Harte Gold: A Promising Canadian Junior Gold Producer With Large Exploration Upside

Gold price hits a record 2019 high in multiple currencies.

Harte Gold is a new junior gold 'producer' in Ontario, Canada, from their 100%-owned Sugar Zone Property.

The Sugar Zone Property has a total indicated and inferred resource of 1.67 million ounces of gold at ~6-8g/t, with large exploration upside.

Current consensus analyst price target is C$0.75, representing 212% upside.

This article first appeared on Trend Investing on June 20, 2019; therefore, all data is as of this date.

Gold price hits a record 2019 high

Just yesterday gold prices hit a record high for 2019, perhaps due to concern that the US-China trade war is about to worsen as the US is poised to soon impose an additional 25% tariff on US$300-325 million of Chinese goods.

10-year gold price chart - Currently gold is at US$1,379/ounce

Furthermore, the gold price is hitting record highs against other currencies such as the Canadian (C$1,826/ounce) and Australian dollars (A$2,003).

Source: Kitco

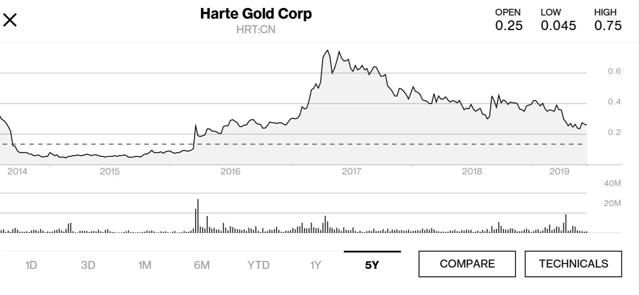

Harte Gold Corp. [TSX: HRT] [GR:H40] (OTCPK:HRTFF) - Price = C$0.24

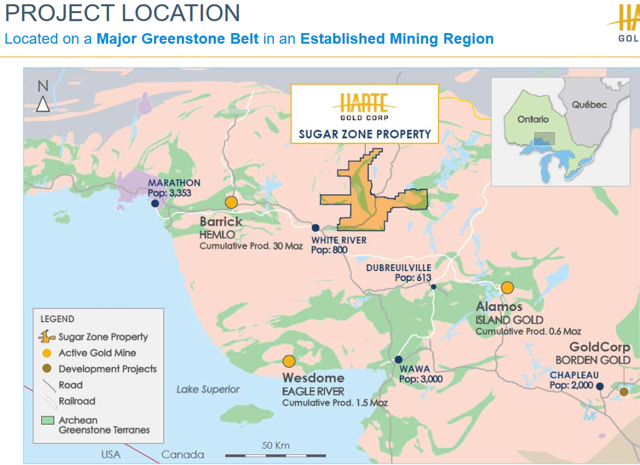

Harte Gold Corp. is a junior Canadian gold 'producer' with a primary focus on their 100% owned Sugar Zone Property 24 km north of White River, Ontario, Canada. The Sugar Zone Property includes 83,850 hectares encompassing a significant greenstone belt with a 35 kilometre strike length. The property has excellent exploration upside with 90% yet to be explored. The 10% explored has already found 1.67 million gold ounces in the Indicated and Inferred categories.

Harte Gold 5 year price graph

Harte Gold Corp.'s two projects

1) The Sugar Zone Property (flagship) - (100% owned) - Ontario Canada

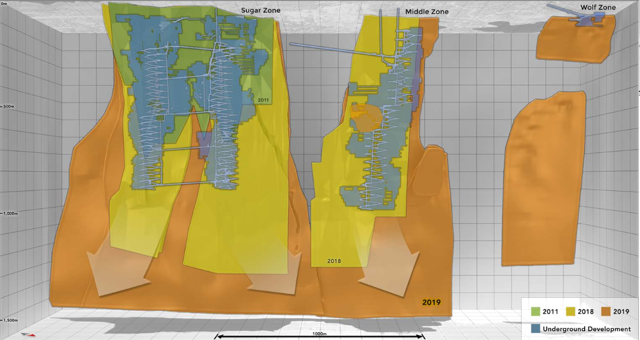

The Sugar Zone Property three deposits - Sugar Zone, Middle Zone, and Wolf Zone

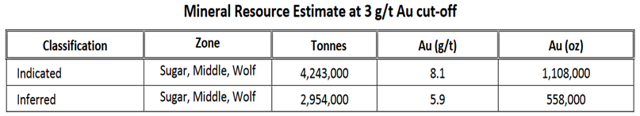

Updated Mineral Resource estimate

The Sugar Zone Property NI 43-101 compliant Mineral Resource Estimate from February 19, 2019 contains an Indicated Mineral Resource of 4,243,000 tonnes, grading 8.12 g/t for 1,108,000 ounces contained gold, and an Inferred Mineral Resource of 2,954,000 tonnes, grading 5.88 g/t for 558,000 ounces contained gold, at 3 g/t cut offs. Therefore, the total Indicated and Inferred resource is 1.666m ounces of gold grading ~6-8g/ounce.

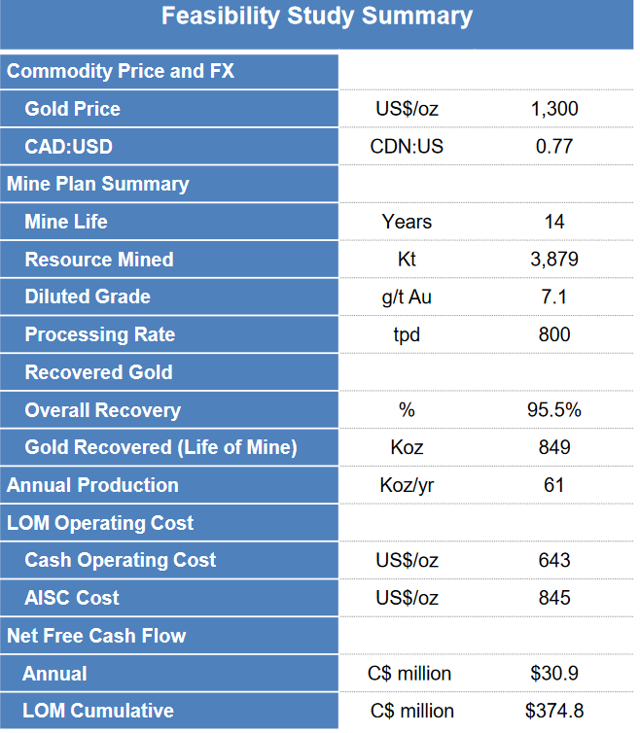

Feasibility Study results for the Sugar Zone Property

The April 2019 Feasibility Study declared a Probable Mineral Reserve of 3.9 million tonnes at 7.1 g/t Au, containing 890,000 ounces of gold. Based on a 800 TPD operation that will produce 61,000 gold ounces p.a. over a 14-year mine life, the post-tax NPV5% was C$266.9m (based on US$1,300/ounce gold). Operating costs were estimated at a cash operating cost of US$643/oz and an all-in sustaining cost ("AISC") of US$845/oz.

Note: The NPV would significantly improve if the mine life was extended beyond 20 years with further gold resources added.

Regarding capital expenditure the company stated: "Effective March 31, 2019, all capital expenditures for process plant construction and related site infrastructure have been spent. The largest sustaining capital item is future underground development costs."

The Sugar Zone Property location map

The project is now fully funded

Harte Gold recently (May 6, 2019) raised US$82.5 million. The financing package includes:

US$52.5 million 6-year Term Loan provided by BNP Paribas ("BNP"). US$20.0 million 3-year Revolving Credit Facility provided by BNP. US$10.0 million equity investment provided by Appian Natural Resources Fund ("Appian").The company stated:

The funding package removes balance sheet overhang and refinancing risk allowing the Company to focus on increasing production to 800 tpd and continued resource expansion. Low interest rate: LIBOR plus 2.875% to 3.875% based on credit ratios.

Gold production has recently begun

Gold production began in Q1 2019 producing 5,476 ounces of gold (10% below plan), due to the usual teething problems typical of new mines.

President and CEO of Harte Gold, Stephen G. Roman, stated:

With our first quarter of operations completed, we are pleased to announce improving production at the Sugar Zone Mine. The quarter started with many winter challenges affecting our mining operations. We have progressed through our startup issues and operations continue to improve.

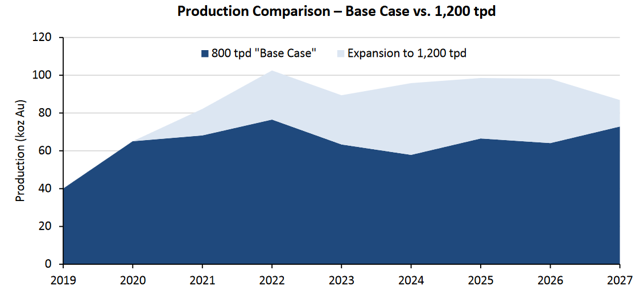

Expansion plan to move from 61,000 oz pa in 2020 to 95,000 oz pa from 2022

The Feasibility Study also confirmed the mine is capable of 1,200 TPD based on current mineral reserves, enabling production to increase to 95,000 gold ounces annually. Through the benefit of increased scale, this can potentially reduce cash costs.

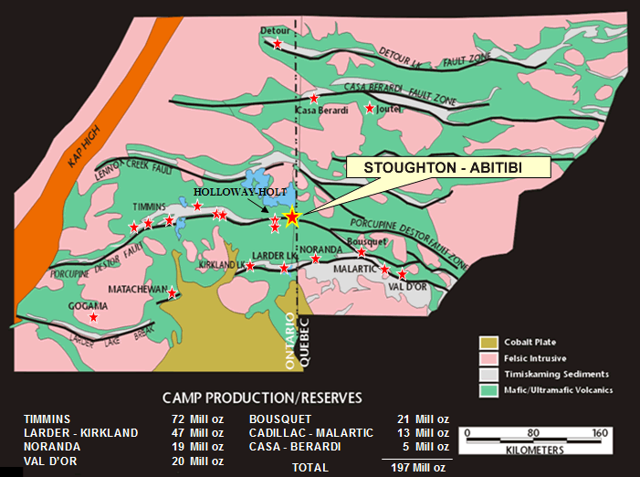

2) The Stoughton-Abitibi Property (100% owned) - Timmins Ontario Canada

The Stoughton-Abitibi Property is located on and adjacent to the Destor-Porcupine Fault, 110 km east of the Timmins, 50 km north-east of Kirkland Lake, Ontario, and 10 km due east of the Holloway-Holt gold mine and mill.

The property covers a 4 km strike length of the Destor-Porcupine Fault with an overall length of more than 11 km along the upper portions of the property, in close proximity to the 2.5 million oz. gold Holloway-Holt gold mine.

Management is currently in the process of evaluating available data associated with the Stoughton-Abitibi property in order to assess the scope of a future exploration program. Again, gold is the main target.

The Stoughton-Abitibi Property is located in a gold rich region near Timmins, Canada

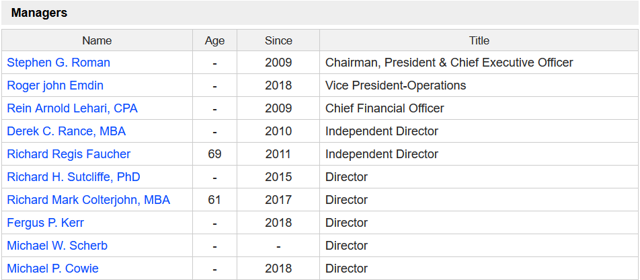

Management

Management has good mining experience. You can read about each one here.

Source: 4-traders

Largest Shareholders and insiders

As of end Q1 2019, the major shareholders are shown below. Since then, Appian has increased their stake with a US$10 million investment. Management holds 6.1% which is not bad.

Valuation

Harte Gold has a debt facility of US$72.5 million. Current market cap is C$145 million. As of end of Q1 2019, there were ~599 million shares outstanding, or 674 million if fully diluted. The forecast 2020 PE is a mere 2.9.

My price target is C$0.41 (1.7x upside) for end 2020 (assumes production of 61,000 ounces selling at USD 1,300/Oz, cost of production USD 700/Oz noting the FS used USD 643/Oz). By end 2022, my price target is C$0.90 (3.7x upside) assuming production reaches 95,000 ounces p.a., which would require further exploration success to extend the mine life, which I see as highly likely.

I have not given any value to the Stoughton-Abitibi Property at this time due to the very early stage.

Current consensus analyst price target is C$0.75, representing 212% upside.

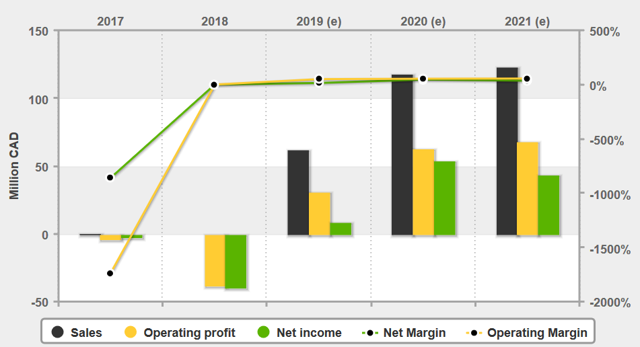

Financial summary and forecast

Source: 4-traders

Catalysts

2019 - Sugar Zone Property production ramp up news and further drilling results. 2020 - Production target of 61,000 ounces/p.a. at the Sugar Zone Property to be reached. Any exploration results at the Stoughton-Abitibi property. 2022 - Possible Sugar Zone Property mine expanded production targeted to reach 95,000 ounces/p.a.Latest News

On May 15, 2019 - Harte Gold announced:

Harte Gold hits high grade south of Sugar Zone. Drilling results were returned from the Upper Zone area of the Sugar Zone, expanding the mineralized envelope an additional 200 metres on strike to the south. Hole SZ-19-266 returned 21.07 g/t over 1.68 metres, including 115.00 g/t over 0.34 metres.

Risks

Gold prices falling. Harte Gold has very low production costs due to their good gold grades so it should survive; however, the stock price would be impacted negatively by lower gold prices. The usual mining risks - Exploration risks, funding risks, permitting risks and production risks. Harte Gold's main risk now is production ramp-up, underground mining risks, and exploration risk to expand their resource and mine life (currently a 14-year life of mine). Management and currency risks. Sovereign risk is very low as Ontario, Canada, is a favorable mining region. Stock market risks - Dilution, lack of liquidity (best to buy on local exchange), market sentiment.Investors can view the company presentation here.

Conclusion

Harte Gold has already discovered 1.67 million ounces of gold (Indicated and Inferred) at good grades of ~6 to 8 g/ounce Au at the Sugar Zone Property with 90% of the property still unexplored. So exploration upside is excellent.

Even better is that their Feasibility Study is done (post-tax NPV5% of C$266.9 million), funding is done at a cheap rate (LIBOR plus 2.875% to 3.875%), and production is underway and should build to 61,000 gold ounces p.a. by 2020, and may expand to 95,000 ounces p.a. from 2022. Costs of production are forecast to be low at a cash cost of US$643/Oz due to the good grades. Access, infrastructure, and jurisdiction (Canada) are all excellent with low risk.

It appears that Harte Gold has everything in place now to succeed. Valuation is very attractive (2020 PE of 2.9) assuming the production ramp goes smoothly.

All in all, I rate the stock a very good buy for mid- to long-term investors with considerable exploration upside.

As usual, all comments are welcome.

Trend Investing

Thanks for reading the article. If you want to sign up for Trend Investing for my best investing ideas, latest trends, exclusive CEO interviews, chat room access to me, and to other sophisticated investors. You can benefit from the work I've done, especially in the electric vehicle and EV metals sector. You can learn more by reading "The Trend Investing Difference", "Subscriber Feedback On Trend Investing", or sign up here.

Latest Trend Investing articles:

Some Newer Investment Trends To Watch Out For Quantum Materials Corp. Looks Set For A TurnaroundDisclosure: I am/we are long HARTE GOLD [TSX:HRT]. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information in this article is general in nature and should not be relied upon as personal financial advice.

Follow Matt Bohlsen and get email alerts