How High Can Gold Go in 2020?

Sam Laakso, VOIMA GOLD

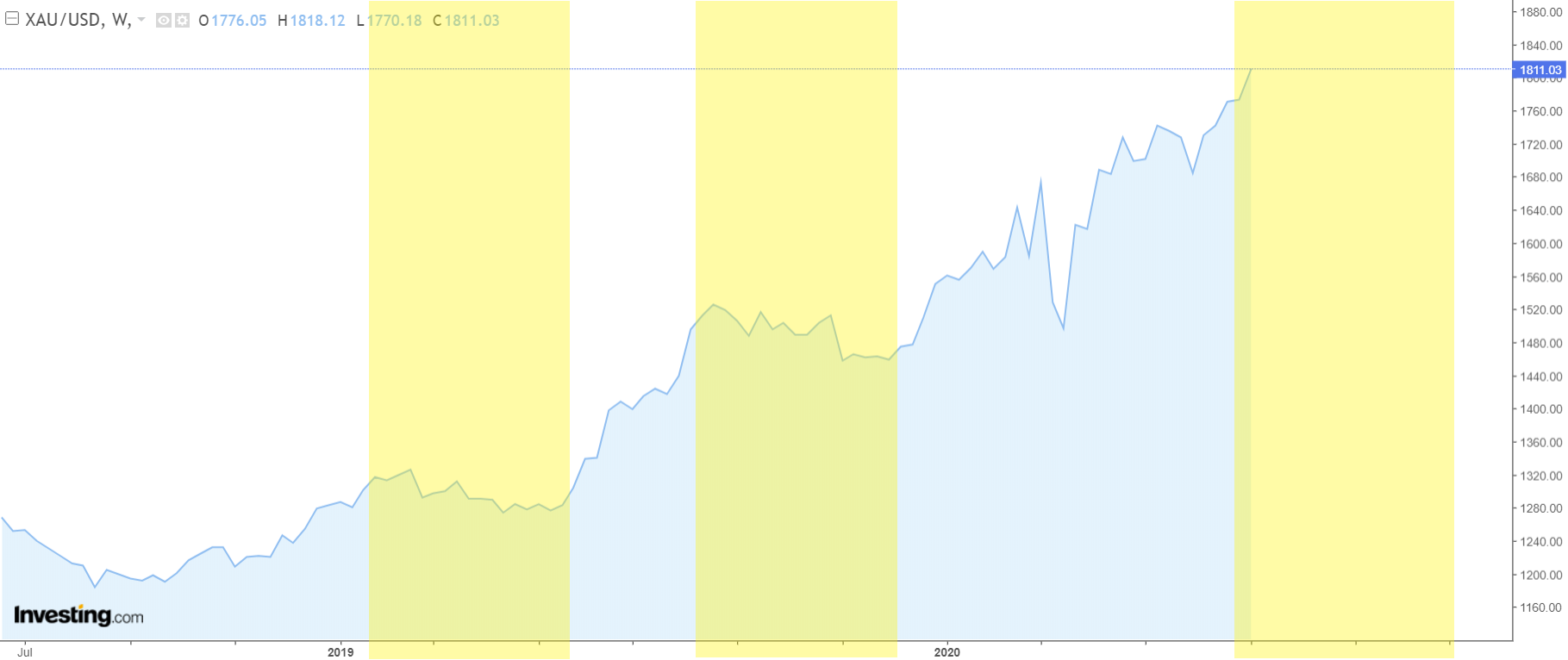

Gold has had a great run over the past year. Gold prices have risen in every single currency on earth and in many currencies gold prices are up well over 30 percent from last summer.

In early January, I published an article (in Finnish) in a local financial newspaper where I articulated why gold would rise to $1800 per ounce during the first half of the year - a rise of 20 percent in just six months. As it turns out, gold did just that on the last day of June meaning that in the end my estimation was correct.

So, what is my forecast for gold for the rest of 2020? How high can gold go this year?

My estimation

I see that there is an extremely optimistic atmosphere around gold at the moment. Investment banks are upping their target prices for gold left and right and my favorite sentiment metric, Twitter, has exploded after gold breached $1800.

I am known as a cycles analyst. In the past I have written rather extensively about how cycles work in the financial markets. You can read more about this topic at SKAL Capital and in my Thesis.

The cycles theory revolves around the thought that, as nature in itself, human nature is cyclical cycling between optimism to pessimism. This transmits to the way people buy and sell financial assets and thus the prices of stocks, bonds, commodities, and gold also rise and fall in identifiable cycles.

Right now, the markets are telling me that the gold market is excessively optimistic due to the rise in gold prices over the past three months and that the cycle in gold is mature and thus ready to start the declining phase of the cycle. Once optimism reaches an extreme, prices tend to start the declining phase of the cycle.

So how exactly I think that the second half of the year is going to play out for gold?

I think that we are close to a short-term top in the price of gold. We have not seen a long and exhausting multi-week decline in the price of gold, which would wash out the highest optimism in gold, for six months.

We did see a short lived and sizable correction in March during the global coronavirus selloff, but since the sharp decline (buying opportunity) was erased just as quickly as it came, I argue that the mental damage to gold market sentiment was not big enough.

As I am writing this article the price of gold is at an eight-year high, or $1816 per ounce to be exact, when measured in US dollars. However, optimism in the gold market is just as high. Calls for $1900 and $2000 gold are everywhere I look at.

The big picture fundamentals for gold are crystal clear and in favor for higher gold prices in the years to come. Central banks around the world are printing money faster than governments are able to spend it at zero percent interest rates = insanity. This type of reckless spending is definitely good for gold prices in the long run.

However, over the next two to three months I would not be surprised to see a multi week decline which would serve as a great buying opportunity in the big picture.

I think that once we get a short-term top on gold, over the next few weeks, we will see a move down to $1770 and possibly all the way down to $1600 in a painstakingly long but necessary correction.

A multi week correction will wash out the excessive optimism surrounding gold. At the bottom of the correction, you will not be hearing calls for $2000 gold like you see now.

After we are done with the correction, I think that gold has a fair shot of reaching $1900 during the second half of this year. This would be the third consecutive year when gold has risen nearly 20% relative to the US dollar.

Another way of looking at it is that the US dollar has lost almost half of its purchasing power relative to gold in just three years.

How to act?

If you do not own any gold - buy it now with the big picture in mind.

Even though I have been accurate with my latest predictions for gold in 2019 and 2020 my predictions are merely estimates and so I do not advise waiting for my prediction of a better buying opportunity to fulfill especially if you do not own any gold already.

I think that the pullback will act as a great buying opportunity for those who already have gold but are looking to add to their holdings - I certainly am.

My advice for everyone thinking about buying gold has been simple for many years:

1) Decide how much of your money you are willing convert into gold

2) Buy gold with 50% of the amount immediately

3) Wait for a few months

a. If gold prices decline - Great! You have chance to buy lower

b. If gold prices rise - you have already bought the first half at lower prices and so you can buy more with peace in mind

Either way you are well off once you own at least some physical gold.

In early 2019, I published my thesis titled "The Future of Gold from 2019 to 2039" in which I explained in detail why I think that gold prices will reach at least $5000 over the next five to ten years. If you are interested in my view of the big picture for gold you can find my Thesis here.

My long-term view still holds today - I think that gold prices are likely to rise every year for the next five to ten years.

We at Voima are in the business of providing gold-backed accounts which we call Voima Accounts. If you are interested in owning gold in one of the safest countries on Earth, open an account and join our thousands of happy customers worldwide.

Sam Laakso, VOIMA GOLD

Stay up to date, subscribe to Voima Insight click here

The views expressed on Voima Insight are those of the author(s) and do not necessarily reflect the official views or position of Voima Gold.

You are allowed to copy our content, in whole or in part, provided that you give Voima Gold proper credit and include the appropriateURL. The name Voima Insight and a link to the original post must be included in your introduction. All other rights are reserved. Voima Gold reserves the right to withdraw the permission to copy content for any or all websites at any time.

Nothing written in Voima's blog or website constitutes investment, legal, tax, or other advice. It should not be used as the basis for any investment decision(s) which a reader thereof may be considering. The purpose of Voima's blog is to provide objective, educational and interesting commentary and is not intended to constitute an offer, solicitation or invitation for investing in or trading gold.