How Has Russia's Ukraine Invasion Impacted the Commodity Markets? / Commodities / Agricultural Commodities

Russia’songoing invasion of Ukraine continues to take an incredible human toll, withthe very latest updates from the Office of the United Nations revealing thatsome 4,509 civilians had been killed in the conflict to date.

However,this geopolitical conflict has also caused significant financial and marketdisruption, from compounding the rise in global energy prices to significantlydisturbing the world’s agricultural space.

But howexactly has this industry been impacted to date, and what does the conflict meanfor the global commodity markets as a whole?

The Price of Goods Continues to Rise

According torecent datasets collated by Eurostat, the average price of agricultural goodsand services increased by 9.5% year-on-year in Q1 2022.

This wasdriven primarily by a 21.4% hike in the price of fertilisers and soil improvers,while the cost of animal feed also increased by 9.2% during the same period.Currently, Russia and Belarus are key fertiliser exporters to the globalmarket, while Ukraine supplies a significant portion of the world’s corn andsunflower oil.

Of course,agriculture has also been adversely impacted by rising energy costs. Because ofthis, the energy costs absorbed by farms increased by 17.4% during Q1,highlighting the significant fiscal challenges facing agriculture in 2022.

While theaverage price of agricultural output also increased during thereporting period, a rise of approximately 6% wasn’t necessarily enough tocompensate for the wider cost hikes and general economic downturn.

How has the Wider Commodity MarketBeen Affected?

Of course,the rising cost of agricultural goods and services has benefited suppliers inthe industry, with the Wynnstay Group reporting record interim results through 2021 that far exceeded managementforecasts.

But what about the restof the commodities market? Well, the war in Ukraine has impacted prices in twosignificant ways, the first of which involved the erection of physicalblockades and the destruction of productive capacity in the war-torn Europeannation.

Productionhas also been impacted by the ongoing financial sanctions imposed on Russia,which is considered to be the world’s largest exporter of pig iron, wheat,nickel and natural gas.

It also accounts for aconsiderable share of global crude oil, coal and refined aluminium exports,creating a scenario where production of these commodities has continued to fallthrough 2022.

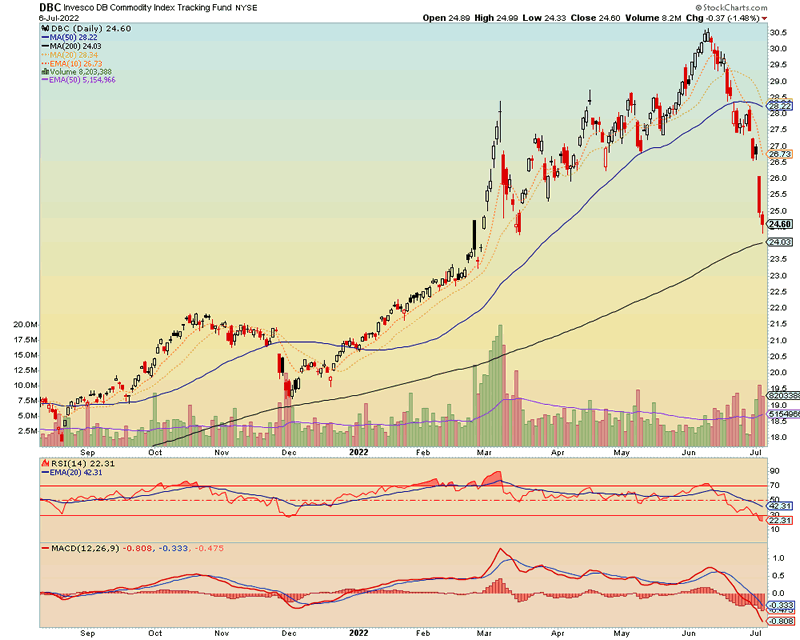

Morespecifically, we’ve seen the balance between supply and demand for thesecommodities dramatically disrupted during the last couple of quarters, withdemand continuing to outstrip supply on a global scale. This is the primarycause of rampant price hikes, although there are signs that this trend isfinally beginning to reverse.

While globalwheat prices traded at a record high of $12.94 a bushel on March 7th, forexample, it has since declined by 27% to just $9.39 as of June 28th.

This mayhave something to do with discussions between Russia and Turkey, who areconsidering the development of a safe passage in the Black Sea through which toship Ukrainian grain. Of course, there’s no guarantee that such a route can befound, particularly given the destruction of ports and need to de-mine seaways.

However, ithas been enough to improve market sentiment in the short-term, while increasingliquidity and making it easier to buy and sell affected commodities inreal-time.

Regardless, this willremain an interesting space to watch in the future, with the increasedvolatility and uncertainty in the commodities market creating a significantchallenge for all parties involved.

By Travis Bard

© 2022 Copyright Travis Bard - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.