Grasberg Shocker

Michael Ballanger of GGM Advisory Inc. shares his thoughts on the fatal mining incident at Freeport-McMoRan Inc.'s (FCX:NYSE) Grasberg mine as well as his top copper pick for 2025.

Michael Ballanger of GGM Advisory Inc. shares his thoughts on the fatal mining incident at Freeport-McMoRan Inc.'s (FCX:NYSE) Grasberg mine as well as his top copper pick for 2025.

On September 8, 2025, one of the most impactful events of the year occurred in the remote highlands of the Sudirman Mountain Range in the province of Papua, Indonesia, which is on the western half of the island of New Guinea.the

Back in 1972, PT Freeport Indonesia (PTFI) (the Indonesian subsidiary of U.S.-based Freeport-McMoRan Inc. (FCX:NYSE) commenced mining operations, but it took until 1988 before discovering the mighty Grasberg mine.

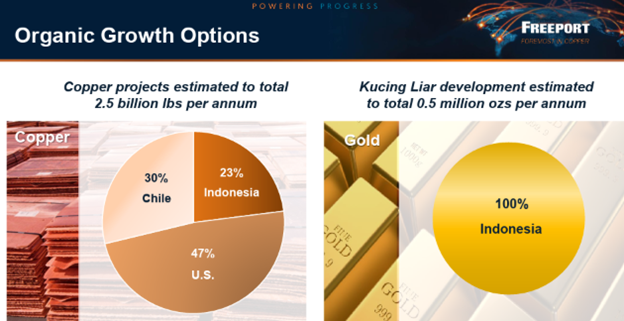

Today, after 37 years of significant production, the Grasberg mining district contains one of the world's largest recoverable copper reserves and wells as one of the largest gold reserves.

It is estimated that copper production represents 3.6% of global supply, while gold production is 2.4% of global gold supply.

On September 8, that nearly four-decade-long run ended abruptly with a geological/topographical/hydrological event called a "mud rush," a fatal mining incident on September 8, 2025, in which a catastrophic flow of 800,000 metric tons of wet material flooded the mine's block cave.

It resulted in the confirmed deaths of two workers, with five others still missing.

It took FCX about two weeks to report the disaster and with it a declaration of "force majeure," a French term for "superior force," which is a contractual clause that excuses parties from fulfilling their obligations if "an extraordinary, unforeseeable, and uncontrollable event prevents performance." Its application involves extraordinary events like natural disasters, war, or epidemics, which must be beyond the parties' control and make performance impossible, impractical, or illegal. The clause allowed for suspension or termination of their copper contracts without liability for breach, offering protection and risk management in uncertain times.

The Grasberg minerals district includes the following underground mines that are being operated: the Grasberg Block Cave, the Deep Mill Level Zone (DMLZ), and Big Gossan. Production from these underground mines was expected to continue through 2041, and an extension of PTFI's operating rights beyond 2041 would have extended the lives of these mines. PTFI also had several projects in progress in the Grasberg minerals district related to the development of the large-scale, long-lived, high-grade underground ore bodies located beneath and proximitous to the Grasberg open pit. In aggregate, these underground ore bodies were expected to produce large-scale quantities of copper and gold. However, that is now seemingly impossible.

The part of the company's mining operation that suffered the disaster was the Grasberg Block Cave ore body, which is the same ore body historically mined from the surface in the Grasberg open pit. Undercutting, draw bell construction, and ore extraction activities in the Grasberg Block Cave underground mine continued to track expectations up until September 8.

The DMLZ ore body lies below the depleted Deep Ore Zone (DOZ) underground mine at the 2,590-meter elevation and represents the downward continuation of mineralization in the Ertsberg East Skarn system and neighboring Ertsberg porphyry. Hydraulic fracturing operations had been effective in managing rock stresses and pre-conditioning the cave following mining-induced seismic activity experienced from time to time.

The Big Gossan mine lies underground and adjacent to the current mill site. It is a tabular, near-vertical ore body. The mine utilized a blasthole stoping method with delayed paste backfill. Stopes of varying sizes were mined, and the ore dropped down and passed to a truck haulage level. Trucks were chute-loaded and transported the ore to a jaw crusher. The crushed ore was then hoisted vertically via a two-skip production shaft to a level where it was loaded onto a conveyor belt. The belt then carried the ore to one of the main underground conveyors, where the ore was transferred and conveyed to the surface stockpiles for processing. To my knowledge, the sections unrelated to the GBC are unaffected.

PTFI commenced long-term mine development activities for its Kucing Liar deposit in October 2021, which was expected to produce over 7 billion pounds of copper and 6 million ounces of gold between 2029 and the end of 204, with an extension of PTFI's operating rights beyond 2041 would extending the life of the project. The Kucing Liar underground deposit lied on the southern flank of and underneath the southern portion of the Grasberg open pit at the 2,605-meter elevation level. Development activities were expected to continue over an approximate 10-year timeframe. At full operating rates, annual production from Kucing Liar was expected to approximate 560 million pounds of copper and 520 thousand ounces of gold, providing PTFI with sustained long-term, large-scale, and low-cost production.

The DOZ ore body lies vertically below the depleted Intermediate Ore Zone. PTFI began production from the DOZ ore body in 1989, and the ore body was depleted at the end of 2021.PTFI began open-pit mining of the Grasberg ore body in 1990. The final phase of the Grasberg open pit was mined during 2019, including the removal of the open pit ramps. In aggregate, the Grasberg open pit produced over 27 billion pounds of copper and 46 million ounces of gold in the 30-year period from 1990 through 2019.

The copper mineralization in these skarn deposits is dominated by chalcopyrite, but higher bornite concentrations are common. Moreover, gold occurs in significant concentrations in all of the district's ore bodies, though rarely visible to the naked eye. These gold concentrations usually occur as inclusions within the copper sulfide minerals, though, in some deposits, these concentrations can also be strongly associated with pyrite.

48.76% of PTFI is owned by FCX; 51.24% share ownership was collectively held by PT Mineral Industri Indonesia (MIND ID), an Indonesian state-owned enterprise, and PT Indonesia Papua Metal Dan Mineral (formerly known as PT Indocopper Investama), which is expected to be owned by MIND ID and the provincial/regional government in Central Papua, Indonesia.

As for the impact on FCX operations, the company reported that "the GBC ore body represents 50% of PTFI's estimated proven and probable reserves as of December 31, 2024, and approximately 70% of PTFI's previously forecast copper and gold production through 2029. The incident occurred in "PB1C", one of five production blocks in the GBC, but resulted in damage to infrastructure required to support other production areas in the GBC." Since the Grasberg Mine accounted for approximately 45% of Freeport's revenues with the GBC contributing 70% of that figure, a significant supply shock has just hit the global copper market.

Alexander Stahel is a Swiss-based investor, energy analyst, and the founder, chairman, and Chief Investment Officer (CIO) of Burg Graben Holding. A commodities and asset-backed industries expert, he made the following observations concerning Grasberg in a tweet he released earlier this week.

"Analysts say full recovery is likely by 2027. That's total nonsense. Nobody really knows. A true "known unknown." What is known: any company with less strength and brainpower than Freeport McMoRan would likely go bankrupt from this. Think Victoria Gold a minor heap leach pad slide sank it within weeks. Mining companies get hit twice: revenues vanish while capital costs to fix the damage soar, and regulators delay re-issuing permits until safety is proven. And this accident involves death. It's a total nightmare. My view? This is no quick fix. With infrastructure damaged, safety paramount, at least two confirmed dead and five still missing, investigations ongoing, potential class actions looming, and permitting hurdles ahead, the road back for Grasberg will be long and uncertain."

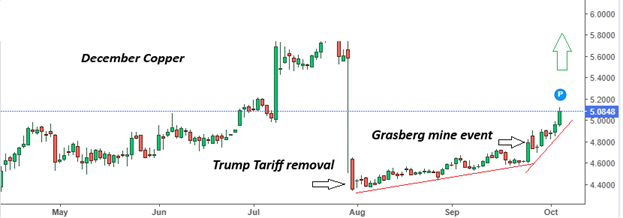

What this means for me as a dyed-in-the-wool" copper bull is that "the road back for global copper supplies will be long and uncertain." And that means higher copper prices . . .

Copper prices decided to respond in earnest to the Grasberg event by closing out the week at $11,200/ mt or $5.08/lb, which was what I have been forecasting since July 29, when President Trump cancelled the tariff duty on imported raw copper causing a one-day, 20% haircut that has had copper producers on the defensive for the past couple of months.

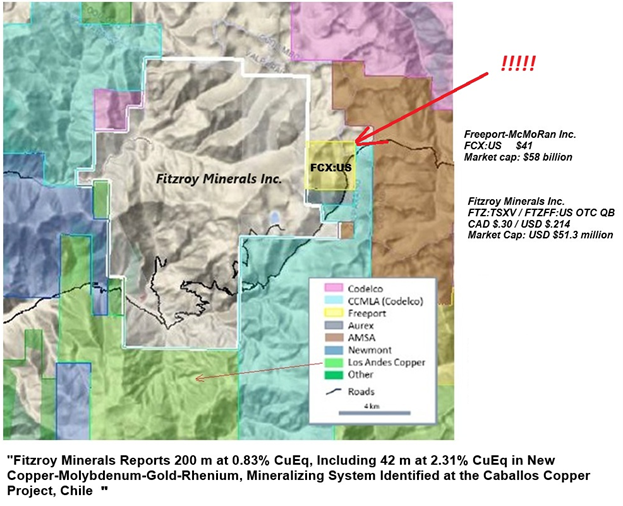

Fortunately for us, we were able to add to our holdings in a number of the junior copper explorer/developers during the late-summer setback including our favorite one Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB) that dropped over 55% from its 52-week high of CA$0.55 to an intraday low of CA$0.245 before turning back up. The company is preparing to deploy three drill rigs to its Caballos copper property, the new discovery announced last March.

Since the Chilean winter ended a couple of weeks ago, they intend to investigate the two major copper anomalies. The first will be a continuation of the work at the site of the discovery known as the Chincolco anomaly where they reported a 200-meter intercept of .83% Cu-Eq (copper-molybdenum-rhenium). Coincident with that will be drilling of the second major target the 1,200-meter-long Cerro las Mulas or "Mule Hill" anomaly, which is located approximately 7 km. to the north of Chincolco. The third rig will probably be moved to the eastern portion of the Chincolco anomaly but as of the date of this report, it remains uncertain.

What is not "uncertain" is the proximity of Freeport-McMoRan Inc. to Caballos as can be seen from the map shown below. There is little doubt that they are watching progress at Caballos like proverbial hawks, so the soon-to-arrive 2025-2026 drill program on these two major anomalies will take on major importance once they are fired up. You just know that FCX is now in-the-hunt for copper reserves especially if they have to forfeit the 48.76% to the Indonesian government, and since 30% of their revenues are already derived from Chilean production, Caballos and Buen Retiro would be a logical addition to their existing operation in South America.

Over the short-term, I see new high ground for FTZ/FTZFF amidst a torrent of news flow with both corporate and exploration-related content dominating the narrative. This is my largest personal holding and top pick for 2025.

While the repercussions of the Grasberg supply shock are unquestionably inflationary, the gold and silver markets had extraordinary weeks as well, with gold closing within a chip shot of the all-time high reached on September 30. It closed a mere $13.50 shy of the record high while silver hit a multi-year high at $48.325 on Friday morning but failed to better the $47.975 high on September 30 by closing at $47.97 in the late afternoon.

I keep reminding the silver bulls that while the new high in silver is impressive, the global market for the annual silver trade is barely US$30 billion while the same figure for copper is $270 billion with gold now at $292 billion. Considering that a pound of copper gleans $5.08 with silver commanding $768.00 for that same pound of metal, a 30% rise in the price increases costs to the global economy of $18 billion while a 30% increase in copper is $810 billion and $873 billion for gold. When one considers that the bulk of trade in the gold market is hoarding by the central banks for monetary uses, copper is used in every facet of the global economy from housing to electronics to communications to automobiles. For this reason, copper price increases will have a significant inflationary impact on domestic prices everywhere while gold price increases affect a relatively minute sector of the economy with silver inflicting barely a scratch.

Nonetheless, for the brave speculators that own silver (like me), it has been a long and arduous road since the lows of October 2008 at US$9.19 per ounce. I bought the three 100-oz. bars back in 2015 at around US$15 and have zero intention of selling them. What I like to do is shut the lights out in the kitchen at night and train my quartz halogen spotlight on them from about two feet away. One thing about finely-polished silver is that it actually shimmers as it reflects the beams of light from the spotlight. Silver is a wonderful metal with great healing powers and a recuperative aura surrounding those that own it. Taking the bars out of the vault once every few months is a medicinal event having absolutely nothing to do with finance.

The only thing more enchanting than handing pure silver bars with that "999.9" designation is one of those gold bars you see in the movies or can handle at the Royal Canadian Mint in Ottawa.

As they say, silver may be "the money of gentlemen" but gold is considered to be "the money of kings," and there is a wide, gaping expanse between the two and hailing from the working-class town of Malton, Ontario, I prefer copper, now that I have finally learned to dine with a knife and fork.

| Want to be the first to know about interestingCopper andBase Metals investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Fitzroy Minerals Inc.Michael Ballanger: I, or members of my immediate household or family, own securities of: Fitzroy Minerals Inc. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: Fitzroy Minerals Inc. I determined which companies would be included in this article based on my research and understanding of the sector.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.