How Global Growth and Infrastructure are Driving Commodities / Commodities / Resources Investing

The global economy is booming again after years in the doldrums,commodities are back in a big way, and metals prices are for the most part, wayup.

The global economy is booming again after years in the doldrums,commodities are back in a big way, and metals prices are for the most part, wayup.

In our last article showing how commodities are the place to be in 2018, we lookedat five drivers: inflation, the low dollar, economic growth, the relativeundervalue of commodities versus other sectors, and tightness of supply. Thisarticle expands on the economic growth argument, and explains how commodityprices are being moved by a bevy of infrastructure projects around the world –all demanding “yuge”, as Donald Trump would say, amounts of metals.

But we'll also talkabout how insecurity of supply has created a climate of uncertainty aroundcommodities, fuelled by increasing trade tensions that could lead to tariffsand quotas, driving up the prices of some imported metals – further exacerbatingsupply-demand imbalances. The US is finally starting to get that it must reduceits reliance on foreign metal suppliers, which is great for domesticexploration and mining. But first, let's talk about global growth and what itmeans for commodities.

Threequarters of the world is growing

A year ago the global economy was stagnant following the recessionof 2007-09, an overhang from the debt crisis in Europe, and slowing Chinesegrowth which had seen double-digit GDP numbers throughout the 2000s. Accordingto the International Monetary Fund, 75% of the world is now enjoying a fullrecovery. The IMF predictsglobal growth to hit 3.7% this year, the fastest rate since2010.

The World Bank says it’s the firstyear since the financial crisis that the global economy will operate at or nearcapacity. Emerging markets will see the lion’s share of growth, 4.5%,while advanced economies including the US, Japan and the EU will grow at 2.2%.China is expected to grow between 6 and 7%. India, Ghana, Ethiopia and thePhilippines will grow more than China, and eight of the 10 fastest-growingcountries this year are likely to be in Africa, according to consulting firm PwC.

Goldman Sachs was quoted saying that “risingcommodity prices will create a virtuous circle, improving the balance sheets ofproducers and lenders, and expanding credit in emerging markets that will, inturn, reinforce global economic growth.”

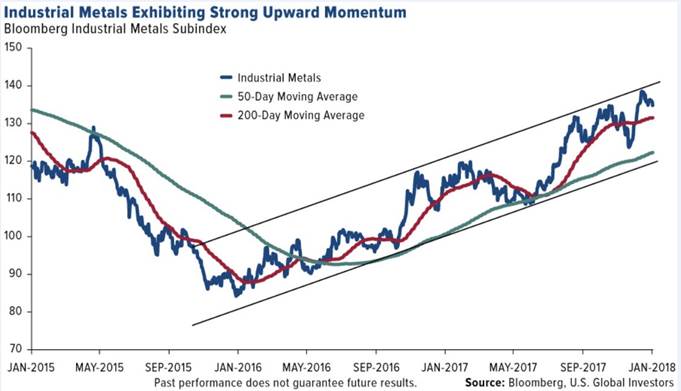

At the end of 2017 the Bloomberg Commodity Index, which measuresreturns on 22 raw materials, had the longest rally on record dating back 27years to 1991.

The index was propelled by major yearly gains in copper, which hadits best month in 30 years in December, oil, which moved above $60 a barrel forthe first time in over two years, and gold, up for the second year in a row, by12.5% in 2017. The roll continued into the New Year, with the index hitting athree-year high on Jan. 5 due to what the Financial Times described as theglobal economy’s best period of growth (measured in manufacturing activity)since the 2008 financial crisis.

At this year's World Economic Forum in Davos, Switzerland, thetone was vastly different from the past two years when everyone was talkingabout the bear market for commodities and the oil price crash.

“In panel discussions, interviews, and conversations on theevening cocktail circuit at the Steigenberger Grandhotel Belvedere, it was hardto find a bearish voice,” Bloomberg reported.

Keyinfrastructure metals all rising

Building large, capital-intensive public and privateinfrastructure projects all requires mined metals, in particular steel forbridges and buildings, aluminum, copper for wiring, and inputs used for makingsteel: coking coal, iron ore, manganese and vanadium. Nickel is also used inlarge quantities for stainless steel.

The outlook in 2018 for these commodities is for the most partbullish. A report from the World Bank states thata correction in iron ore prices – due primarily to a supply glut – will beoffset by jumps in other base metals including lead, nickel and zinc.

A week ago mining stocks outperformed overall gains in US stockmarkets following the Feb. 5 correction, with investors piling intomining heavyweights like BHP, Vale, and Anglo American. The optimism wasspurred by global demand for raw materials ahead of the annual Chinese New Yearholiday. Copper rose above $3.24 a pound, nickel was at 14,100 a tonne, thehighest since May 2015, and zinc hit a near-decade high of $3,567 a tonne. Eventhe iron ore price which many expect to pull back, rose to a five-week best of$78.25 a tonne.

Speaking recently with Robert Friedland of Ivanhoe Mines, USGlobal Investors CEO Frank Holmes laid out the bullish case for copper, noting theever-increasing demand for the red metalnot only in industry, but electrical vehicles which consume three to four timesas much copper as gas-powered cars and trucks.

Friedland pointed to aluminum, cobalt, nickel, platinum andscandium as among the biggest beneficiaries in the shift to EVs and cleanenergy. Holmes mentioned a few other key trends that are driving commoditieshigher, including the global purchasing managers index (PMI) being near aseven-year high, construction confidence in the Euro Zone, and constructionspending in the US which hit a record $1.257 trillion in November.

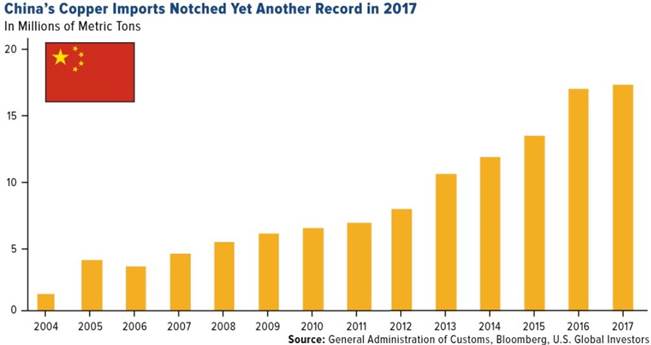

As usual a crucial factor is China, the world'slargest consumer and producer of metals. On Feb. 8 China's copper concentrate imports increased 25% from thesame period last year, continuing the trend from 2017 when copper imports hit anew high due partly due to Beijing banning of scrap metal and other recyclables.

The Chinese have also been importing record amounts of iron ore –102.8 million tonnes in September 2017. China wants higher-grade ore because itboosts steel-making productivity and reduces emissions.

China's iron ore imports rose in January even as steel mills areidled as part of a government drive against pollution and stockpiles at portsreached new peaks above 150 million tonnes. The country consumes two thirds ofthe world's iron ore shipments and produces as much steel as the rest of theworld combined.

And for all the talk of the coal industry being on its knees,prices of the fossil fuel are up and so are US coal exports. Platts reportedthat in 2017, US coal exports rose by 60% between 2016 and 2017, to 88million tonnes. Thermal coal prices in 2017 were the highest in Northern Europesince 2012 - $84.77 a tonnes, while met-coal prices used in steelmakingaveraged $173.95/tonne, up 39% from 2016.

Newcommodities super cycle?

Many investors are wondering whether we've begun a new commoditiessuper cycle.

“Purchasing Managers’ Index™ (PMI™)surveys have been developed in many countries to provide purchasingprofessionals, business decision-makers and economic analysts with an accurateand timely set of data to help better understand industry conditions.

PMI data are based on monthly surveys ofcarefully selected companies. These provide an advance indication of what isreally happening in the private sector economy by tracking variables such asoutput, new orders, stock levels, employment and prices across themanufacturing, construction, retail and service sectors.

The PMI surveys are based on fact (latest PMI’s from Markit Economics), not opinion, andare among the first indicators of economic conditions published each month. Thedata are collected using identical methods in all countries so thatinternational comparisons may be made.”Markit Economics

Here is a link to more global PMI charts from YardiniResearch.

“Supercycles are extended periods of historically high global growth, lasting ageneration or more, driven by increasing trade, high rates of investment,urbanisation and technological innovation, characterised by the emergence oflarge, new economies, first seen in high catch-up growth rates across theemerging world”~ Helmut Reisen shiftingwealthblogspot.com

As mentioned, Goldman Sachs, the influential investment bank,thinks that rising commodities prices will expand credit in emerging markets,thus creating more economic growth. Back in 2011 I wrote about how developing economies will boost the commoditiessupercycle, with the drivers in these countries being population growth,urbanization and the growth of the middle class, all of which spur consumption– of cars, fridges, smart phones, etc. These minerals have to come fromsomewhere.

In Daily Reckoning Australia, Callum Newman observes that there issome serious money right now sloshing around waiting to find ahome. Examples include Saudi Arabia's Crown Prince wanting to spend US$500billion to build a new city, and Australia's $130 billion Future Fund.Callum presages a new mining boom in Australia by pointing out that between2010 and 2025 infrastructure spending in Asia will hit US$5.3 trillion, withChina's total spend increasing 250% and for the Philippines, 300%. All of thisbodes well for Australia, a major exporter of iron ore and coal, used to makesteel needed for bridges, roads and airports, plus gold and other minerals.

Maxwell Gold, director of investment strategy andresearch at ETF Securities, agrees that we are on the cusp of a new commodities super cycle, which he points outusually last 10 to 15 years.

Gold says we are currently at the last phase of thecurrent business cycle (lasting 5 to 7 years) where commodities tend tooutperform stocks.

“The Fed and other central banks want to increase interest ratesto slow down and control economic growth to prevent the economy fromoverheating too much. That typically goes hand in hand with a period wherethere's increased demand for inputs, raw materials and resources ― primarilycommodities. It's very typical to see commodity prices increase when we’re in arate-hiking cycle and interest rates are rising.”

Infrastructureengine revving up

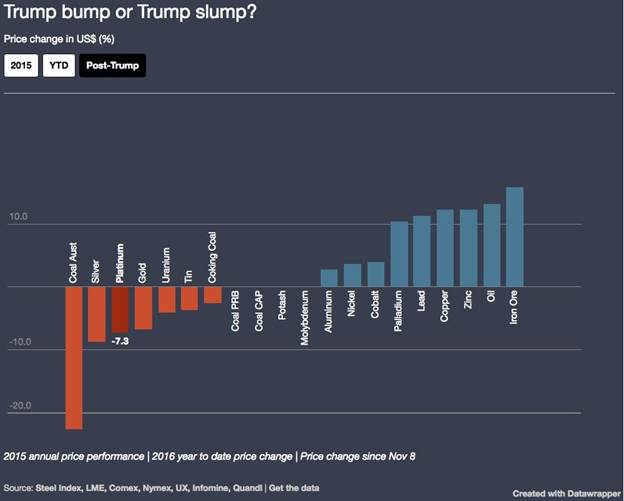

Most of us have heard of Donald Trump's $1-trillion infrastructureplan to fix American's crumbling cities, touted during his 2016 electioncampaign. A year into his mandate, that spending has been elevated to $1.7 trillion over thenext decade. When or whether it comes to fruition is still fuzzy – the planbeing presented to Congress involves $200 billion in federal funds, an amountbeing disputed by Democrats, and could involve a gas tax to pay for it – whatis interesting is what happened to commodities after Trump was elected. A monthafter the election was decided on November 8, 2016, oil and most base metalsreceived a “Trump bump”, as shown in the graphbelow by MINING.com – proving that the promise of infrastructure spending has adirect impact on commodity prices – albeit in the short-term.

The effect of the US infrastructure plan on metals prices in 2018is difficult to say, but one thing is for sure: the need is desperate. A 2017 reportfrom the American Society of Civil Engineers gave America'sinfrastructure a D+ and found that the US is facing $4.6 trillion ininfrastructure investment needs over the next 10 years. The report looked at 16categories including bridges, schools, railways and ports.

“Deteriorating infrastructure is impeding our ability to competein the thriving global economy, and improvements are necessary to ensure ourcountry is built for the future,” according to the ASCE. Consulting firm PwCestimated in a comprehensive infrastructure report that the US is looking at a total funding gap between 2016 and 2025 of $1.4 trillion, with thevast majority of funds needed for surface transportation ($1.1 trillion fundinggap).

North of the 49th, Canada also plans to roll out amajor infrastructure spend, though far less ambitious than the one planned inthe US. The federal government's $5.4 billion infrastructure package in transitand water systems for provinces and cities was recently extended fromtwo to five years. Ottawa and the YukonTerritory are partners in a promise to spend $360 million for road access tomineralized areas in the Yukon,including 650 kilometers of new roads and road upgrades.

The Quebec government has called for the province to invest about$1.3 billion in infrastructure over the next five years to attract $22 billionin private sector investment. The scaled-down “Plan Nord” aims toaccess untapped deposits of iron ore, copper, nickel, zinc and other mineralsin Quebec's far north. Next door in Ontario, the provincial government ismoving forward on an all-season road to the Ring of Fire, allowingroads in to a wealth of minerals in the remote region including chromite,nickel, copper, vanadium, zinc, platinum and gold.

Looking globally, Futurism put together a graphic of the world's largest megaprojects currently underconstruction. They are:

the International Space Station: $150 billion Al Maktoum International Airport, Dubai: $82 billion South to North Water Transfer Project, China: $78 billion California High-Speed Rail: $70 billion Dubailand: $64 billion London Crossrail Project: $23 billion Beijing Daxing International Airport: $13 billion Jubail II, Saudi Arabia: $11 billion Hong Kong-Zhuhai-Macao Bridge: $10.6 billionIn terms of commodities demand, though, the most impactful countryis, without a doubt, China.

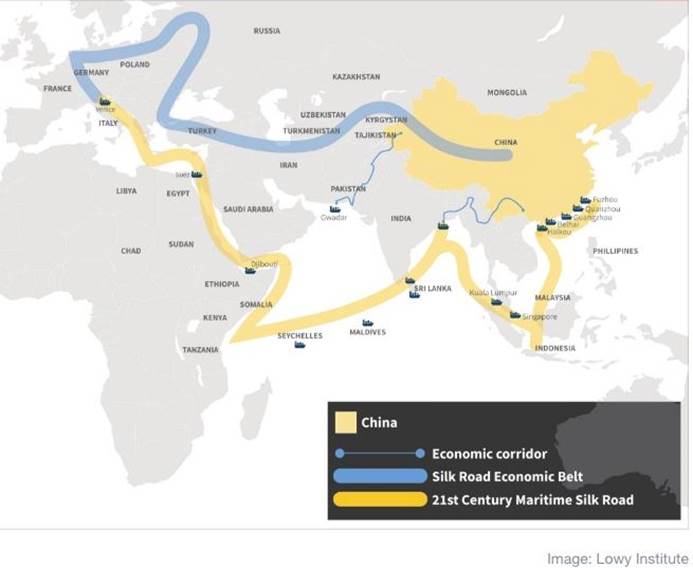

“More than2,000 years ago, China’simperial envoy Zhang Qian helped to establish the Silk Road, a network of traderoutes that linked China to Central Asia and the Arab world. The name came fromone of China’s most important exports - silk. And the road itself influencedthe development of the entire region for hundreds of years.

In 2013,China’s president, Xi Jinping, proposed establishing a modern equivalent,creating a network of railways, roads, pipelines, and utility grids that wouldlink China and Central Asia, West Asia, and parts of South Asia.” McKinsey& Company

China’s One Belt, One Road is a $900 billion initiative meantto open channels between China and its neighbors, mostly through infrastructureinvestments. China long ago put a lock on much of Africa’s vastresources.The rationale is to increase trade in order to bolster poorer countries toChina's south, and foster new markets that will keep China's economy goingstrong. According to the World Economic Forum, "Beijing says it willultimately lend as much as $8 trillion for infrastructure in 68countries," which represents a third of global GDP.

And there's more. Last AprilPresident Xi Jinping announced a grand scheme to transform a backwater calledXiongan,south of Beijing, into a city triple the size of New York. Consulting firm WoodMackenzie estimates that building the city will use 20 million tonnes of steel,400,000 tonnes of aluminum, and 250,000 tonnes of copper during the first 10years of construction.

Are two Belt and Roads better than one? Australia, the US, India and Japan are planning a jointregional infrastructure scheme as an alternative to China’smultibillion-dollar Belt and Road Initiative.

Supplyinsecurity

Completing all of these infrastructure projects will requiremillions, maybe billions of tonnes of iron ore, coal, steel, copper, vanadium,cement and asphalt. But what is often lost in the discussion about commoditiesis where these materials will come from and whether the countries requiringthem will be able to get their hands on the metals in time and in the quantitiesneeded. I've written before on the metallurgical Achilles heel of theUnited States, which has allowed the depletion of four critical metals:chromium, cobalt, manganese and platinum. Added tothis list should be vanadium, which is becomingincreasingly important as an ingredient (vanadium pentoxide) in vanadium flowbatteries used in renewable energy storage.

The U.S. is dependent on South Africa, the politically unstable Democratic Republic of Congo(DRC) and an increasingly unreliable and aggressive China for overhalf of its supply of what it considers strategic or critical minerals.

“As resource constraints tighten globally, countriesthat depend heavily on ecological services from other nations may find thattheir resource supply becomes insecure and unreliable. This has economicimplications – in particular for countries that depend upon large amounts ofecological assets to power their key industries or to support their consumptionpatterns and lifestyles.” Dr. Mathis Wackernagel, President of the Global Footprint Network

The United States has no producing manganese or vanadiummines. Stillwater Mining is the only American miner of platinum group metals,and there is just one company in Michigan that produced cobalt in 2017 as a by-productof nickel and copper.

Cobalt is an interesting metal to look at because it demonstratesthe stark and growing disparity between supply and demand, reflected in amassive recent price spike. Over the past year cobalt prices have nearlydoubled from US$47,500 a tonne to $80,000/tonne.

As a key ingredient in lithium-ion batteries that power electricvehicles (cobalt is used in both nickel-cobalt aluminum (NCA)-based batterycells used by Tesla and nickel-manganese cobalt (NMC) batteries employed byother EV manufacturers), cobalt is in high demand by battery makers.

Tesla says it wants to make half a million EVs a year, and has repeatedly stated that it plans to sourcethe cobalt for its Gigafactory exclusively from North America. But the numbersdon't add up. According to the US Geological Survey Canada and the US together produce only 4% of the world'scobalt supply – around the amount Tesla would need for just one of its models.In 2017 the US and Canada produced 4,950 tonnes of cobalt against the worldtotal of 110,000 tonnes. How about metal in the ground? North American reservesstand at 273,000 tonnes versus 3.5Mt in the Congo and 1.2Mt in Australia.

But there's another problem with cobalt supply. Around 97% of itis mined as a by-product of copper and nickel, so in order for cobalt mining tobe economic, the prices of nickel and copper need to be high enough to makemining the deposits economic. 60% of the world's cobalt reserves and resourcesare in the DRC, which uses child labour and is highly unstable. One of thelargest African copper-cobalt mines is Tenke Fungurume, in the DRC. US copperminer Freeport MacMoran used to hold 56% of the mine, with Lundin Mining andCongolese state-owner miner Gecamines owning the rest, but in 2016 China Molybdenum acquired Freeport's portion for $2.65billion – the largest ever investment in the country.

So, we now have the largest cobalt mine in the DRC majority-ownedby China, in a country that controls 60% of cobalt supply, and we havevirtually no domestic supply, with demand and prices for a scarce commodityexploding.

Let's take manganese as another example. While 10 to 20 pounds ofmanganese per ton of iron is needed to make steel, an equally importantapplication is electrolytic manganese metal. EMM was historically used in thealloying of steel, stainless steel and aluminum but a more recent applicationof electrolytic manganese dioxide (EMD) – a refined form of manganese- - is for the anodes of lithium-ion batteriesused in EVs. This technology is already used in GM's Volt and the Nissan Leaf.The United States is the largest consumer of EMM but guess who produces 97% ofthe world's EMM? China.

The good news is that the United States has finally woken up tothe fact that it needs to secure some of these strategic minerals. As part ofthe Trump Administration's plan to stoke the domestic economy, the InteriorDepartment last Friday announced it wants to boost domestic production of 35 criticalminerals including uranium, cobalt and lithium, to reduce its reliance onforeign suppliers.

"Any shortage of these resources constitutes a strategicvulnerability for the security and prosperity of the United States," saidan Interior Department spokesman.

But some companies and countries aren't waiting. Tesla andVolkswagen AG are already hunting for long-term supplies of battery metals,while on Wednesday, Apple said it is considering going directly to miners tosource cobalt – a key ingredient in mobile phones as well as EVs. As we havejust shown, that means talking to the Chinese and the Congolese.

A week ago Sweden joined the race for cobalt and lithium, saying itwill invest 10 million kronor (1.26 million) over the next two years to findbattery metals. Sweden's Volvo plans to make all of its new car models electricfrom 2019.

Metalwars

It doesn't take much of a leap of logic to see that competitionfor critical metals and those essential for building infrastructure and societyas a whole – like steel and aluminum – is heating up. Of the 35 metals the UShas identified as strategic, many are produced by countries the US and Canadawould not consider to be friendly. Take China and Russia as the two mostobvious examples.

Last week the US Commerce Department recommended imposing tariffs or quotas on foreignproducers of steel and aluminum. This was the result ofan investigation into whether the imports posed a threat to national security. Theydo.

"The Secretary of Commerce concludes that the presentquantities and circumstance of steel imports are 'weakening our internaleconomy' and threaten to impair the national security as defined in Section232," the department said. It recommends a 24% tariff on all steelimports, and 7.7% on aluminum. Or, the US could target 12 countries includingChina and Brazil which export the most cheap steel to the States. If that wereto happen, those countries could face 53% tariffs or higher.

China respondedimmediately to the Commerce Department threat, suggesting that US exports of sorghum and soybeans could face trade retaliatorytrade restrictions. The Trump Administration has already imposed new tariffs onmade-in-China solar panels and washing machines. South Korea, a major steelproducer and one of the 12, said Tuesday it will consider filing a complaint with the World TradeOrganization if the US follows through on steel tariffs.

Tariffs or import quotas are generally imposed to protect domesticindustries, by increasing the prices of the higher-taxed goods, makingAmerican-made goods more competitive. The higher costs of imported goodshowever may be passed on to consumers, who would pay more for goods made fromimported steel, for example.

Russia is another tempest that the United States seems to beconstantly battling. First it was sanctions imposed on Russia for theannexation of Ukraine and the still-mysterious shooting down of a Malaysianairliner. Now it's suspected Russian interference in the US election.

The recent indictment of 13 Russians forintervening in the 2016 presidential election has only made matters worse.Could the tensions spill out into a trade war? It hasn't happened yet –President Trump has a lot of business ties to Russia asdemonstrated by the infamous meeting at Trump Tower organized by Donald TrumpJr. with Russians who had links with the Kremlin – but according to Aljazeera, “Tensions between Russia and the US.... were on fulldisplay during the second day of a high-profile security conference inGermany featuring world leaders and top diplomats.” A hint that a trade fightmay be coming though was seen on Tuesday, when Russia joined South Korea insaying it will lodge a complaint to the WTO if the USacts on its threat to impose stiff sanctions on Russian steel and aluminum.

Conclusion

For the first time in a decade we are looking at across the boardglobal growth in both developed and developing economies, setting up tremendousdemand for commodities – both mined and grown – due to the effects ofurbanization, growing middles classes and population growth. Add to this theambitious plans for infrastructure spending in the US, Canada, China andelsewhere, and the bullish case for mined metals becomes even stronger.

But even as demand for metals, particularly battery metals used inthe new electrified economy, continues to skyrocket as witnessed by theshocking increases in the one-year prices of lithium and cobalt, competition isbecoming intense. Countries and companies are starting to realize that withouta domestic supply, they are wholly dependent on foreign suppliers who set theprices and could easily hold these metals for ransom to extract political oreconomic capital from the buyers. For example, if Gabon, from which the USimports three-quarters of its manganese, suddenly decided to ban Mn exports,the effect on the US steel industry would be crippling.

All of this points to the need to develop local, North Americanproducers of strategic metals that can act as a counter-point to the tradedisadvantage the US and Canada currently find themselves in. The TrumpAdministration's plan to increase domestic production is laudable and a longtime coming. Let's see whether the talk turns into action. I've got commoditiesand infrastructure spending on my radar screen, and I am on the hunt forinvestment opportunities that can make North America less dependent on foreignsources of strategic metals.

Are the future suppliers - our junior resource companies whoseplace in the resource food chain is to explore for, find, and develop to acertain point the world’s future mines – of metals and minerals that enableyour modern lifestyle on your radar screen? I can guarantee they are on mine.

If not, maybe it should be.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com

Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector.

His articles have been published on over 400 websites, including: Wall Street Journal, Market Oracle,USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2018 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2018 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.