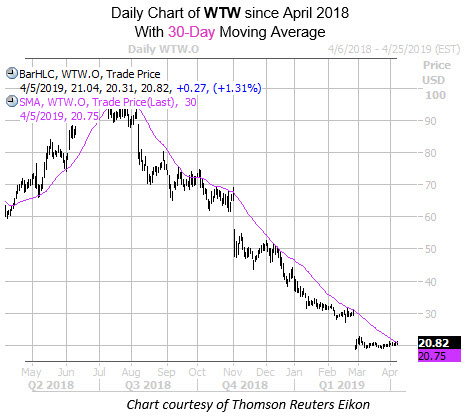

History Says WW Shares Could Fall More

The $20 mark has been a placeholder for WW shares since February

The $20 mark has been a placeholder for WW shares since February

Oprah-endorsed WW International, Inc. (NASDAQ:WTW) is moving higher in afternoon trading, last seen up 1.3% at $20.82. WW stock has been on a long-term downtrend since touching its June 20 record high of $105.73. The weight-loss program has had no fewer than three bear gaps in that time, and since late February has been stagnant. Further, this past week the security has neared a key trendline that tends to have historically bearish implications.

Digging deeper, WTW is within one standard deviation of its 30-day moving average after a lengthy stretch below it. For the stock, this trendline has proven to act as resistance over the past three years. In the four other times this signal has sounded during this time frame, the security fell 100% of the time one month out, averaging a loss of 25.68%. At WTW's current perch, a drop of the same magnitude would put the shares just near $15.48.

WW International stock has been a favorite of call options traders recently. This is per data from the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), that shows WTW with a 10-day call/put volume ratio of 6.08, in the highest annual percentile. In other words, calls have been purchased over puts at an exceptionally faster-than-usual clip.

WTW has seen a 9.5% drop in short interest during the past two reporting periods, and now accounts for a notable 15.1% of the stock's total available float. At the equity's average pace of daily trading, it would take shorts less than two days to buy back their bearish bets.