Hedge funds have never been this bearish on commodities

Gold is the big exception with managed money futures investors slashing bearish bets on the gold price by 44%After a nice run at the beginning of the new trading year, on Monday on the Comex market in New York, gold futures with February delivery retreated as worries about the global economy and geopolitics overwhelmed financial and commodity markets.

In afternoon trade gold was exchanging hands for $1,095.50 an ounce, down $2.30 compared to Friday's close. Last week the metal reached a two-month high on the back of safe-haven buying, but with a fresh plunge in oil and copper prices and continuing weakness on global stock markets, bulls were in retreat everywhere.

Anticipation that the US Federal Reserve will raise rates for the first time in nine years, prompted large futures speculators or "managed money" investors such as hedge funds to dramatically raise bearish bets on the metal, dumping more than 150,000 lots or the equivalent of some 425 tonnes of gold since November.

Net short positioning - bets that gold could be bought back at a lower price in the future - hit a record during the final trading week of 2015, but into the new year bearish speculators pull back dramatically, cutting net short positions by 44%.According to the CFTC's weekly Commitment of Traders data released on Friday speculators added to long positions - bets that prices will rise - and trimmed short positions.

The gold futures market is still in a net bearish position of nearly 13,600 lots or more than 1.3 million ounces, but the change in the view taken by hedge funds on gold (and silver, with speculators net long) at the beginning of 2016 is in contrast to other commodities.

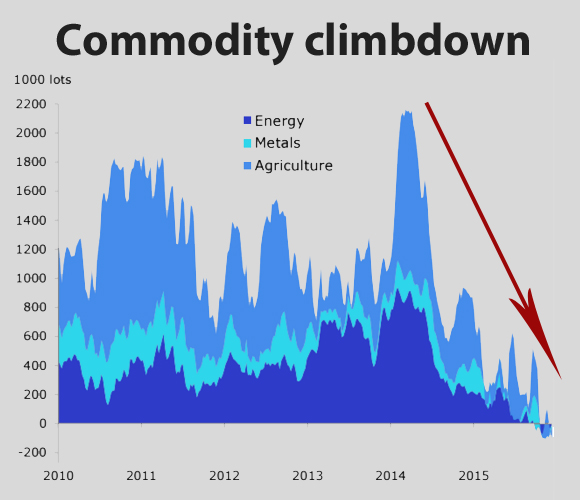

Across 24 commodity futures markets money managers have never been this bearish. Net short positions rose to 112,000 lots, the highest since government records began in 2009, with grains and crude oil once again leading the negative trend.

Commenting ahead of the trading data, Ole Hansen, chief of commodity strategy as Denmark's Saxo Bank pointed out that despite gold's great start to the year investors trading gold through exchange-traded products were net-sellers during the past couple of weeks "and only at the end of the week did we see a pick-up in demand":

Total holdings at the beginning of this year are still hovering just above a six-year low. Any change in sentiment at this stage will leave many - and particularly [hedge] funds - underinvested, but at this stage no large-scale reduction or change in sentiment has been detected. This leaves the upside limited for now with strong US data still pointing towards an accelerated pace of US rate hikes.

Source: Saxo Bank