Higher-Value Stones Lift Petra Sales

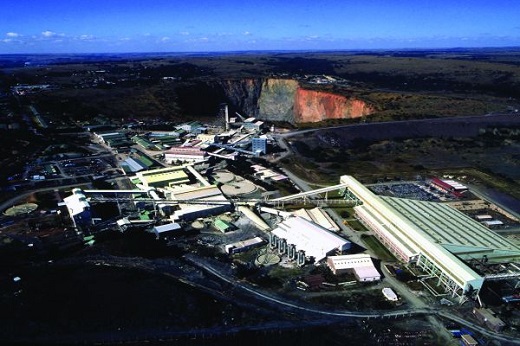

RAPAPORT... Petra Diamonds' revenue jumped in the first fiscal quarter dueto demand for higher-quality goods. Revenue surged 22% year on year to $80.2 million for thethree months ending September 30, the miner reported Monday. Sales volumeincreased 7% to 626,541 carats, with the average selling price up 15% to $128per carat, even as overall rough prices weakened. Prices for the quarter fell about 5% compared with theprevious 12 months "due to the usual seasonal weakness...partially offset by theimprovement in product mix," the miner said. The presence of sales from the Williamson mine also inflatedthis year's growth. Last year, the Tanzanian government seized a parcel of71,654 carats of rough from that mine, resulting in zero revenue from thatasset, and a company-wide sales drop of 17%. The government has still notreleased the parcel for sale. Production for the first quarter climbed 21% to 1.1 millioncarats as higher output at the Cullinan, Koffiefontein and Williamson minesoutweighed lower recovery levels at Finsch. Petra maintained its production forecast of 3.8 million to 4million carats for the fiscal year ending June 2019, compared to the 4.6 millioncarats it recovered in fiscal 2018. Image: An aerial view of the Cullinan mine. (Petra Diamonds)

RAPAPORT... Petra Diamonds' revenue jumped in the first fiscal quarter dueto demand for higher-quality goods. Revenue surged 22% year on year to $80.2 million for thethree months ending September 30, the miner reported Monday. Sales volumeincreased 7% to 626,541 carats, with the average selling price up 15% to $128per carat, even as overall rough prices weakened. Prices for the quarter fell about 5% compared with theprevious 12 months "due to the usual seasonal weakness...partially offset by theimprovement in product mix," the miner said. The presence of sales from the Williamson mine also inflatedthis year's growth. Last year, the Tanzanian government seized a parcel of71,654 carats of rough from that mine, resulting in zero revenue from thatasset, and a company-wide sales drop of 17%. The government has still notreleased the parcel for sale. Production for the first quarter climbed 21% to 1.1 millioncarats as higher output at the Cullinan, Koffiefontein and Williamson minesoutweighed lower recovery levels at Finsch. Petra maintained its production forecast of 3.8 million to 4million carats for the fiscal year ending June 2019, compared to the 4.6 millioncarats it recovered in fiscal 2018. Image: An aerial view of the Cullinan mine. (Petra Diamonds)