Has a Fuse Been Lit for Junior Minors?

Newsletter Writer Jeff Clark explains why he believes a fuse has been lit for junior minor stocks.

Alright, I'm calling it. The clock has started for when cash starts pouring into junior mining stocks.

Now, I'm not one for making predictions, and I'm not saying it's gonna happen tomorrow, but in my book, the fuse that'll drive investors into our sector has been lit.

You could point to a bunch of reasons for this. Gold price shooting up like a rocket. The Fed slashing interest rates. Recession is looming, the stock market is taking a nosedive, and the monetary policy getting loosey-goosey. In my view, all of that is coming down the pike. But the fuse? It's been lit by something else, and I've got a table to show you . . .

Check this out: In Q2 this year, the average gold price hit US$2,337.98. Last year's Q2? US$1,977.84. That's a jump of US$360.14, or 18.2%, in just 12 months. For a hunk of metal that basically just sits there, that's one heck of a gain.

It has done wonders for the bottom line of producing companies. Sure, inflation's been creeping up, but it's started to level off and was already baked into costs. So, that higher gold price? It went straight to profit.

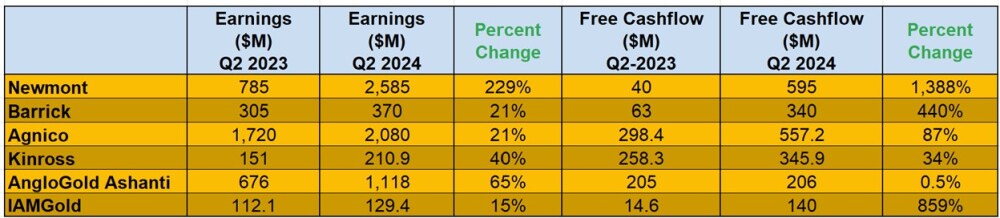

We took a look at six big gold producers and crunched the numbers on what this gold price hike did to their earnings and free cash flow (FCF).

We stacked up their earnings and FCF against last year's figures.

Every single one of these producers saw their earnings jump by double digits year-over-year. And Newmont had a triple-digit increase.

Now, let's talk free cash flow. Two of 'em saw double-digit boosts, and another two hit triple digits, and one quadruple digits! Only AngloGold Ashanti was treading water with flat FCF.

Why is this important?

First off, it gives these companies some serious financial muscle. We're talking about paying down debts, giving shareholders dividends, buying back stock, and doing other things to grow the business. And this all could lead to M&A from larger juniors.

Secondly, it's like catnip for investors. Wall Street, Main Street, even the folks in our industry who've been twiddling their thumbs on the sidelines they're all seeing green. It makes these miners look pretty tasty, especially when the broader market starts to wobble and people are scrambling for a safe bet.

Lastly, but the most important reason for this countdown is that money starts flowing into the metals first. That's happening right now, with gold busting through US$2,500 an ounce. Next stop? The senior companies. And we've just lit the fuse on that one. After that, it's gonna trickle down to the developers and, finally, our beloved juniors.

In other words, if history's any guide . . . It's only a matter of time before the cash starts flooding into junior stocks.

The fuse is lit, folks. We can't pin down exactly when it'll blow, but the window to get your ducks in a row is closing fast.

So, have you got your stocks picked out yet?

I've got my eye on a few strong ones, and I'm loading up on the dips. And I've got more coming down the pipeline.

Last year, my portfolio went through the roof thanks to some killer picks:

* 550% profit on Kraken Energy (UUSA:CSE; UUSAF:OTCQB)

* 357% on Brunswick Exploration Inc. (BRW:TSX.V)

* 151% from Denison Mines Corp. (DML:TSX; DNN:NYSE.MKT)

* 313% on NexGen Energy Ltd. (NXE:TSX; NXE:NYSE.MKT)

You can see all of this in Paydirt Prospector that's where I keep my personal stash of gold, silver, uranium, copper, and lithium mining stocks.

These are the junior stocks I'm betting on hitting the jackpot when the money starts pouring in.

It's coming, folks, and we gotta be ready. Are you?

| Want to be the first to know about interestingGold andSilver investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

Jeff Clark: I, or members of my immediate household or family, own securities of: All. I determined which companies would be included in this article based on my research and understanding of the sector.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.For additional disclosures, please click here.