How Far Will Gold Reach Before the Upcoming Reversal? / Commodities / Gold & Silver 2019

Justwhen most traders thought that the previous week is going to end in the red forgold, something exceptional happened. The USD Index reversed after rallying,and gold rallied sharply in response. In the end, gold ended the week in thegreen by forming a clear weekly reversal.

Thatwas actually the second weekly reversal that we saw recently. Why is thisimportant? Because of what happened shortly after we saw the opposite of it notso long ago.

TheAnatomy of Gold Reversals

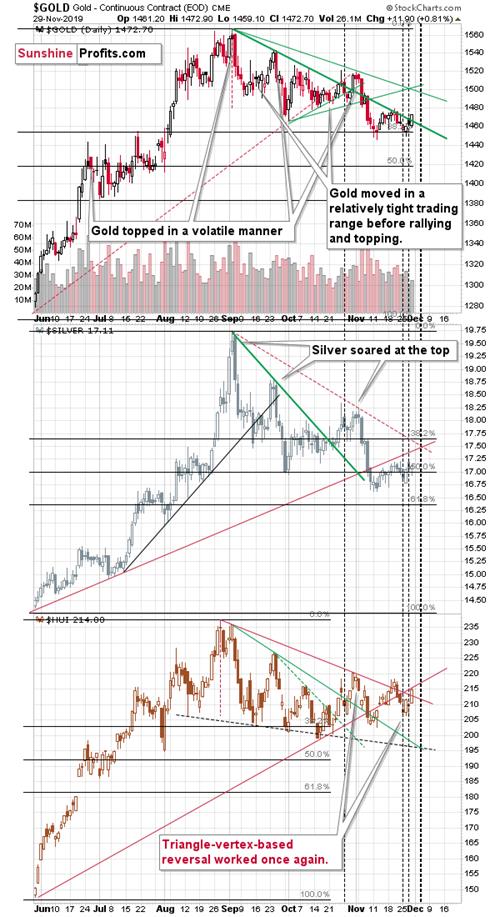

TheAugust and early-September reversals were followed by sizable short-termdeclines and the combined reversals themselves have most likely created the2019 top.

Theopposite of what created the major top, should create a major bottom now,right? Not so fast. The double reversal is indeed bullish, but there’s one moredetail to pay attention to before callinga major bottom in gold. Gold’svolume.

Thevolume that accompanied the August and September reversals was big, and thevolume that we saw recently – especially last week – was small. Sure, it wasthe long Thanksgiving weekend, which means that fewer traders were makingtransactions, which explains why the volume was low. Still, knowing what’sbelow the low volume’s surface doesn’t change the fact that low volume meansthat the candlestick formations (like the weekly reversal) should not be takenat face value. They give some hints, but they are not as reliable as if theytook place on huge volume.

Therecent situation is more similar to what we saw in early March. There was aclear weekly reversal, but it was accompanied by low volume. And what happenedshortly thereafter? Gold rallied, but not significantly so. At least not withinthe next several weeks. This tells us that the recent reversals – while bullish– are not too bullish and not beyond the next week or a few of them. Perhapsnot even beyond the next several days.

Whatwould one use to forecasta top in gold prices within this week?

TheCase for the Upcoming Gold Top

Becauseof the looming triangle-vertexbased turning point. The recent turningpoints for gold, silver and mining stocks worked perfectly bypinpointing the early November top, and they also correctly estimated the mostrecent reversals – the local bottoms after which gold, silver and miners movedhigher.

Theearly November top is clearest in case of silver (middle of the above chart),while the recent local bottoms are most clearly visible in case of gold miners(lower part of the chart).

Thenext triangle reversal is due this week, which makes it likely that we’ll seesome kind of turnaround shortly. The important details about this turnaround isthat it’s confirmed by not one but two markets – silver and miners, whichincreases the odds that the reversal will indeed take place. The early-Novembertop, for instance, was indicated by all three parts of the PMmarket at once.

Let’skeep in mind that it’s not the only factor pointing to this outcome. The True Seasonalityfor gold confirms the above.

On average,gold price has been spiking around late November and early December. Please notethat while on average gold performs best in late November, the accuracy readingactually rises strongly in the next several days. This means that while thebiggest price moves usually happened sooner, some of them arrive a bit late.When gold soared sooner, it didn’t decline immediately. The take-away here isthat even if the above is not 100% correct, and price spike doesn’t happenright away, it means that it’s still likely to arrive shortly.

Basedon the weekly candlestick reversals in gold, the looming triangle reversals,gold’s True Seasonality, and other factors, it seems that gold is going torally and top shortly.

Apartfrom outlining the take-profit targets of our long position opened rightafter the November 12 reversal, the full version of thisanalysis features a valuable sign from yesterday’s action in mining stocks, andthe analysis of gold’s upcoming very short-term moves and targets. Bottom line,these are invaluable tools in planning when and where to profitably switchmarket sides – just as our preceding success with the earlier short position.Please note that you can still subscribe to these Alerts at very promotionalterms – it takes just $9 to read the details right away, and then receivefollow-ups for the next three weeks. Profitalong with us.

Theabove article is a small sample of what our subscribers enjoy on a daily basis.Check more of our free articles on our website, including this one – justdrop by and have a look. Weencourage you to sign up for our daily newsletter, too - it's free and if youdon't like it, you can unsubscribe with just 2 clicks. You'll also get 7 daysof free access to our premium daily Gold & Silver Trading Alerts to get ataste of all our care. Signup for the free newsletter today!

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.