Green, social and sustainability bonds to reach $400 billion in 2020

Moody's expects 2020 to be another exemplary year for the environmental, social and governance (ESG) bond market, with issuances expected to reach record levels.(Stock image.)

Moody's expects 2020 to be another exemplary year for the environmental, social and governance (ESG) bond market, with issuances expected to reach record levels.(Stock image.)

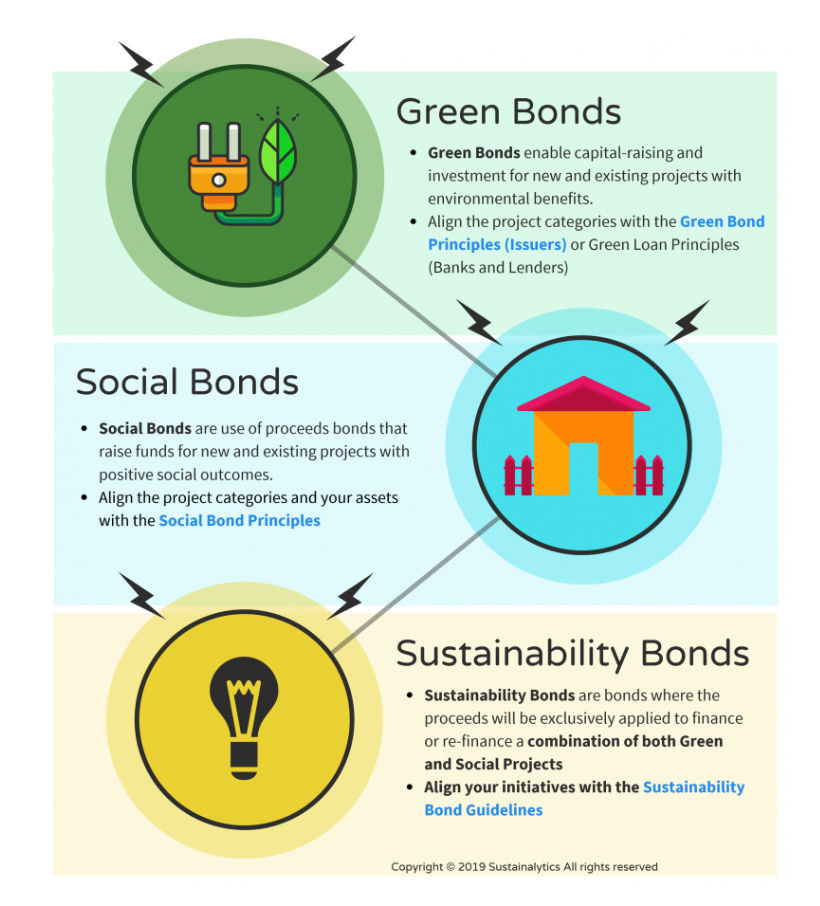

The issuance of green, social andsustainability bonds, those where the proceeds will be exclusively applied toeligible environmental and/or community projects, are expected to climb24% to $400 billion in 2020 from a previous record of $323 billion achieved lastyear, a reportpublished Monday shows.

"Across the financial sector,market participants are increasingly integrating environmental, social andgovernance (ESG) considerations and sustainability," said MatthewKuchtyak, analyst at Moody's Investors Service. "Governments andregulators are also providing greater structure and clarity to the sustainablefinance market as their focus on climate change and sustainability grows."

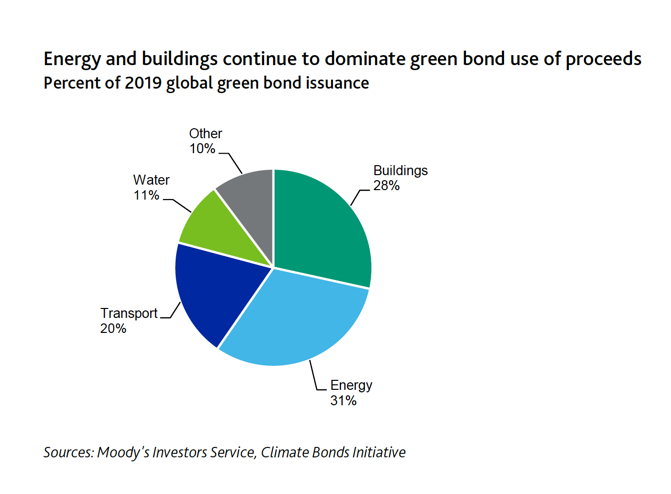

Green bond issuance will reach $300 billion this year, while social and sustainability bonds will reach $25 billion and $75 billion, respectively, spurred by the EU's newly approved set of guidelines on what counts as a sustainable investment, Moody's says.

As the social and sustainability bond markets grow and mature, the credit ratings firm expects issuance from these segments to become more diversified in terms of sector and region, similar to trends seen in the green bond market.

Moody's expects that growth inissuance from alternative sustainability-themed labels, such as transitionbonds, will accelerate given the market attention in this area. Those so-calledtransition instruments are designed to help issuers in emissions-heavyindustries, such as oil production and coal mining, finance their shift tocleaner ways of conducting business.

The difference between green and transition bonds is that the former are restricted to financing for projects that are environmentally friendly, while the other kind focus on an issuer's behaviour - how committed it is to becoming greener.

Image courtesy of Sustainalytics.

Image courtesy of Sustainalytics.Growth may be uneven over the near term, however, due to the current lack of definitional clarity, Moody's warns. There's no consensus yet on what types of commitments companies would need to make, though it's expected that borrowers would need to sign up to specific targets, as well as broader sustainability goals.