Handicapping the Silver Market

Michael Ballanger of GGM Advisory Inc. shares his thoughts on the silver market and talks about a few companies on his radar.

Michael Ballanger of GGM Advisory Inc. shares his thoughts on the silver market and talks about a few companies on his radar.

In every precious metals bull market since the 1970's there has always been a period in which silver outperforms gold. Since the lows in December 2015 June Gold futures plunged yesterday from $3,509 to $3,271, taking the GLD:US from the opening high of $317.63 to an intraday low of $300.75. The GLD May $300 puts on the books at $4.10, traded up to $6.10 before a late session rebound in gold took had them go out at $5.25. I took no action yesterday as I am looking for a double to $8.20, where I will sell half, recouping my original investment, so I can ride the remaining 50 contracts for free.

I see a correction in gold lasting until June with sideways action dominating as it works off the overbought conditions which were present on the daily, weekly, and monthly charts up until the Tuesday-Wednesday crash. I am uncertain as to whether the gold price will decline enough over this corrective period to get to an oversold condition, but overbought conditions across these three time lines have me exercising "caution" over the next month or so.

Silver

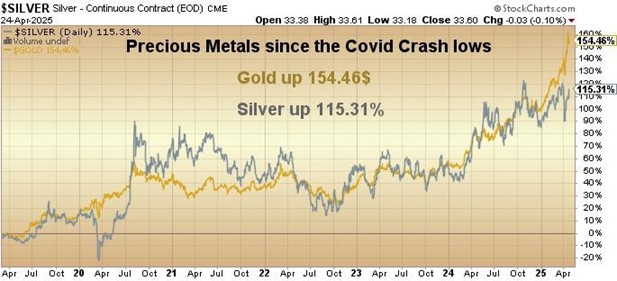

After looking through my trusty chart book over the past few days, I have been combing the archives to find a previous technical set-up for silver that could be applied to current conditions. A recent period in which gold took off to the upside while silver stayed flat was in March-June of 2020 after the Covid Crash sucked all of the liquidity out of the global markets forcing the Fed and the Treasury to embark on a highly inflationary rescue mission, injecting trillions of dollars into the global economy.

Initially, when the stimulative measures were announced, gold bolted higher without the company of silver taking the GSR (gold:silver ratio) to 125, the rationale being that shutting down the entire global economy to prevent the spread of the flu bug would hurt silver a great deal more than gold since silver demand is driven by industrial and monetary demand while gold is driven exclusively by monetary demand.

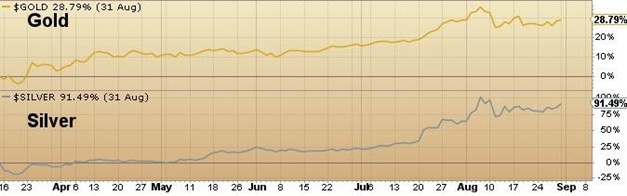

However, after I called the March 16 low in the gold and silver miners, the gold and silver started a stunning advance that would take the GSR down to 69.80 while silver outperformed gold by a margin of 91.49% to 28.79%.

What silver needed was a correction in gold before it could find its footing, and that is where I believe we are today. The current correction in gold mirrors the one in February-March of 2020 and it is important to remember that the resumption of gold's uptrend after March 16, 2020 signaled to the silver gods that is was time to assume the lead in the precious metals advance. I see the same set-up occurring today. While I do not believe that the current sell-off in gold is over, it would not surprise me if there was a tradable low sometime in late May or early June from somewhere south of $3k gold. Additionally, I do not think that the GSR is heading back to the 2020 peak around 125, and it is important to remember that the resumption of gold's uptrend after March 16, 2020, signaled to the silver gods that it, but rather trade sideways between 90 and 100 while gold completes its consolidation process.

The next item I needed to research was the performance of the silver shares in the same time frame in which silver outperformed gold back in 2020 so I pulled up the March 16 August 30 chart for Pan American Silver Corp. (PAAS:TSX; PAAS:NASDAQ) and lo and behold, PAAS advanced 163.13% during that same period.

Coeur Mining Inc. (CDE:NYSE) had a 230.47% advance in the same period while junior developer-explorers such as MAG Silver Corp. (MAG:TSX; MAG:NYSE American) and Dolly Varden Silver Corp. (DV:TSX.V; DOLLF:OTCQX) were up 211.85% and 469.71%, respectively.

In sum, the GGM Advisory is going to attempt to build a position in long-dated call options on PAAS and CDE and will be adding to Aftermath Silver Ltd. (AAG:TSX.V; AAGFF:OTCQX; FLM1:FRA). I am also looking at two junior silver companies Silver North Resources Ltd. (SNAG:TSX.V; TARSF: OTCQB) and Carlton Precious Inc (CPI:TSXV; NBRFF:OTCMKTS).

SNAG/TARSF just completed a CA$1,350,000 10-cent financing in order to advance work on their two projects in the Yukon Haldane and Kim.

The Haldane Silver Project is in the prolific Keno Hill District, host to Hecla Mining Company's Keno Hill Mine. The Haldane Project has very similar geology and vein mineralization to the Keno Hill Mine. At Silver North's Haldane Project, only a fraction of the 12 kilometers of the prospective structure that may host silver vein mineralization has been tested.

Silver North's geological team has determined that an airborne magnetics and electro-magnetics (EM) geophysical survey is a key step in unlocking the structural architecture at Haldane to aid in targeting further drilling at the Main Fault and surrounding targets. To date, Silver North has identified three additional silver-bearing vein-fault targets at the West Fault, Middlecoff, and Big Horn areas. Drilling at the West Fault returned 3.14m (TW) of 1351 g/t silver, 0.08 g/t gold, 2.43% lead, and 2.91% zinc in HLD21-24.

Silver North's second high-grade silver project, Tim, is under option to Coeur Mining Inc. ("Coeur") whereby Coeur can a earn 51% interest by spending $3.55 million on exploration and making staged cash payments to Silver North. At their election, Coeur can earn-in to a total of an 80% interest in Tim by funding a feasibility study. Analytical results from Coeur's 2024 six hole drill program at Tim, where positive characteristics of a productive CRD system were observed, are pending and will be announced as soon as they are received.

CPI/NBRFF has 100% of the Esquilache Silver Project located in southern Peru and is now advancing the permitting process to begin a drill program in the Mamacocha area in 2025 from 20 platforms. The program will be planned to bridge continuity of the known mineralization as well as extend to depth these major mineralized silver and gold-bearing veins that occur at Esquilache.

Esquilache has a historical database that includes 7,075 samples from surface and underground sampling and from two historical drilling programs, totaling approximately 5,500 meters (Vena Resources Ltd., 2009-2011 and 2014-2015) compiled by previous operators. The main Esquilache vein system consists of 12 sub-parallel, sub-vertical, primary veins (>1.0 m width) found in the Mamacocha and Creston zones, along with more than 40 secondary veins (0.3 - 0.5 m width) occurring in vein swarms in dilatant structural settings. Two mineralized breccia bodies have been recognized along structural jogs in the Elvira Vein located in the Mamacocha Zone.

Mineralization in these veins has been shown to range consistently between 3.0 and 12.0 oz/t Ag. The gold-rich Franja de Oro zone has been recognized in the Mamacocha Zone with an average of 1.94 g/t Au, 138 g/t Ag, and 1% Zn from the Ivet Vein. In 2023, Carlton's geological staff and consultants re-modelled more than 26 primary and secondary veins containing significant mineralization that were not previously recognized on surface by historical geological mapping. Website can be found here.

Chairman Marc Henderson is noted for his brilliant sale of Aquiline Resources (owner of the Navidad Silver Project) to Pan American Silver in 2010 for US$625 million. Also serving on the Board of Directors is Fitzroy Minerals Inc. Chairman Campbell Smyth.

I am inquiring as to the likelihood of a financing opportunity for Carlton and would eagerly participate if available. With a working capital position