How Not To Launch A Gold Standard - Precious Metals Supply And Demand

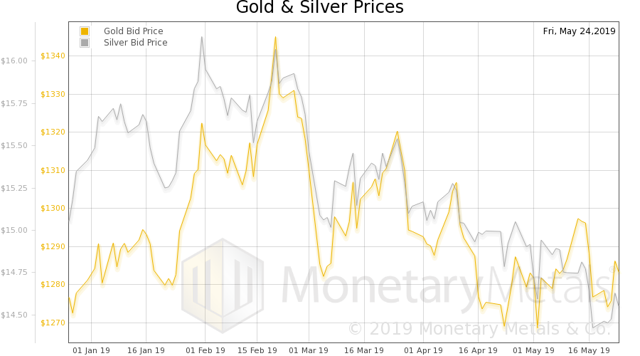

Last week the price of gold rose 8 bucks, and silver 16 cents.

No amount of gold reserves can push a gold standard into the world as it exists today.

The Monetary Metals Silver Fundamental Price was down a penny, to $15.33.

The Money of the Free Market, not of Governments

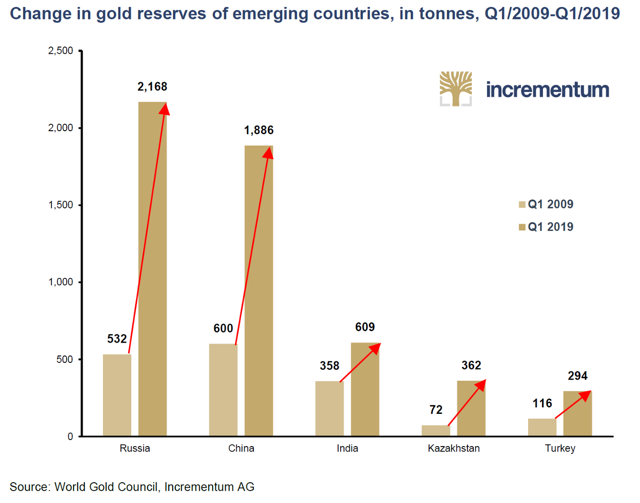

Monday was Memorial Day holiday in America. Last week the price of gold rose 8 bucks, and silver 16 cents. With Keith traveling in Asia right now, this will be a brief report. But speaking of Asia, everyone seems to be talking about China's (and other countries, such as Russia) accumulation of gold.

Accumulation of gold reserves over the past decade by various emerging market central banks (from the new Incrementum In Gold We Trust 2019 Report) [PT]

Accumulation of gold reserves over the past decade by various emerging market central banks (from the new Incrementum In Gold We Trust 2019 Report) [PT]

We are not privy to the top-level discussions inside these governments, which are top secret and therefore anyone who is privy is not at liberty to write about them. But we can make a few observations.

First, whatever their intentions, accumulation of gold reserves is not sufficient to launch a gold standard. This confuses cause and effect. It is like looking at a wet street, then upon seeing the rain one thinks "wet street causes rain." This is the example, by the way, given by Michael Crichton who coined the term Gell-Mann Amnesia Effect.

No amount of gold reserves can push a gold standard into the world as it exists today. It can only amount to a price-fixing scheme, where the government stands ready to buy or sell gold at its official price. When the market decides it wants the gold, it will buy relentlessly until the central bank runs out of gold and abandons the peg - alternatively they can abandon the peg earlier.

A gold standard arises by the decisions of millions of people to extend credit in preference to hoarding gold. Reserves are accumulated, not because someone decides to buy X tons of gold, but because people willingly hand their gold over to banks to get interest. Absent interest, even if there were reserves, those would be drained away by limitless redemption requests.

Everyone understands the case of banana republic trying to maintain the peg of its currency to the dollar. This involves selling its dollar reserves and buying its currency to take the other side of the trade. Well, when it runs out of dollars, it is "game over."

But even in the other direction - when a central bank wants to keep its currency down - it doesn't work. The Swiss National Bank demonstrated this in January 2015. All it had to do was issue more francs and buy more euros, which everyone believed could be done without limit. But that fateful January, it hit the limit. Or we should say it hit the stop. The stop loss order.

The gold standard is the money of a free market. It will not come about as the next step in our centrally banked, centrally planned world. We may not be privy to the internal discussions of any central bank, but we can be sure that none of them mean to renounce their power and shut down. They are looking for whatever works.

To the extent they understand that the present system will collapse (we would not bet on this), they want the next thing. They may even think that next thing will be a government-managed, centrally banked, centrally planned gold standard. But if so, we can say for certain: it will not work.

And we are skeptical they think this. We suspect they are buying gold for the same reason others buy gold - in the expectation that its price will go up. If the price of gold goes up 3% a year, then it will be a better asset to own than a 10-year treasury bond, currently paying 2.3% (not including the capital gains that treasuries are likely to deliver).

Fundamental Developments

Anyway, let us look at the supply and demand picture of gold. But first, here is the chart of the prices of gold and silver.

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). The ratio fell half a point.

Gold-silver ratio - still trending up

Gold-silver ratio - still trending up

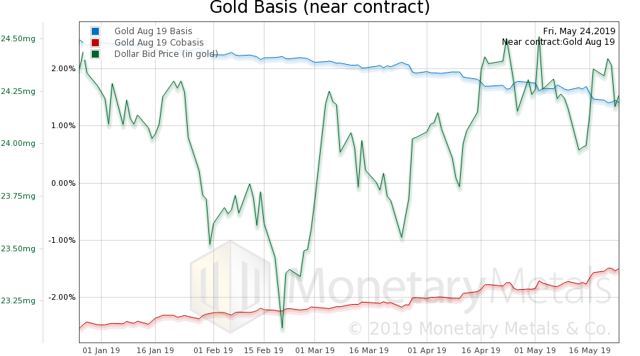

Here is the gold graph showing gold basis, co-basis and the price of the dollar in terms of gold price.

Gold basis, co-basis and the USD priced in milligrams of gold

Gold basis, co-basis and the USD priced in milligrams of gold

Note that we switched from the expiring June contract to the August. There was not much change in the near contract basis, nor in the continuous gold basis. Nor in the Monetary Metals Gold Fundamental Price, up two bucks to $1,372.

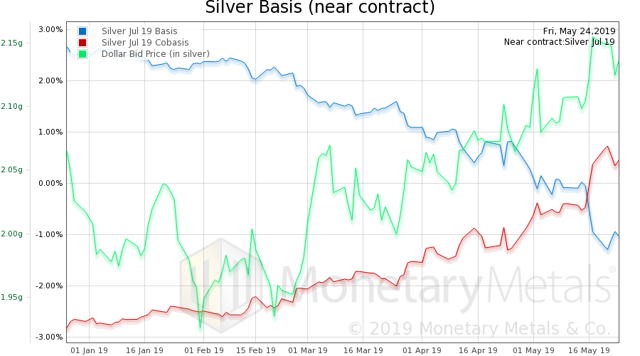

Now let us look at silver.

Silver basis, co-basis and the USD priced in grams of silver

Silver basis, co-basis and the USD priced in grams of silver

In silver the basis move is choppier, but similarly ends close to even. The Monetary Metals Silver Fundamental Price was down a penny, to $15.33.

(C) 2019 Monetary Metals

Charts by: Incrementum, Monetary Metals

Chart and image captions by PT

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Follow Keith Weiner and get email alerts