Hidden Copper Giant with Breakout Gold Exposure: Why This Dual Commodity Play Deserves Attention

John Newell of John Newell & Associates explains why he believes that McEwen Mining Inc. (MUX:TSX; MUX:NYSE) is the most overlooked dual-commodity play in the market today.

McEwen Mining Inc. (MUX:TSX; MUX:NYSE) may be one of the most overlooked dual-commodity play in the market today.

With gold at all-time highs and copper entering a structural bull market, McEwen offers a compelling combination of technical breakout potential and strategic asset value through its stake in the world-class Los Azules copper project in Argentina.

Recent technical signals confirm that upside targets are activating. Fundamental developments, including permitting success, ESG leadership, and investment from major players, point to an imminent revaluation. The market has yet to catch up.

Technical Setups: Three Targets and a Fractal Pattern Repeating

The two updated charts indicate that MUX is breaking out after a healthy correction.

The setup looks familiar, because it already happened once, in early 2024.

On a long-term basis, MUX appears to be completing a multi-year inverse head-and-shoulders pattern, with a neckline around $16.50 already surpassed. If momentum continues, price targets of $22.50, $44.10, and even a big-picture target of $47.50 are visible.

In 2024, shares rallied more than 100% after forming a rounded base. That move hit the $16.50 target before correcting to find support near the 0.618 Fibonacci retracement area.

In 2025, the chart shows a near-identical fractal pattern forming, with fresh momentum.

In the short-term chart (below), Target 1 ($13.80) has been achieved and exceeded. Target 2 is $19.50, and Target 3 is $21.75 or higher, mirroring the 114% rally from 2024.

These are not just lines on a chart.

They reflect real market behavior repeating under similar conditions, price consolidation, volume surges, and strong macro tailwinds.

Why McEwen Mining Now?

Five Key Fundamentals

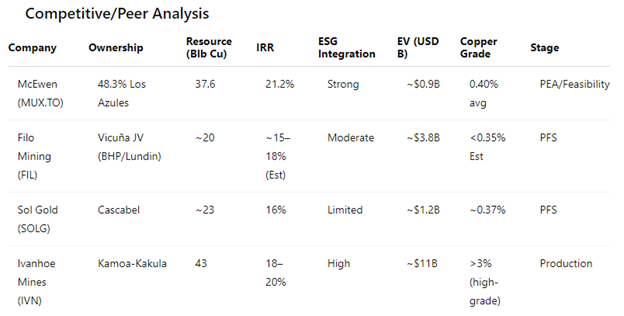

Los Azules is Bigger, Cheaper, and Cleaner Than Its PeersWith 37.6 billion pounds of copper (M&I + Inferred), the Los Azules copper project is larger than the combined Filo del Sol and Josemaria deposits, which BHP and Lundin acquired for US$4.5 billion. Yet McEwen Mining's current enterprise value is less than US$700 million.

This disconnect is stark. Los Azules is positioned to be Argentina's first large-scale copper cathode producer, low cost, ESG-aligned, and now fully permitted.

McEwen Copper has raised more than US$453 million, with significant backing from Stellantis (18.3%) and Rio Tinto's Nuton (17.2%). Their continued investment signals a strong belief in the project's future. McEwen Mining holds a 46.4% stake in McEwen Copper, giving shareholders direct leverage to this world-class asset.ESG Leadership Attracts Institutional Capital

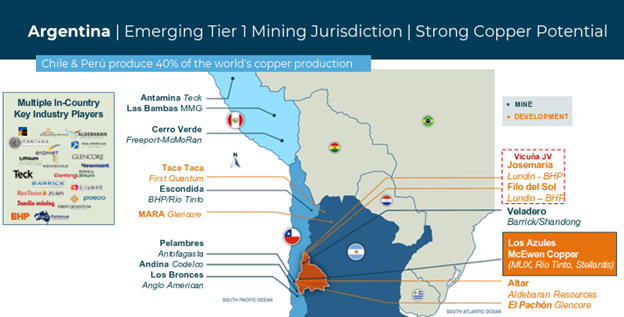

Los Azules is designed to run on 100% renewable energy and aims to be carbon-neutral by 2038. With 50% less water usage and carbon emissions than global peers, the project meets the rigorous standards sought by ESG funds, export credit agencies, and multilateral lenders. Over 97% of surveyed locals in San Juan support the project, a key de-risking factor.Argentina is Becoming a Mining Powerhouse

Under President Milei, Argentina has introduced the RIGI regime, offering 30 years of fiscal stability, lower taxes, and guaranteed currency repatriation. Los Azules has already applied and is expected to qualify. With majors like BHP, Rio Tinto, and Lundin expanding their presence in San Juan, the investment case for McEwen Copper continues to strengthen.

MUX is not just a copper story. The company is generating free cash flow from its Fox Complex in Timmins and the Gold Bar mine in Nevada. In Q1 2025, EBITDA rose to $9 million, and gold production is on track to reach 120,000-140,000 ounces gold equivalent for the year, with improving costs and extended mine lives into the 2030s. The stock offers hard-asset leverage to both commodities, a rare combination in today's market.

Valuation: Deep Discount to NAV

Based on McEwen's latest AGM presentation, management estimates a sum-of-the-parts NAV between $17.22 and $53.99 per share, compared to a current price of approximately $15.75 (TSX).

This includes:

$8.47/share for McEwen Copper (conservative case)Up to $29.04/share for McEwen Copper if benchmarked against the BHP-Lundin deal$0.65/share for NSR royalties$8.10 to $24.30/share for gold/silver operations based on peer multiplesEven under discounted assumptions, MUX trades well below its intrinsic value.

Copper: A Structural Growth Story

Copper Powers the Energy TransitionDemand for copper is rising with the growth of electric vehicles, AI data centers, and grid modernization. North America and Europe are focused on securing supply, while demand in India, ASEAN, and the GCC is accelerating.New Mines Are Urgently Needed

To meet future demand, 900,000 tonnes of new copper capacity must come online annually. Yet, permitting delays of 7-10 years and geopolitical risk (e.g., Panama) are limiting new development.Supply Security Is Driving Protectionism

Despite abundant reserves, the U.S. still imports 30-40% of its refined copper. Europe is even more constrained. Both regions are prioritizing domestic production and securing upstream supply chains.The Concentrate Market Remains Tight

Smelter capacity has expanded faster than concentrate supply, pushing treatment and refining charges (TC/RCs) into negative territory. With low utilization and tight feedstock, the market remains constrained.

"The global demand for copper is 27 million tonnes. With prices averaging $9,177 per tonne in April 2025, this translates into a $250 billion annual market."

"Demand could rise to 36.6 million tonnes by 2031 and potentially exceed 50 million tonnes by 2050."

Risks and Considerations

Copper Capex: Los Azules will require ~$2.5 billion in development capital. While strategic partners are helping fund this, further dilution or debt could pressure the share price.

Argentina Political Risk: Although reforms are promising, economic volatility and historical FX controls remain concerns.

Execution Risk: Los Azules is still pre-construction. Delays in feasibility, engineering, or financing could extend timelines.

Gold Operations: Historically underperformed. However, recent operational improvements and rising gold prices support a turnaround narrative.

Final Thoughts

McEwen Mining Inc. (MUX:TSX; MUX:NYSE) is no longer just a small-cap gold stock. With Los Azules advancing rapidly, strategic capital flowing in, and technical breakouts confirmed, it is evolving into a tier-one copper growth story.

McEwen Mining may be the right stock at the right time, offering leveraged exposure to gold and copper in a market desperate for new supply and scalable discoveries.

The last breakout delivered 100%+ gains. With a similar chart structure and improving fundamentals, the next one may already be underway.

| Want to be the first to know about interestingCopper andGold investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

John Newell: I, or members of my immediate household or family, own securities of: None. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.