How Gold Can Save the US Dollar / Commodities / Gold & Silver 2024

Canwe save the dollar before central banking kills it?

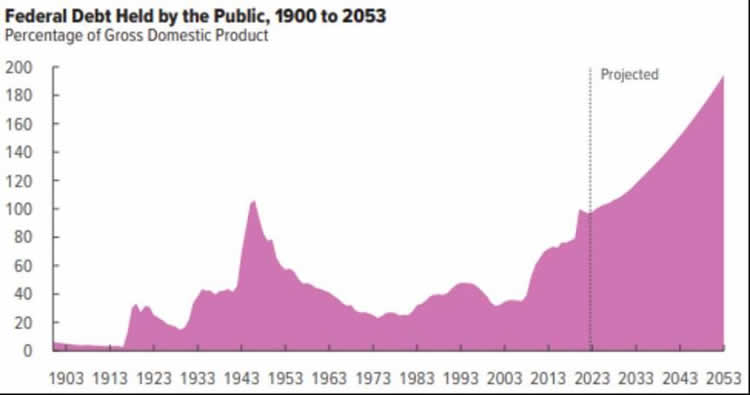

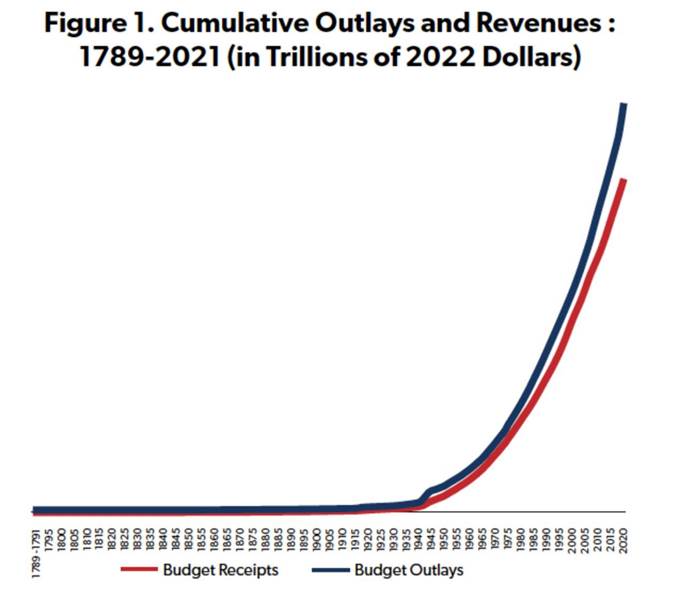

Ourdeficits are now stuck at 8% of GDP — unprecedented in peacetime. And ournational debt just hit $35 trillion — unprecedented in the history of man.

Eventhe central bankers realize that this isn't sustainable. That we are coming tothe day our paper money utopia crumbles.

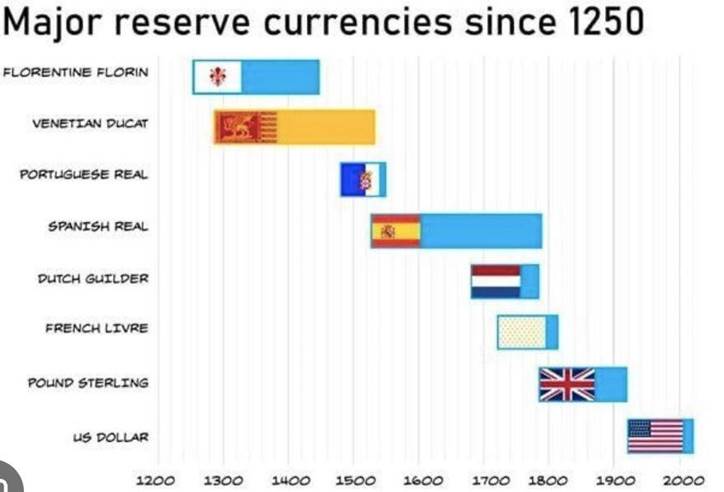

Historically,from Song Dynasty China to Weimar Germany, when paper dies we return to hardmoney. Because backing the dollar with hard money like gold -- and eventuallyBitcoin -- is the only way to finally kill the money printer.

Happily,we can actually do this without the crash.

When Paper Money Dies

Theother day Charles Payne sent me a quote by 1970s Fed Chair Paul Volcker whowrote, paraphrasing:

“Itis a sobering fact that central banking has led to more inflation, not less. Wedid better with the 19th-century gold standard, with passive central banks,with currency boards, or even with ‘free banking’. The power of a central bank,after all, is the power to create money and, ultimately, the power to create isthe power to destroy.”

Thisis a fairly striking admission of failure from -- by all accounts -- the bestFed Chair we've had since Wall Street forced the Fed on us in 1913.

Acentral bank is indeed an extraordinary thing: it’s a privately-owned,federally-licensed counterfeiter the regime can use to seize literallyeverything in the world by printing money.

It’swhy we have inflation and recessions.

It’swhy we have Wall Street bailouts and a colossal national debt.

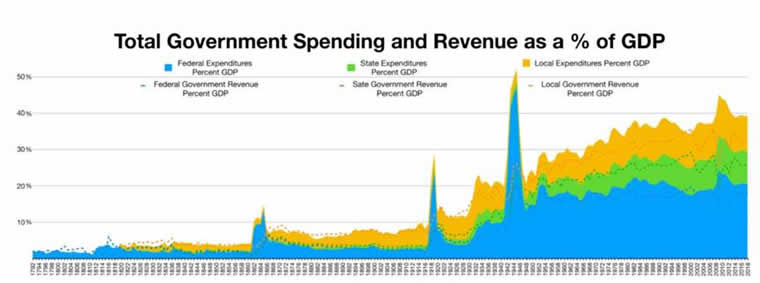

It'swhy the government has grown to dominate our economy and our lives.

Incontrast, under the gold standard, we had zero cumulative inflation over 124years.

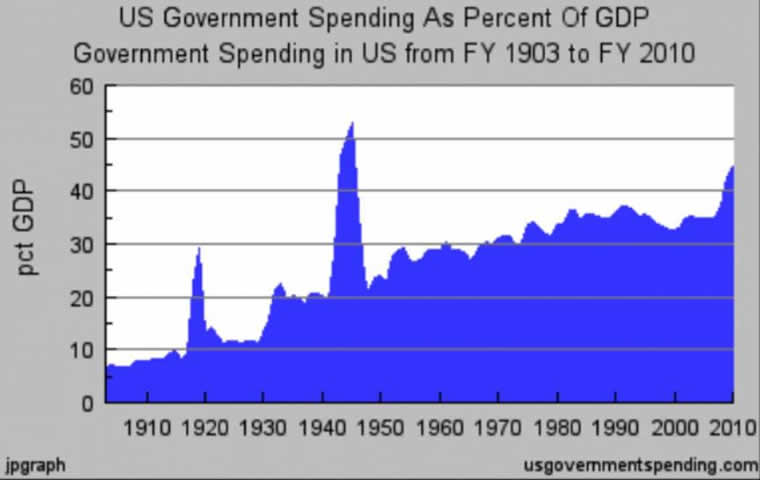

Wehad a federal government that was 7 times smaller as a percent of GDP.

In1913 we had a national debt of 8% of GDP. Today, it’s 140% -- in fact, it's rising by almost 8% peryear.

How We Get Back to Gold

Sohow do we get back?

Simple:back the dollar with gold at today's price -- twenty-five hundred per ounce --then mandate that if gold flows out the Treasury has to buy it back in beforeit does anything else -- before it pays Ukraine before it pays interest on thenational debt.

Presto.

Why?Because if they keep printing money it creates inflation and gold goes to, say, twenty-six hundred an ounce.

At2600 people can make free money handing 2500 to the Fed for an ounce of goldand turning around and selling that ounce for 2600.

Goldflows out. And now the Treasury has to buy it in at 2600.

Inother words, they lose money on the money printer: they give it away for 25 andbuy it at 26.

Inflation in a Gold Standard

Thatmeans that, under a gold standard, the Fed and Treasury are forced to keepmoney creation low enough for zero percent inflation -- for stable gold.

Inpractice, that would mean they can’t print more than gold demand — roughly thesame as GDP. Which is about a trillion less per year compared to today.

Onthe ground, this means interest rates above inflation -- no more paying hedgefunds to borrow.

Itmeans no more quantitative easing to buy up rich people's assets leavinginflation for the poors.

Itmeans no more Wall Street bailouts.

And,above all, it chokes off the spending cancer of the welfare-warfare industrialcomplex.

Itcould even include ending or reducing fractional-reserve banking -- where bankslend out money they don't have -- by tightening long-standing reserverequirements so banks don't inflate and they don't crash in the first place.

Neitherthe gold standard nor full reserve banking are remotely on the bingo card forthe foreseeable future. And, historically, it takes a crisis to put them there.

Butit's important to remember how easy it is to solve ourfinancial catastrophe if and when weget a politician brave enough to try.

Originally Published on Substack.

Peter St. Onge writes articles about Economics and Freedom.He's an economist at the Heritage Foundation, a Fellow at the Mises Institute,and a former professor at Taiwan’s Feng Chia University. His website is www.ProfStOnge.com.

© 2024 Copyright Peter St. Onge - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.