a good trading movefrom my point of view. After all one wants to sell or short at the tops andtops can only form after rallies.

The above remains up-to-date. Let’s getback to the reason why this invalidation of the breakdown in the GDX might notreally mean the true, meaningful invalidation of the breakdown in miners ingeneral. The reason is that other proxies for the mining stocks sector don’tconfirm it.

The GDXJ ETF is relatively far from theneck level (which I marked with a thick, black line). On a side note, thebreakout that we saw recently (above the short-term declining resistance line)seems similar to the breakout that we saw in January – above the line that wasimportant back then. Just as the January strength turned into declines, I expectto see the same thing this time.

Let’s move to the two key indices for themining stocks sector, the HUI and the XAUindices .

In neither of them did we see theinvalidation of the breakdown. Consequently, the GDX ETF is the odd one out inthe entire pack, not to mention the lack of a breakout in gold. Therefore, itseems prudent not to give particular meaning to what happened in the GDX ETFalone.

Silver

Andwhat about silver’s outlook ?

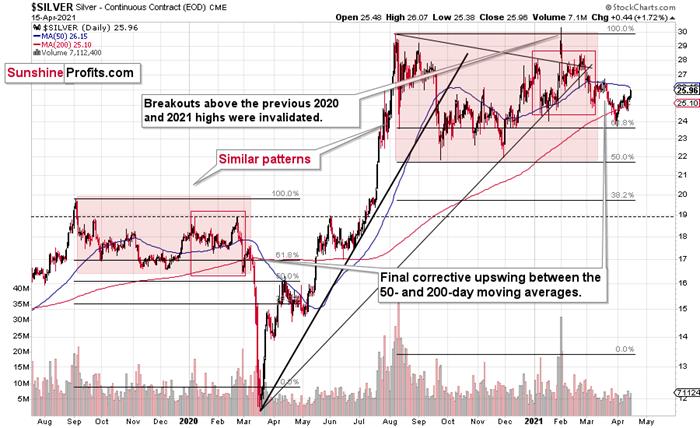

Nothing really changed despiteyesterday’s strength. Just as was the case in March 2020, silver is correctingafter a visible decline. Back in March 2020, the correction ended between the200-day (red) and 50-day (blue) moving averages. The same is happening rightnow. Silver’s 50-day moving average is currently at $26.15 and the whiteprecious metal closed at $25.96.

All in all, it seems that quite a lothappened yesterday, but nothing really changed as far as the outlookfor gold is concerned.

Thank you for reading our free analysistoday. Please note that the above is just a small fraction of today’sall-encompassing Gold & Silver Trading Alert. The latter includes multiplepremium details such as the target for gold that could be reached in the nextfew weeks. If you’d like to read those premium details, we have good news foryou. As soon as you sign up for our free gold newsletter, you’ll get a free7-day no-obligation trial access to our premium Gold & Silver TradingAlerts. It’s really free – sign up today.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.