Holding DUST Turns A Portfolio Into Dust As Gold Rallies

Gold is consolidating above the breakout level.

Lower rates favor the yellow metal.

A weaker dollar is also bullish for gold.

A triple-leveraged ETN product is only appropriate for short-term trades.

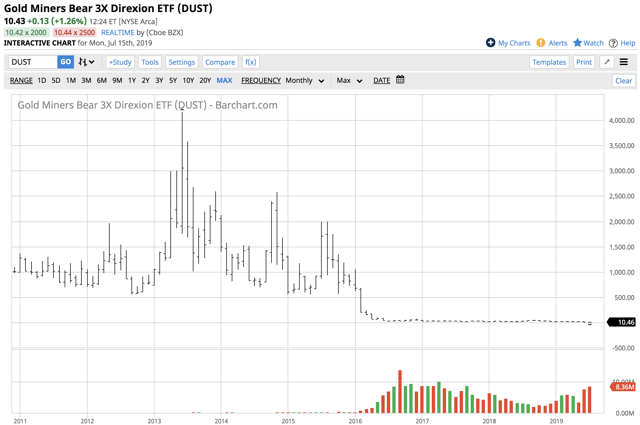

DUST is on its way to another reverse split.

When the US Federal Reserve told markets that they would be cutting the Fed Funds rate over the coming months at the June FOMC meeting, it lit a bullish fuse under the gold market. The price of the yellow metal blew through technical resistance levels at the 2018 and 2016 highs like a hot knife through butter and has been consolidating on either side of the $1400 per ounce level.

Gold moved above the critical level of technical resistance at the post-Brexit, 2016 $1377.50 immediately following the June meeting of the central bank, and it has not yet returned to that level.

Leveraged ETN products can offer explosive returned when the price of an asset moves in the right direction. However, during periods of low volatility or contrary price movement, they experience rapid evaporation of value. The Direxion Daily Gold Miners Index Bear 3X Shares product (DUST) has been faithful to its name, the value of the instrument has turned to dust over recent weeks as the price of gold broke out to the upside.

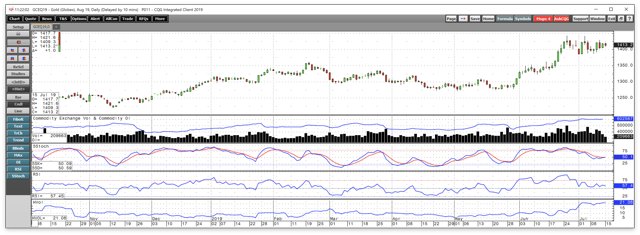

Gold is consolidating above the breakout level

After moving above its critical resistance levels in June, the gold market has entered into a consolidation phase over the recent weeks. The technical break to the upside after sitting within a $331.30 range since 2014 has led to a period where the price of the yellow metal is hovering around the $1400 per ounce level.

Source: CQG

As the daily chart of August gold futures highlights, the price has traded in a $1384.70 to $1442.90 range since it moved above the $1377.50 resistance level in June. Open interest, the total number of open long and short positions in the COMEX gold futures market, is sitting near the recent high at just above 600,000 contracts. The rise in open interest alongside the break to the upside provides a level of technical validation for the bullish price action. Short-term price momentum and relative strength indicators had risen into overbought conditions in late June, but the recent price action has moved the metrics back into more neutral positions. Daily historical volatility at 21% is high for the gold market, and an indication of the wider daily trading ranges for the yellow metal over the past weeks.

Lower rates favor the yellow metal

At the June meeting, the Fed lit the bullish fuse under the price of gold when it told the market to expect rate cuts by the end of 2019. At the same time, the program of balance sheet normalization will come to an end in September taking the upward pressure off of rates further out along the yield curve. While the latest economic data in the US has been robust with June employment figures adding 224,000 new jobs and June CPI pointing to some rising inflationary pressures, Chairman Powell did not leave any doubt that rates would head lower last week. Even though China and the US agreed on a moratorium on any new protectionist measures, short-term US rates are going to move to the downside. In testimony before both houses of the US Congress, the Fed Chairman reiterated that the central bank would lower the Fed Funds rate soon.

While some analysts have said that a Fed rate cut at this time is preemptive because of low levels of inflation and "crosscurrents" from China and Europe, I look at the monetary policy move as corrective. Without directly stating it, the Fed is telling the market that its hawkish approach to monetary policy in 2018 was overdone, and rate cuts are correcting their overenthusiastic approach when it came to tightening credit.

A weaker dollar is also bullish for gold

Lower rates are likely to weigh on the value of the dollar, which is good news for the President of the US and his administration who had been advocating for a weaker dollar since taking office.

Source: CQG

The daily chart of the US dollar index illustrates that it has been making lower highs and lower lows since May when it traded to a high at 97.715 on the September futures contract.

Source: CQG

While the weekly chart of the index continues to display a trend of higher lows and higher highs that has been in place since February 2018 when the index found a bottom at 88.15, a move below 95.17 would start to eat away at that bullish pattern. A decline under 93.395 would send the dollar into a bearish trend. If the Fed follows through with cutting interest rates at the July meeting and throughout the rest of 2019, it could send the dollar index significantly lower from its current level.

Since a weaker dollar would benefit US exports and profits for multinational corporations and would counter manipulative currency moves by China when it comes to the trade dispute, President Trump would welcome a decline in the value of the US dollar. Gold, on the other hand, would welcome the combination of falling rates and a weak dollar as together they could present a potent bullish cocktail for the price of the precious metal that continues to consolidate above the breakout level and just under the recent high.

A triple-leveraged ETN product is only appropriate for short-term trades

In the markets, there is nothing worse than being on the wrong side of a leveraged trade. Leverage is a tool that can generate fantastic profits, but the risk is the potential for devastating losses.

Over the past decade, leveraged ETN products have become extremely popular as they offer market participants with an equity account what amounts to the price action of an asset on steroids. Bullish and bearish products are available to the masses. These products have taught more than a few, including me, some harsh lessons about the cost of leverage and the price of stubbornness. Leveraged ETN products require discipline in the form of price and time stops as the latter is an enemy. Market participants must understand that leverage creates time decay, which eats away at the value of a product over time. For anyone looking at a graphic representation of the cost of time decay, any long-term chart of a triple-leveraged product can be an eye-opening experience. While significant short-term gains are possible with these instruments, anyone who holds on for too long tends to wind up with a dust collector in the portfolio. The long-term chart of the triple leveraged Direxion Daily Gold Miners Index Bear 3X Shares product displays the high price that leverage creates.

Source: CQG

In June 2013, DUST was at a split-adjusted high at $4,162.50 per share, and the GDX gold miners index was at a low at $22.21 per share. As of July 15, DUST was at $10.48, or 99.75% below the high in June 2013, while the GDX was $26.09 per share or 17.5% higher. The DUST product that offers triple short-term rewards if GDX falls in the short-term extracted more than a pound of flesh for those holding on over the years waiting for a comeback in the product.

DUST is on its way to another reverse split

At $10.48 on July 15, and with gold looking like it is only a matter of time before lower US interest rates and a weaker dollar carry the price higher, it seems like the leveraged DUST product is heading lower. A further decline in the value of DUST will lead to another in a long series of reverse price splits that destroy the value of the ETN product.

Lots of market participants use products like DUST and make money. The ETF has net assets of $282.58 million and trades over 5.8 million shares each day. DUST charges an expense ratio of 1.05%. The most significant thing to remember when buying DUST to position for a downside correction in gold mining shares, or any other leveraged market product is that a price and time stop are the two disciplines that can prevent leverage from turning into dust over time. Collector items are great on the mantle in a living room, but in a portfolio, they weigh on the value of a nest egg. Embracing leverage requires a plan that avoids dust collectors.

The Hecht Commodity Report is one of the most comprehensive commodities reports available today from the #2 ranked author in both commodities and precious metals. My weekly report covers the market movements of 20 different commodities and provides bullish, bearish and neutral calls; directional trading recommendations, and actionable ideas for traders. I just reworked the report to make it very actionable!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The author always has positions in commodities markets in futures, options, ETF/ETN products, and commodity equities. These long and short positions tend to change on an intraday basis.The author is long gold.

Follow Andrew Hecht and get email alerts