Golds quick price move increases the odds of a correction / Commodities / Gold & Silver 2020

Every market corrects, maybe profit taking, maybe of allowing those who missed out, to get in!

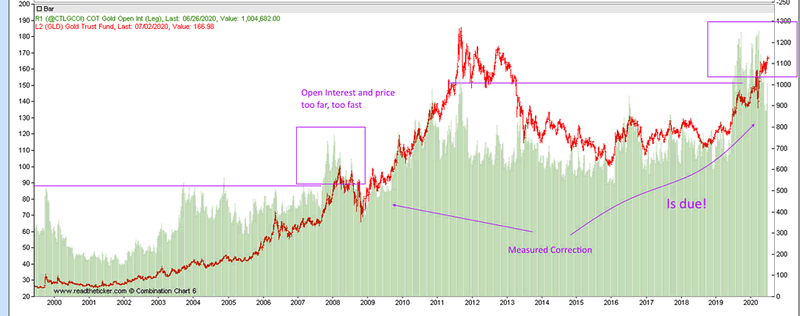

The current open interest on the gold contract looks to high after a very fast price move, it looks like 2008 may be repeating. A quick flushing out of the weak hands open interest may take place before a real advance in price takes place. The correction may be on the back of a wider sell off of risk assets (either before of after US elections) as all assets suffer contagion selling (just like 2008).

This blog view is a gold price correction of 10% to 20% range is a buying opportunity. Of course we may seea very minor price correction but a long time correction, a price or time is correction is expected, we shall watch and wait.

The explosion of open interest (chart below) along with gold price suggests 'all have loaded up', the big boys wont like this as they will not want to share gold gains with the public, one therefore can expect some sort of wash out of the weak public hands holding of gold future contracts before a real advance takes place.

Gold open interest

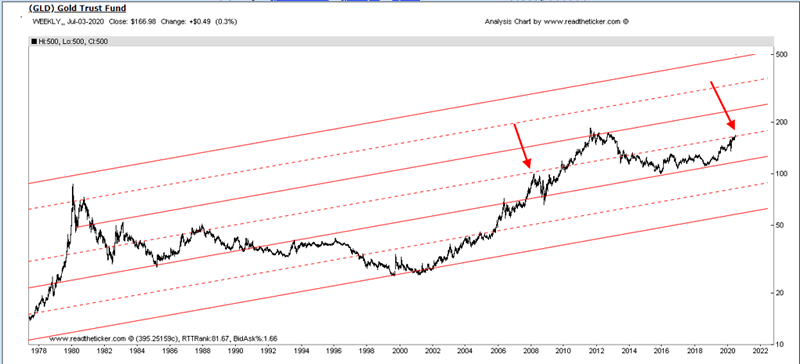

Also price has meet channel resistance.

Gold channel

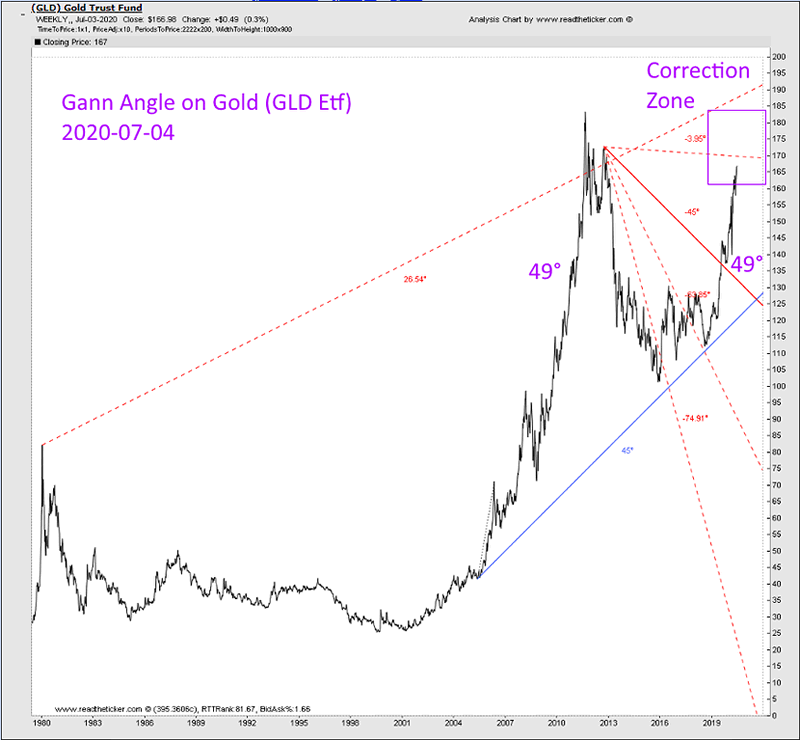

Also price is near upper resistance of the previous high.

Gold gann

Fundamentals are important, and so is market timing, here at readtheticker.com we believe a combinationof Gann Angles, Cycles, Wyckoff and Ney logicis the best way to secure better timing than most, after all these methods have been used successfully for 70+ years. To help you applying Richard Wyckoff and Richard Ney logica wealth of knowledge is available via our RTT Plus membership. NOTE: readtheticker.com does allow users to load objects and text on charts, however some annotations are by a free third party image tool named Paint.netInvesting

NOTE: readtheticker.com does allow users to load objects and text on charts, however some annotations are by a free third party image tool named Paint.net

Readtheticker

My website: www.readtheticker.com

We are financial market enthusiast using methods expressed by the Gann, Hurst and Wyckoff with a few of our own proprietary tools. Readtheticker.com provides online stock and index charts with commentary. We are not brokers, bankers, financial planners, hedge fund traders or investment advisors, we are private investors

© 2020 Copyright readtheticker - All Rights Reserved

Disclaimer: The material is presented for educational purposes only and may contain errors or omissions and are subject to change without notice. Readtheticker.com (or 'RTT') members and or associates are NOT responsible for any actions you may take on any comments, advice,annotations or advertisement presented in this content. This material is not presented to be a recommendation to buy or sell any financial instrument (including but not limited to stocks, forex, options, bonds or futures, on any exchange in the world) or as 'investment advice'. Readtheticker.com members may have a position in any company or security mentioned herein.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.