History Says This e-Commerce Stock is Set to Bounce

The equity is down today on competition concerns

The equity is down today on competition concerns

E-commerce name Shopify Inc (NYSE:SHOP) is trading down 1.9% at $202.32 this afternoon, lower on reports that Microsoft (MSFT) is considering creating a competitor. However, SHOP stock may be worth betting on, if history is any indicator.

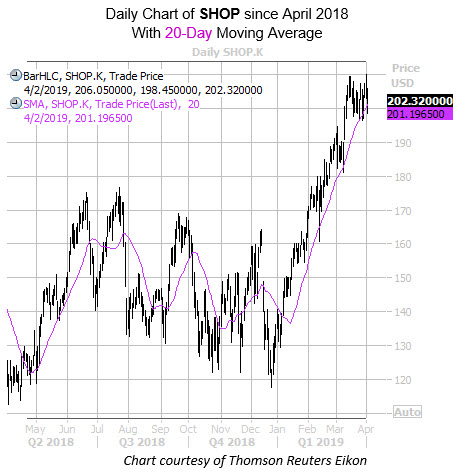

On the charts, SHOP hasadded 65% since this time last year, and just yesterday touched a fresh record high of $210.10. The 20-day moving average has beensupportive for the shares since the end of February, and the round-number $200 level -- where the equity landed after a mid-March bull gap -- could also serve as a floor.

Despite its quest for record highs, data from the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) shows Shopify stock with a 10-day put/call volume ratio of 1.13, ranking in the 71st percentile of its annual range. This suggests that puts have been purchased over calls at a faster-than-usual clip during the past two weeks of trading. An exodus of option bears could be a tailwind for SHOP.

Digging deeper, Shopify's short-term option premiums look relatively inexpensive at the moment. This is per the security's Schaeffer's Volatility Index (SVI) of 39%, which stands in the low 7th percentile of its annual range. In other words, near-term options are pricing in relatively low volatility expectations.

Since 2008, there have been six other times SHOP shares were within 2% of a 52-week high and simultaneously sported an SVI in the bottom 20% of its annual range. After those signals, the stock was higher one month later 83% of the time, averaging an impressive gain of 9.84%, according to data from Schaeffer's Senior Quantitative Analyst Rocky White. Another surge of this kind would put the shares near $222 -- another record high.