History Says Sell QCOM Before April

QCOM has had a few struggles on the charts this year

QCOM has had a few struggles on the charts this year

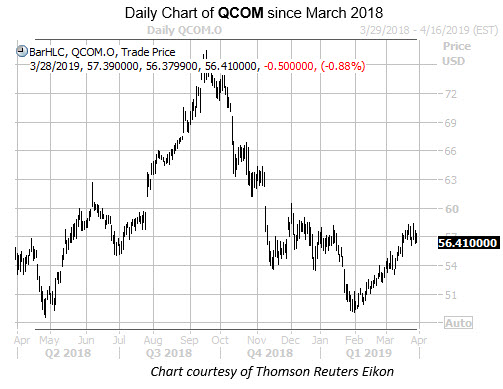

Qualcomm, Inc (NASADQ:QCOM) is slightly lower in afternoon trading, last seen down 0.9% at $56.41. The shares have struggled long-term, falling sharply since a September peak near $76. While they've been gaining in recent weeks, they're approaching potential resistance in the overhead 200-day moving average, and according to Schaeffer's Senior Quantitative Analyst Rocky White, QCOM is one of the 25 worst S&P stocks to own in April.

Digging deeper, Qualcomm stock has finished eight of the past 10 Aprils in negative territory, averaging a loss of 2.67%. This is quite a notable fall, and another move of this magnitude could push QCOM shares back below the $55 mark -- back to the level of its November through January rut.

Looking toward options shows a seemingly bullish bias, however. QCOM's Schaeffer's put/call volume ratio (SOIR) of 0.68 ranks in the low 33rd percentile of its annual range. In other words, an unusual preference toward short-term Qualcomm calls is currently seen from speculators.

Lastly, the stock's Schaeffer's Volatility Scorecard (SVS) stands at a 96 out of a possible 100. This means QCOM has tended to make outsized moves over the last year, compared to what the options market had priced in.