How Options Traders Tripled Their Money On This Struggling Retail Stock

Subscribers to Schaeffer's Weekly Options Countdown service recently scored a 200% profit with Michael Kors Holdings Ltd (NYSE:KORS) weekly 3/2 66-strike put. We're going to take a look back to see why we were initially bearish on KORS when we recommended the put, and how the options trade unfolded.

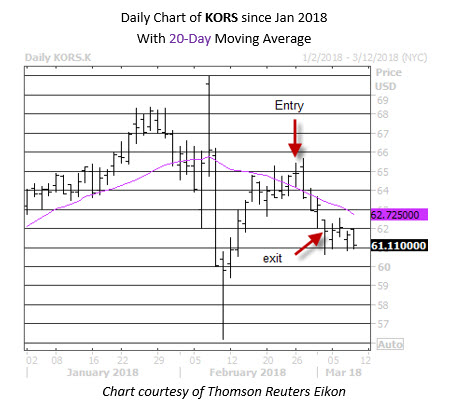

We entered our bearish KORS position on Monday Feb. 26, meaning options traders tripled their money in just a week. Looking back, the retailer had a negative reaction to its last earnings beat, and formed a bear flag near a 50% retracement of its mid-February earnings highs and lows. This pointedto potential resistance, which was reinforced by the equity's 20-day moving average.

Options traders were unusually bullish at that time, per the stock's 10-day International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) call/put volume ratio of 3.49 -- in the 90th annual percentile. Plus, its Schaeffer's put/call open interest ratio (SOIR) of 0.63 ranked lower than 96% of all comparable readings taken in the past year. Drilling down, a heavy accumulation of call open interest was docked at the weekly 3/2 64 strike, which strengthened resistance in the near term.

Lastly,KORS stock boasted a Schaeffer's Volatility Index (SVI) of 30%, which ranked below 85% of all comparable readings taken in the past year, pointing to cheap short-term options prices. Furthermore, its Schaeffer's Volatility Scorecard (SVS) of 88 indicated the equity consistently outperformed the expectations priced in by the options market over the last 12 months.

As expected, Michael Kors stock breached its 20-day moving average in the days after we entered the put trade. We closed the put position just before expiration on March 2, just five days after entry to lock in a 200% profit.