Here is Why I'm Still Bullish on Gold Mining Stocks / Commodities / Gold and Silver Stocks 2022

The medium-term outlook for theprecious metals remains bearish, but does this mean we can’t profit onshorter-term moves? Quite the opposite!

Precious metals declined yesterday, andso did the general stock market. Is the rally already over?

When Iwrote about this rally on May 12, which took place at the same timewhen I took profits from the short positions and entered the long ones, Imentioned that I planned to hold these long positions for a week or two. Sincethat was exactly a week ago, the question is: is the top already in?

In short, it probably isn’t. As always,it’s useful to check what happened in the past in similar situations to verifywhether what we see is normal or some kind of an outlier that cannot beexplained by something that has already happened.

Let’s start with a quote from yesterday’sanalysis:

Ofcourse, there will be some back-and-forth movement on an intraday basis, but itdoesn’t change anything. Junior miners are likely to rally this weeknonetheless. And perhaps not longer than that, as the nexttriangle-vertex-based reversal is just around the corner – on Friday/Monday.

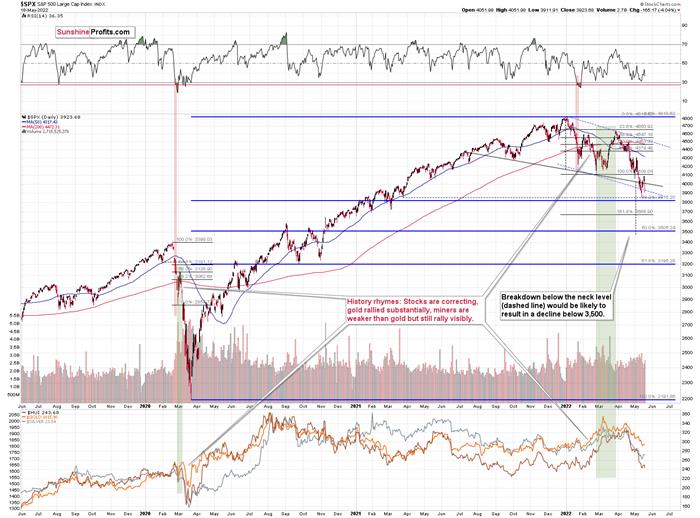

The previous few days were the “forth”and yesterday was the “back” movement – so far, my comments remain up-to-date.However, comparing the market action with what I wrote previously isn’t what Imeant by analogies to past situations. I meant this:

The areas marked with green rectanglesare the starting moments of the previous short-term rallies. Some were biggerthan others, and yet they all had one thing in common. They all included acorrective downswing after the initial post-bottom rally.

Consequently,what we saw yesterday couldn’t be more normal during a short-term rally. Thismeans that yesterday’s decline is not bearish at all and the profits from ourlong positions are likely to increase in the following days.

Besides, the general stock marketdeclined by over 4%, while the GDXJ (normally moving more than stocks) ETF – aproxy for junior mining stocks – declined by only about 2%.

If the general stock market continues todecline, junior miners could get a bearish push evenif gold prices don’t decline.

However, let’s keep in mind the fact thatminers tend to bottom before stocks do – in fact, we saw that in early 2020.This means that even if the S&P 500 moves to new yearly lows shortly andthen bounces back up, the downside for miners could be limited, and the stocks’rebound could trigger a profound immediate-term rally.

If stocks decline, then they have quitestrong support at about 3815 – at their 38.2% Fibonacci retracement level.

Let’s keep in mind that junior minershave triangle-vertex-basedreversal over the weekend, so they might form some kind of reversalon Friday or Monday.

Ideally, miners would be after a quickrally that is accompanied by huge volume on Friday. This would serve as aperfect confirmation that the top is in or at hand.

However, we can’t tell the market what itshould do – we can only respond to what it does and position ourselvesaccordingly. Consequently, if stocks take miners lower, it could be the case thatFriday or Monday will be the time when they bottom. This seems less likely tome than the previous (short-term bullish) scenario, but I’m prepared for it aswell. In this case, we’ll simply… wait. Unless we see some major bearishindications, we will wait for the rally to end, perhaps sometime next week.

Again, a nearby top appears more likelythan another bottom, in particular in light of what I wrote about the commonpost-bottom patterns in the GDXJ.

Naturally, as always, I’ll keep mysubscribers informed.

Having said that, let’s take a look atthe markets from a fundamental point of view.

The Chorus Continues

While investors still struggle withthe notion that the Fed can’t bail them out amid soaring inflation, the S&P500 and the NASDAQ Composite suffered another reality check on May 18.Moreover, with Fed officials continuing to spread their hawkish gospel, Iwarned on Apr. 6 that demand destruction does not support higher asset prices.I wrote:

Pleaseremember that the Fed needs to slowthe U.S. economy to calm inflation, and rising asset prices are mutuallyexclusive to this goal. Therefore, officials should keep hammering thefinancial markets until investors finally get the message.

Moreover,with the Fed in inflation-fighting mode and reformed doves warning that theU.S. economy “could teeter” as the drama unfolds, the reality is that there isno easy solution to the Fed’s problem. To calm inflation, it has to killdemand. And as that occurs, investors should suffer a severe crisis ofconfidence.

To that point, while the S&P 500 andthe NASDAQ Composite plunged on May 18, Fed officials didn't soften theirtones. For example, Philadelphia Fed President Patrick Harker said:

"Going forward, if there are nosignificant changes in the data in the coming weeks, I expect two additional 50 basis point rate hikes in June and July. After that, I anticipate a sequence of increases in the funds rate at ameasured pace until we are confident that inflation is moving toward theCommittee’s inflation target."

For context, "measured" ratehikes imply quarter-point increments thereafter.

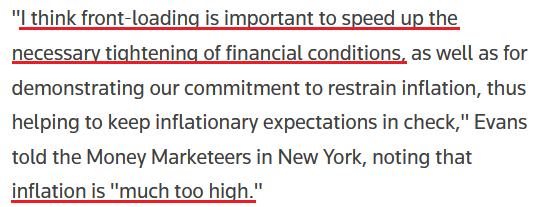

Please see below:

Source: Reuters

Likewise, Chicago Fed President CharlesEvans delivered a similar message on May 17. He said that by December, "wewill have completed any 50 [basis point rate hikes] and have put in place atleast a few 25 [basis point rate hikes]."

Moreover, "given the currentstrength in aggregate demand, strong demand for workers, and the supply-sideimprovements that I expect to be coming,” he added that “I believe a modestly restrictive stance will still be consistent witha growing economy."

Therefore, while their recent rhetorichad Fed officials “expeditiously” marching toward neutral, now the prospect ofa “restrictive stance” has entered the equation. For context, a neutral rateneither stimulates nor suffocates the U.S. economy. However, when the federalfunds rate rises above neutral (restrictive), the goal is to materially sloweconomic activity and consumer spending. As such, the medium-term liquiditydrain is profoundly bearish for the S&P 500 and the PMs.

Please see below:

Source: Reuters

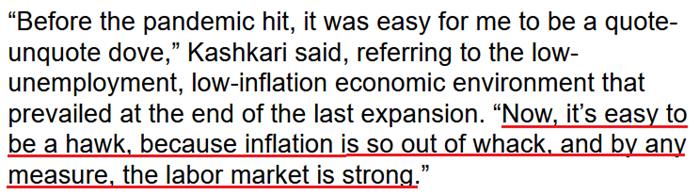

Making three of a kind, Minneapolis FedPresident Neel Kashkari (a reformed dove) said on May 17 that “My colleagues and I are going to do whatwe need to do to bring the economy back into balance…”

“What a lot of economists are scratchingtheir heads and wondering about is: if we really have to bring demand down toget inflation in check, is that going to put the economy into recession? And wedon’t know.”

For context, Fed officials initiallythought inflation was “transitory,” so don’t hold your breath waiting for that“soft landing.” However, while Kashkari is ~16 months too late to the inflationparty, he acknowledged the reality on May 17:

Source: Bloomberg

As a result, while the S&P 500 andthe NASDAQ Composite sell-off in their search for medium-term support, Fedofficials haven’t flinched in their hawkish crusade. As such, I’ve long warnedthat Americans’ living standards take precedence over market multiples.

To that point, the U.K. headline ConsumerPrice Index (CPI) hit 9% year-over-year (YoY) on May 18. For the sake ofobjectivity, the results underperformed economists’ consensus estimates (themiddle column below).

Source: Investing.com

However, while investors may take solacein the miss, they should focus on the fact that the U.K. output Producer PriceIndex (PPI) materially outperformed expectations and often leads the headlineCPI. As a result, the inflation story is much more troublesome than it seems onthe surface.

Please see below:

Source: Investing.com

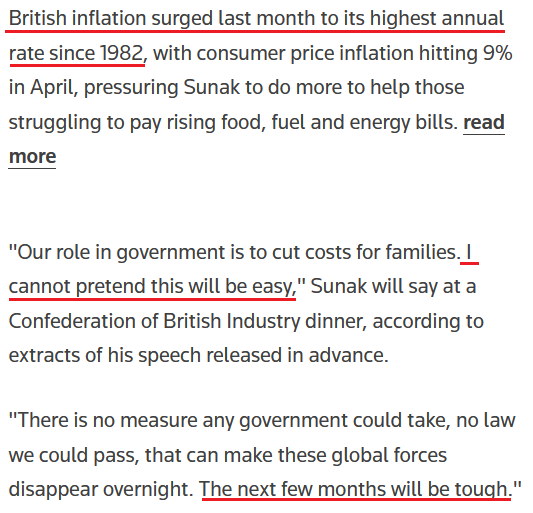

In addition, British Finance MinisterRishi Sunak warned of a cost of living crisis on May 18, saying that “as thesituation evolves our response will evolve” and “we stand ready to do more.”

Please see below:

Source: Reuters

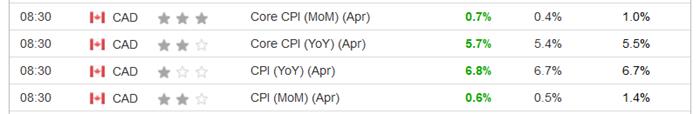

Even more revealing, I’ve noted onnumerous occasions that Canada is the best comparison to the U.S. due to itsgeographical proximity and its reliance on the U.S. to purchase Canadianexports. Therefore, with Canadian inflation outperforming across the board onMay 18, the data paints an ominous portrait of the challenges confronting NorthAmerican central banks.

Please see below:

Source: Investing.com

To that point, the official reportstated:

“Canadianspaid 9.7% more in April for food purchased from stores compared withApril 2021. This increase, which exceeded 5% for the fifth month in arow, was the largest increase since September 1981. For comparison,from 2010 to 2020, there were five months when prices for foodpurchased from stores increased at a rate of 5% or higher….

“Basics, such as fresh fruit (+10.0%),fresh vegetables (+8.2%) and meat (+10.1%), were all more expensive in Aprilcompared with a year earlier. Prices for starchy foods such as bread (+12.2%),pasta (+19.6%), rice (+7.4%) and cereal products (+13.9%) also increased.Additionally, a cup of coffee (+13.7%) cost more in April 2022 thanin April 2021.”

Moreover, “in April, shelter costs rose 7.4% year over year, the fastestpace since June 1983, following a 6.8% increase in March.” Therefore, the data is nearly synonymous withthe U.S., and I’ve been warning for months that rent inflation would prove muchstickier than investors expected.

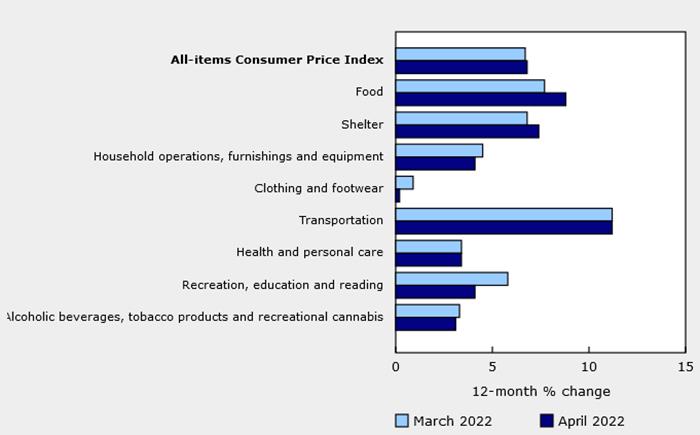

Please see below:

Source: Statistics Canada

Finally,the investors awaiting a dovish pivot from the Fed assume that growth willoverpower inflation. In a nutshell: the U.S. economy will sink into a deeprecession in the next couple of months (some believe that we are already inone), and the Fed will resume QE. Moreover, they assume that the inflationarybackdrop has left consumers destitute and that we’re a quarter away fromfamine.

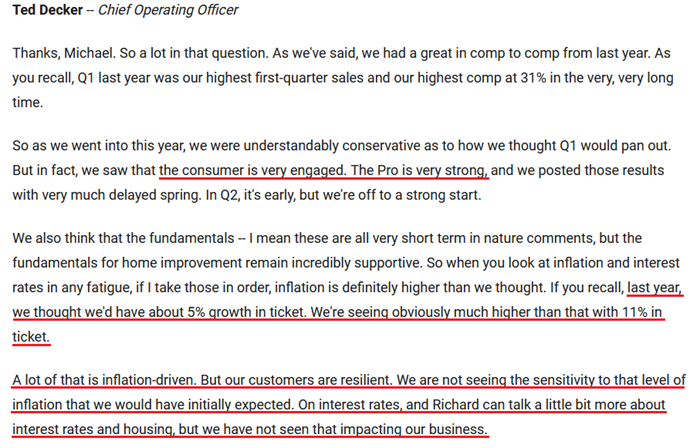

However,I couldn’t disagree more. With Home Depot – which primarily sells discretionaryitems – noting that consumers are showing no signs of slowing down, I warned onMay 18 that investors don’t realize that the Fed’s war with inflation would beone of attrition.

Pleasesee below:

Source: Home Depot/TheMotley Fool

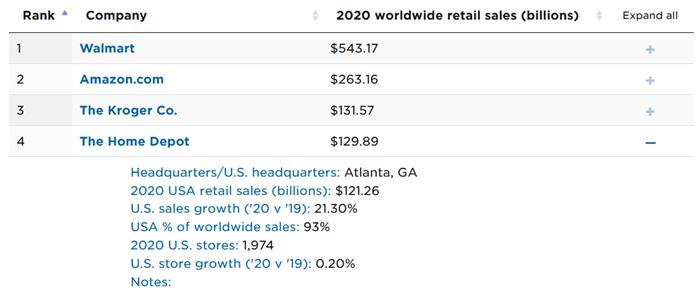

For context, the National RetailFederation (NRF) listed Home Depot as the fourth-largest retailer in the U.S.in its 2021 report. As a result, the company's performance is a reliableindicator of U.S. consumer spending.

Source: NRF

To that point, The Confidence Boardreleased its U.S. CEO Confidence survey on May 18. The report revealed:

CEO confidence “declined for the fourthconsecutive quarter in Q2 2022. The measure now stands at 42, down from 57 inQ1. The measure has fallen into negative territory and is at levels not seensince the onset of the pandemic. (A reading below 50 points reflects morenegative than positive responses.)”

Please see below:

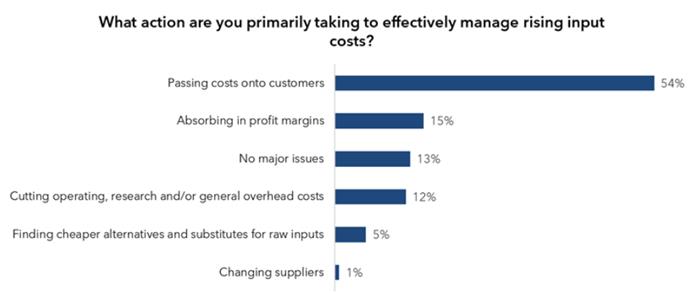

However, the devil is in the details andthe details are what matter to the Fed. For example:

“Morethan half (54%) of CEOs said they were effectively managing rising input costsby passing along costs to customers, while 13% saidthey had no major issues with inputcosts.”

Source: The ConfidenceBoard

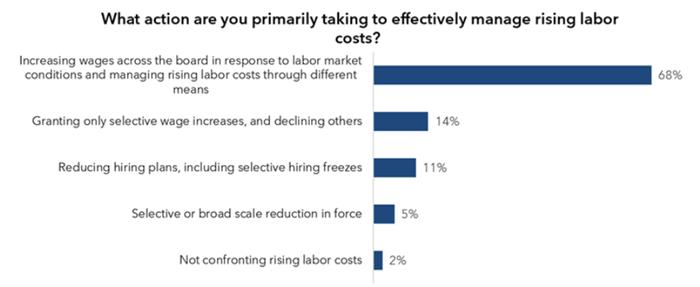

Second:

“Morethan two-thirds of CEOs said they are increasing wages across the board inresponse to labor market conditions and managing rising labor costs throughdifferent means.”

Source: The Confidence Board

More importantly, though:

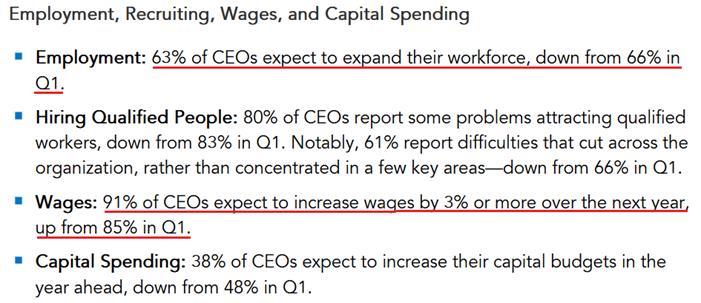

Source: The ConfidenceBoard

Therefore, while consolidated CEOconfidence has crashed to “levels not seen since the onset of the pandemic,”nearly two-thirds of CEOs plan to increase their workforce and more than nineout of 10 plan to increase wages. As a result, would major U.S. corporations be adding employees and paying them moreif demand has fallen off a cliff? Of course not. Moreover, whenconsidering the 15-point drop in consolidated CEO confidence, the three-pointdecline in employment expectations is largely immaterial.

The bottom line? While investors keepusing the post-GFC script as their roadmap for when the Fed turns dovish, theydon’t realize that 1970s/1980s-like inflation is a completely different animal.Thus, what I wrote on May 18 should prove prescient in the coming months:

WhilePowell keeps warning investors of what’s to come, a decade of dovish pivots hasa generation of investors believing that the central bank is all talk and noaction. However, with inflation at levels unseen in 40+ years, Powell is notout of ammunition, and the Fed followers should suffer profound disappointmentas the drama unfolds.

In conclusion, the PMs declined on May18, as risk-off sentiment returned to the financial markets. However, sincefits and starts are always expected along the way, the GDXJ ETF should have moreupside in the coming days, and profits from our long position should increase.The medium-term outlook for the mining stocks remains bearish, though.

Today's article is asmall sample of what our subscribers enjoy on a daily basis. They know aboutboth the market changes and our trading position changes exactly when theyhappen. Apart from the above, we've also shared with them the detailed analysisof the miners and the USD Index outlook. Check more of our free articles on our website, including this one – justdrop by and have a look. Weencourage you to sign up for our daily newsletter, too - it's free and if youdon't like it, you can unsubscribe with just 2 clicks. You'll also get 7 daysof free access to our premium daily Gold & Silver Trading Alerts to get ataste of all our care. Signup for the free newsletter today!

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.