Here is why the mining sector in sub-Saharan Africa is not ready to shine

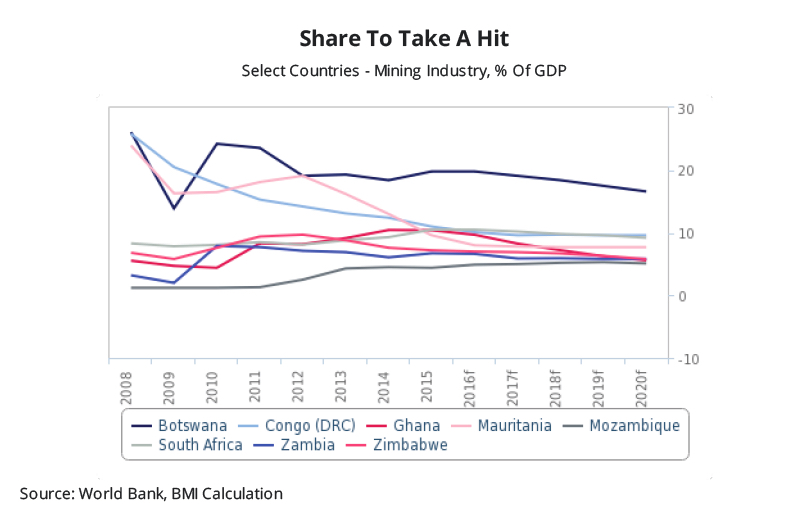

Despite optimism brought by the ongoing recovery in commodity prices and the mining potential of sub-Saharan Africa, operational challenges and regulatory uncertainty in the region will keep a lead on its resources sector until at least 2020, a new report shows.

According BMI Research's latest outlook for the region, risks such as disruption sin the supply chain, labour unrest and intermittent power supply, continue to weigh on the miners operating in countries located south of the Sahara desert.

From: BMI Research.

The region needs to invest at least $93 billion annually until 2023 to overhaul its decaying transport and energy facilities, with two-thirds of that amount required for entirely new infrastructure, according to a 2013 Deloitte LLP quoted by Bloomberg. From that total, only about $25 billion is currently being spent on capital expenditure, the report said.

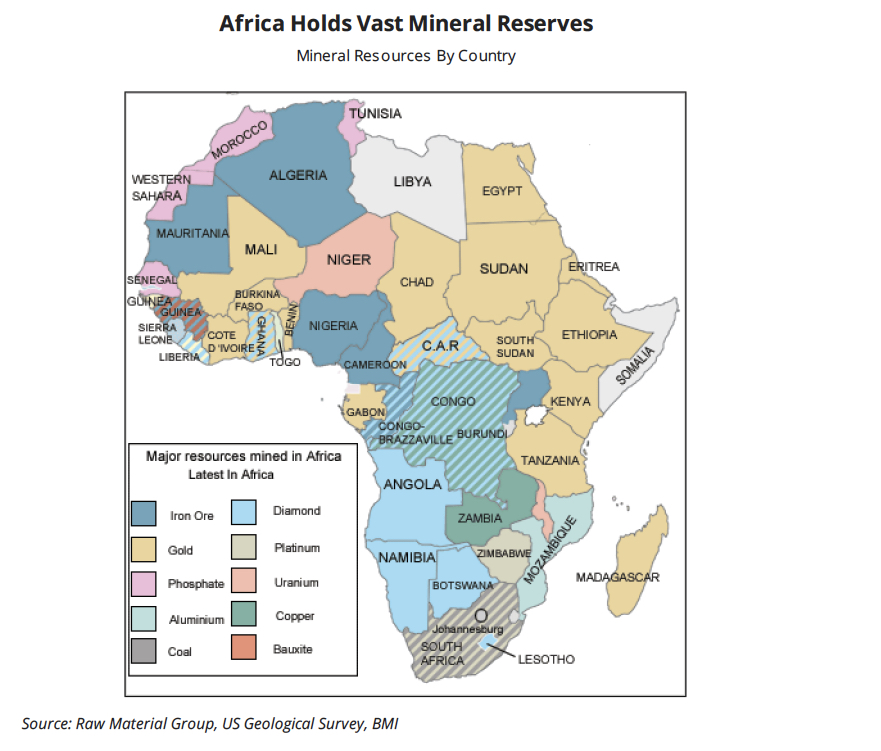

However, the experts at BMI believe most adverse conditions will ease in the short term with low production costs and vast mineral reserves offsetting the challenges that current and potential investors may find in those countries.

From: BMI Research.

"If all you focus on in Africa are risks and challenges, you will never see the opportunities," writes Kemi Arosanyin, a trade development specialist for Africa at the World Trade Center Miami. "The biggest risk is not any of the identified ones, it is ignoring the sub-Saharan Africa markets."

And BMI's reports offers some support to Arosanyin's perspective, In fact the experts highlight a expected surge in mining investments in a few countries, with the Democratic Republic of the Congo (DRC) and C??te d'Ivoire being two of the region's brightest production spots. BMI expects growth averaging 6.5% in DRC and 12.2% C??te d'Ivoire every year between 2016 and 2020 respectively.

But all the countries that comprise sub-Saharan Africa, the experts expect South Africa to continue beingthe region's leader over the coming years.