GoldSeek Weekly Radio: Peter Schiff & Arch Crawford

(S14-E711)

Featured Guests

Peter Schiff

& Arch Crawford

Note: Guest order via seniority.

Interview Recap.Arch Crawford, head of Crawford Perspectives for 42 consecutive years rejoins the show.He expects further fireworks ahead in the PMs sector, in particular with silver.Investors are only beginning to appreciate the remarkable opportunity.A single ounce of the yellow metal yields nearly 90 silver dollars.While gold is approaching the all all-time record high posted in 2011, silver remains a bargain.The highly inelastic silver demand/supply curves amplify the impact of future capital flows.Warren Buffett accumulated approximately 130 MILLION silver ounces.Buffett promptly sold at a 100%+ gain.Interest from a single legendary investor could trigger a market force majeure.President Putin continues to add 1000 oz. silver bars to the national currency reserves.Similarly, will US policymakers rebuild our former 1.6 billion silver ounce strategic military-stockpile before the impending price eruption or pay 5x-10x more?Returning from a sabbatical in Italy, Peter Schiff notes profligacy could unravel the domestic economy.The ideal panacea includes returning the global reserve currency to a gold-backing.Ghana recently experienced a financial crisis where 1/3 of the financial institutions closed their doors.$1.6 billion evaporated - Wikipedia rolled out a webpage outlining the Ghana Banking Crisis.A legion of top Wall Street money managers/analysts continue to recommend gold.Several top analysts are predicting $2,000+ gold.Mark Mobius recently advised investors to "Buy gold at any price."The duo both agree that the "King of Currencies" will eventually be re-monetized.Leading the charge to remonitization remains the Bank of International Settlements (BIS).The team also concurs on a minimum fair valuation for gold falls within the range of $5,000-10,000.Bank of England Governor Mark Carney proposed a cryptocurrency as the reserve currency.Reallocation from the 4 key FANG stocks alone could send the PMs share sector into deep space-orbit.Peter Schiff notes that Bitcoin and related tokens could run much higher in sympathy with gold.Recent examples include Zimbabwe where half a million of their dollars will procure 1 ounce of gold and Venezuela, where only a few years ago, the price of gold in pesos was comparable to dollars; today an ounce of gold is worth approximately 400 million.GSR Hotline - Call 24/7

Share Your Questions & Comments!

Q&A Hotline: (641) 715-3900 followed by extension number and #: 514049# you can call, delete, re-record, your feedback is appreciated!

Please Listen HereDial-Up Real Audio

MP3

FAST Download

Highest Quality Download

Right click above & "Save Target As..." to download. To learn more about software needed to play the above formats, please visit the FAQ.

Guest Bios

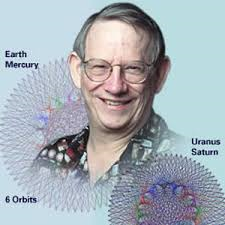

Arch Crawford

Stockmarket Cycles

Arch Crawford cut his technical analysis teeth as first assistant to top Wall Street technician Robert Farrell at Merrill Lynch in the early 1960s. In 1977, following Arch's extensive research into astrophysical phenomenon, astrology and its correlation to market performance, he edited and published the premiere issue of Crawford Perspectives market timing newsletter.

Arch Crawford cut his technical analysis teeth as first assistant to top Wall Street technician Robert Farrell at Merrill Lynch in the early 1960s. In 1977, following Arch's extensive research into astrophysical phenomenon, astrology and its correlation to market performance, he edited and published the premiere issue of Crawford Perspectives market timing newsletter. Today, nearly 40 years later, Crawford Perspectives continues to bring readers one of the most highly regarded and consistently accurate market timing newsletters available.

Website: click here.

Peter Schiff

Schiff Gold

Peter Schiff President & Chief Global StrategistPeter is one of the few investment advisors to have correctly called the current bear market before it began and to have positioned his clients accordingly. As a result of his accurate forecasts of the mortgage meltdown, credit crunch, and decoupling of commodities, precious metals, and foreign markets from the U.S. Dollar, he has become a sought-after economic commentator on a range of investment topics. Peter delivers lectures at major economic and investment conferences, and is quoted often in the print media, including the Wall Street Journal, New York Times, L.A. Times, Barron's, BusinessWeek, Time and Fortune. His broadcast credits include regular guest appearances on CNBC, Fox Business, CNN, MSNBC, and Fox News Channel, as well as hosting a weekly radio show. As an author, he has written four best-selling books, including his latest: " Crash Proof 2.0: How to Profit from the Economic Collapse" and "How an Economy Grows and Why It Crashes."

Schiff Gold: click here.